Start Up Business Account

1 free banking means no account maintenance fee and free standard transactions on your primary account any additional or secondary accounts will be charged in line with your choice of small business tariff or electronic banking tariff.

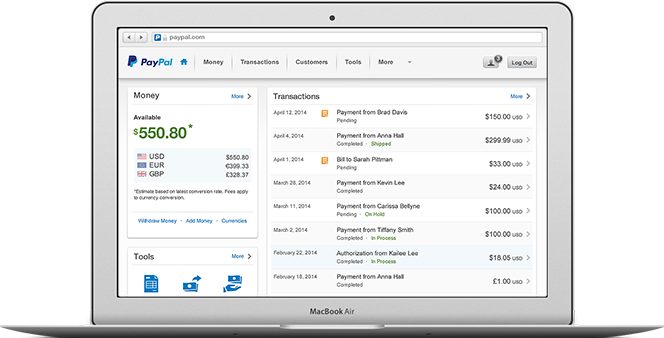

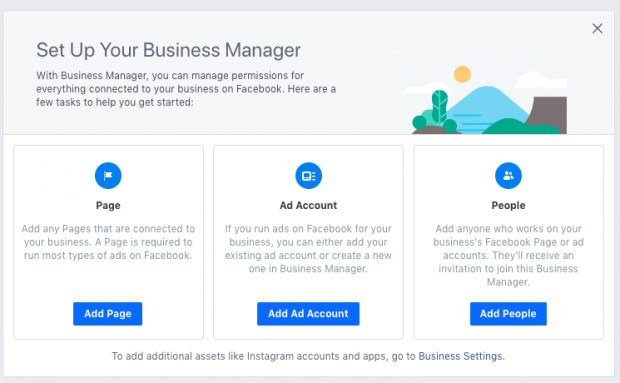

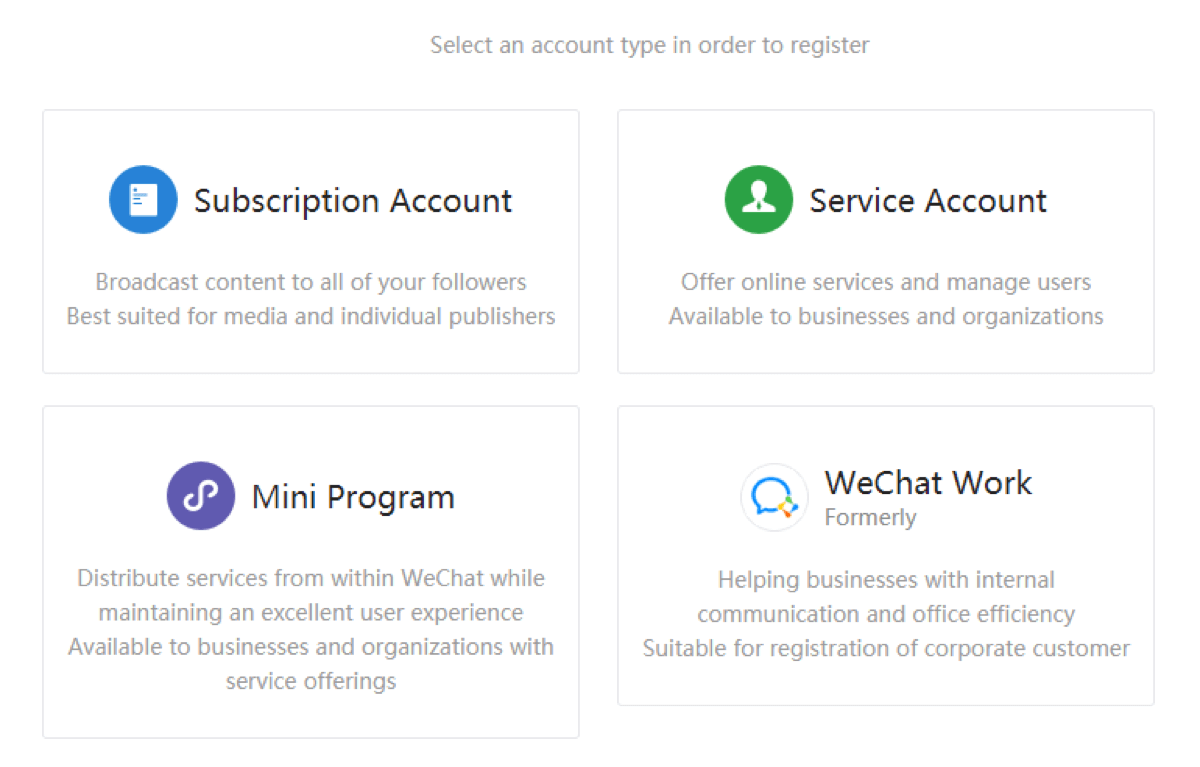

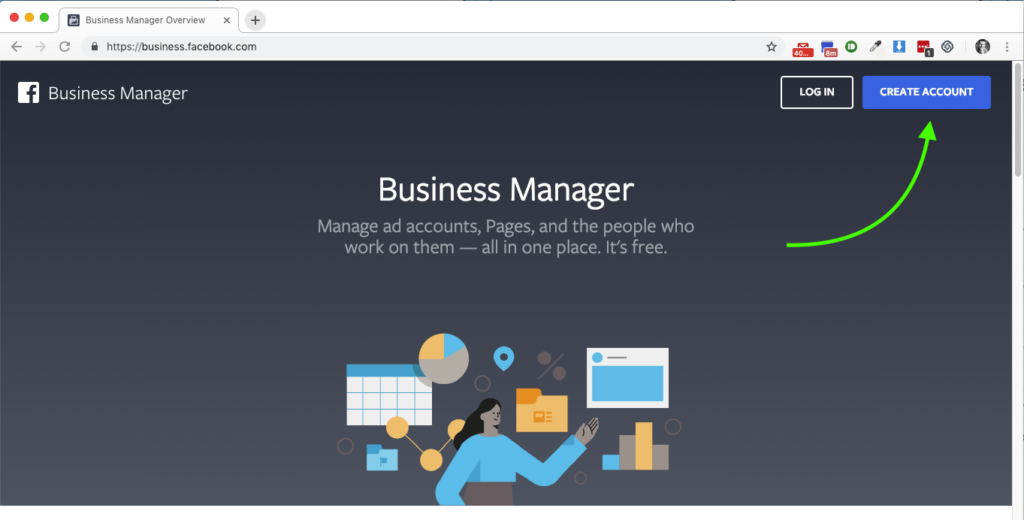

Start up business account. All we ask is that you operate your account in credit or within agreed limits. Setting up a separate account has a lot of positives going for it through there are a few downsides. This guide gives you the details for the best deals for new business and start up business bank accounts from the leading banks through to the lesser known providers. Business accounts work in a very similar way to personal accounts you ll be able to set up payments have people pay you and make debit card transactions.

2 after 18 months account maintenance fee will be 6 50 a month and you ll be able to pay in up to 3 000 cash per month free we ll charge 0 50 of. A business bank account allows you to easily keep track of expenses manage employee pay convey finances to investors receive and deposit payment and plan your budget more accurately. The start up business account is free for the first 12 months and you get access to barclays business direct team which offers support on growing your business the business account for turnover up to 400 000 is for established business there are two price plans depending on whether you use mixed payments or electronic payments only with a 6 and 6 50 monthly fee respectively. 3 free day to day business banking includes cheques standing orders cash uk sterling direct debits deposits and withdrawals.

We reserve the right to change or withdraw the start up offer without prior notice. The start up business account is available for businesses that have been trading for less than 1 year and have a turnover of less than 1m. Both the ocbc business growth account and the ocbc business entrepreneur account requires no minimum monthly balance for the first six months after account opening. Having a business bank account also makes it possible to apply for a business loan or a business credit card in the future.

Where a business bank account differs from a personal bank account is the fact that you will often have to pay a fee to use your business account and possibly individual transaction charges. Everyday banking that saves you time spend less time managing money and more time focusing on your business with our safe secure and simple online banking tools and our app. It is available for eligible customers who are over 18 and have the right to be self employed in the uk. You can apply for your business account online get your approval instantly and start using your account to pay and receive funds without having to worry about maintaining a monthly balance in the initial months.