What Happens After Underwriter Approved Loan

The processor will notify you via email and or the floify secure document portal if any additional documents will be required after the initial underwriting approval is issued.

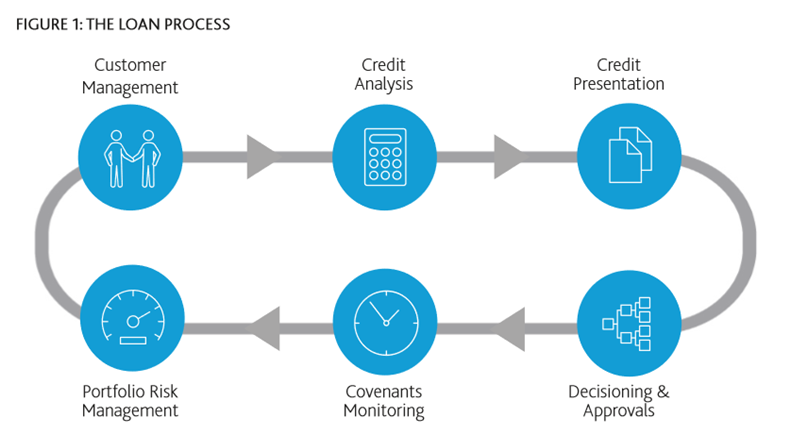

What happens after underwriter approved loan. After final approval you attend the loan closing signing and bring a cashier s or certified check for your cash to close or arrange for a wire transfer. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. To put this into a broader context let s look at the basic steps that take place during a typical mortgage approval process. The initial underwrite of the mortgage loan process typically takes 48 to 72 hours.

The underwriter will determine whether you are approved for your mortgage loan. Once approved the lender will provide you with a commitment letter and require you to meet certain conditions. You ve dutifully gathered the mountain of documentation required to obtain a mortgage you ll hand them over to your loan officer or a mortgage processor. You receive underwriter approval for a home loan after you meet certain conditions but you still have work to do before loan funds are disbursed and you become a homeowner.

The underwriter has completed the initial review of your loan application and issued a conditional approval along with a set of conditions that need to be satisfied before a final approval can be issued and you can move to the closing process. Approved denied suspended or approved with conditions once the underwriter thoroughly reviews your application the best outcome is that you are approved for a. What happens after underwriting. If the underwriter determines that the loan looks good in most respects but there are a couple of things that need to be resolved it s referred to as a conditional mortgage approval.

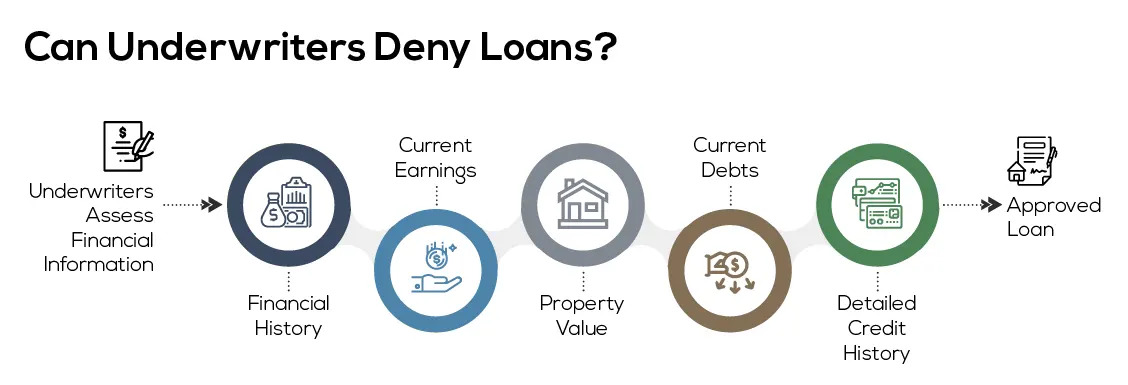

An underwriter is a financial expert who takes a look at your finances and assesses how much risk a lender will take on if they decide to give you a loan. A mortgage file is submitted to underwriting after the processor has completed the processing stage of the mortgage. The approval stage of the underwriting process shows that you have a lender s approval to close but it may include some lingering conditions.

/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png)

/what-happens-after-a-home-buyer-s-offer-is-accepted-1798286_final-ea24b0329f724d86b39142c7fdbcecbb.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

/house-resting-on-calculator-concept-for-mortgage-calculator--home-finances-or-saving-for-a-house-962837250-5b92ddbe4cedfd0025b1642f.jpg)