Secondary Insurance Policy

Then see how people use these special policies to prepare for the unexpected financial and health challenges life sends their way.

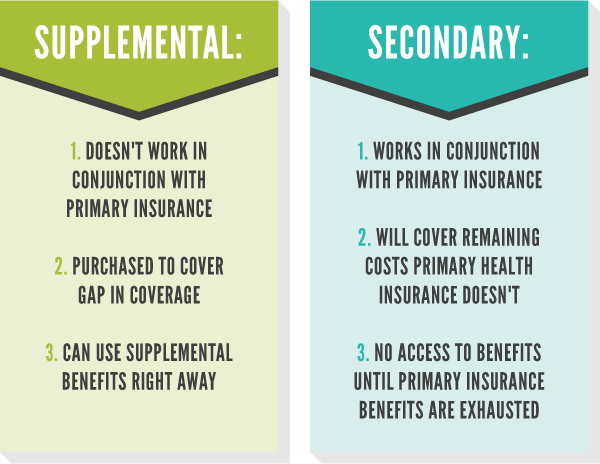

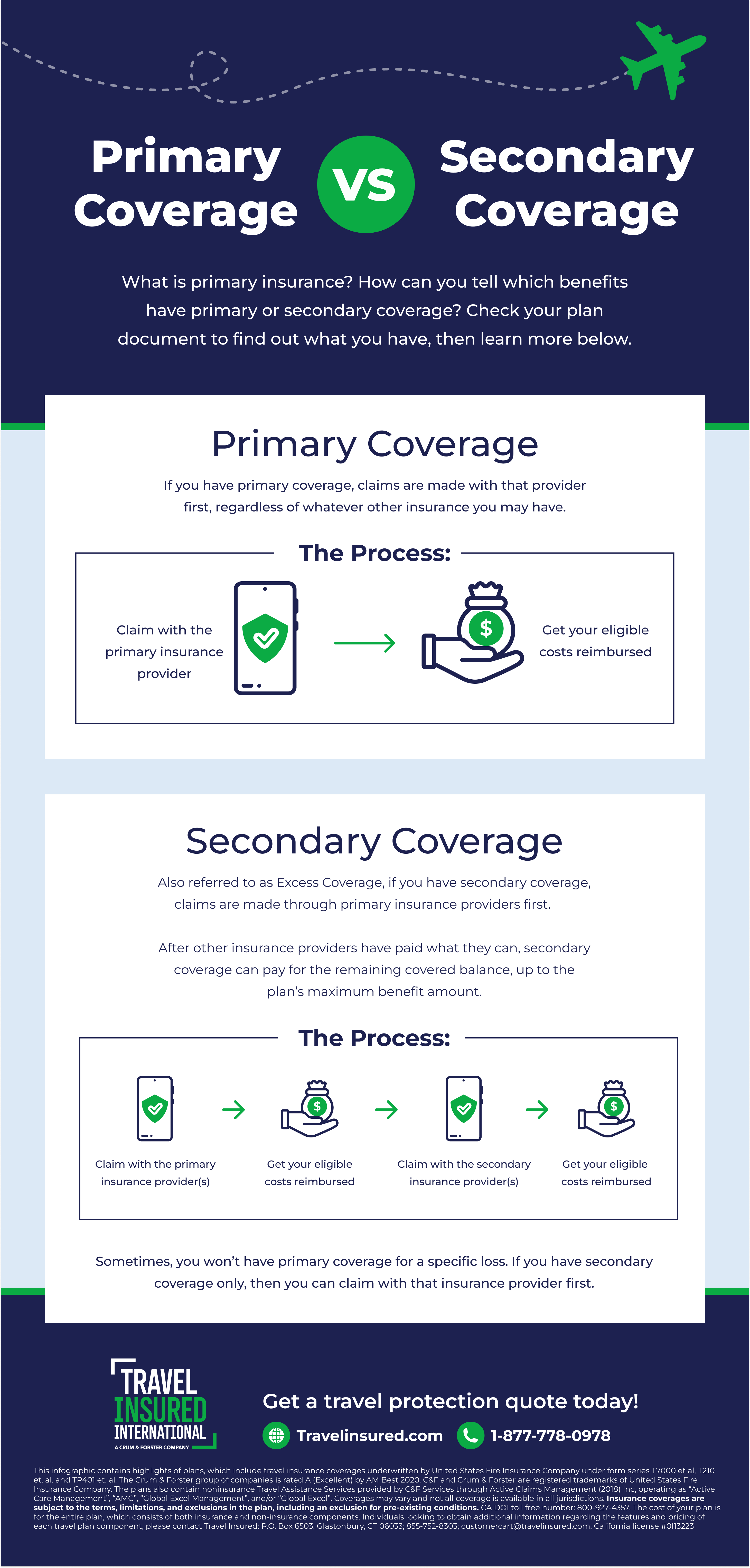

Secondary insurance policy. A vision plan can provide coverage for routine eye exams and prescription glasses or contacts depending on the plan. Secondary insurance can help defray some of the health care expenses not covered by a family s primary insurance policy. If purchasing a vision or dental plan eyeglasses and dental visits are just some of the routine items that could be a part of your coverage. Secondary health insurance covers and pays for the gaps in a person s primary health insurance policy.

There may be some limitations though so it s important to study both policies before incurring medical costs. Learn about the different secondary health insurance coverage options available to you beyond basic medical plans. Secondary insurance is purchased to cover known medical expenses that are not covered by a primary policy and contain a wide array of included services. The process for filing insurance claims for a secondary home is the same as for a primary home.

Therefore it is important to thoroughly understand your insurance policy and how it works. Your medical plan will not cover you for vision care. Secondary health insurance or voluntary or supplemental insurance could refer to many types of coverage including. Owning a vacation home is one of the most cherished milestones for any family.

Medicaid recipients may have secondary insurance for the extras.