Using Rollover Ira For Home Purchase

You don t need to provide proof to the ira administrator that you re using the money for a home purchase according to vanguard but you do need to file irs form 5329 with your tax return for the.

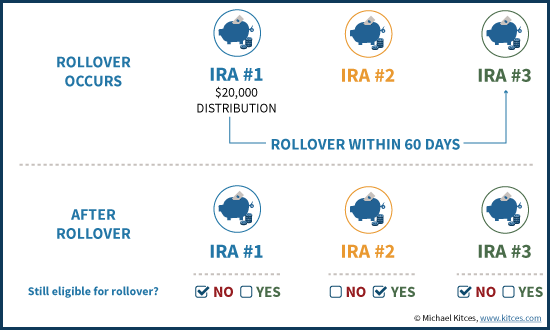

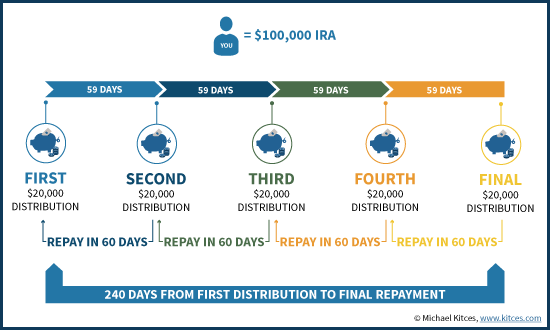

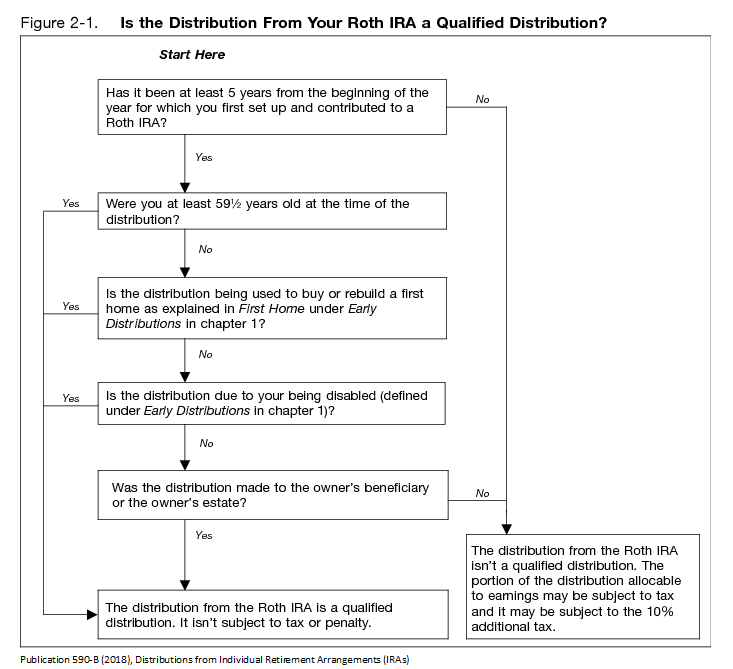

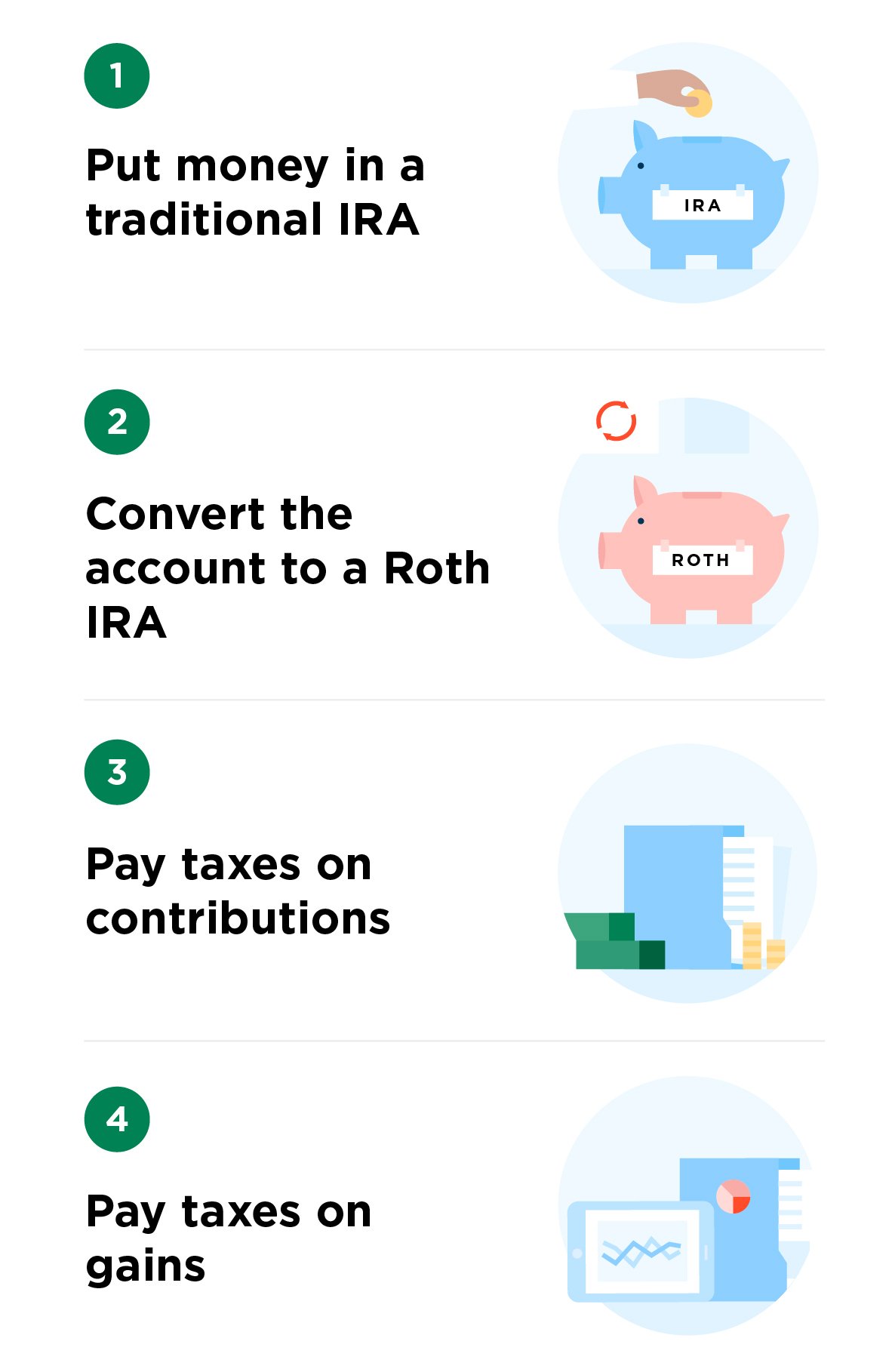

Using rollover ira for home purchase. However unless you have a roth ira or have made non deductible contributions to a traditional ira you re still subject to income taxes on contributions and any earnings withdrawn. As mentioned earlier you can withdraw all your contributions to your roth ira plus up to 10 000 worth of investment earnings penalty and tax free to help you purchase your first home but you must meet the following requirements. You could buy a rental property use your ira as a bank and loan money to someone backed by real estate i e a mortgage you can purchase tax liens buy farmland and more. However if you can prove that the money was distributed from the ira with the intent to be used for a first time home purchase but a delay or cancellation of the closing brought you beyond the 60 day rollover window the irs provides first time homebuyers with a 120 window to complete the rollover to avoid tax and penalties on the withdrawal.

You and your spouse are first time homebuyers the irs defines this as someone who hasn t owned a principal residence. Using your roth ira to purchase a home. If you make a withdrawal from your ira to finance a down payment make sure you use the money to acquire a home within 120 days after the withdrawal for these purpose the acquisition date is the date you enter into a binding contract to purchase a home not the date escrow closes.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/buying-house-57a3180b5f9b589aa9d8529d.jpg)

/GettyImages-1017300682-3086d9bb0cc942df8fc62401a5286372.jpg)

:max_bytes(150000):strip_icc()/house_for_sale114958475_copy-5bfc3280c9e77c00519bf0c0.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)