Rollover 401k To Gold Ira

A gold ira rollover is where you transfer your paper assets like the 401 k to the physical gold bars.

Rollover 401k to gold ira. If you have an old 401 k from an employer that is sitting idle transferring all or part of your 401 k into a rollover ira with gold investments is a popular option. Buy gold the ultimate monetary insurance policy. You may not be aware but the company managing the fund takes fees from your 401 k even when you. Once you ve opened your gold ira you can contact the company managing your 401 k account to begin the rollover process.

401k to gold ira rollover. In this case if you were to accomplish a gold ira rollover you would receive the money from your current custodian and you would have 60 days from the date you receive the funds to deposit the money in the gold ira company or custodian you have chosen if you do not complete the transaction within this period the money becomes a taxable withdrawal and you will face. A gold ira rollover can occur under a wide variety of conditions. A 4 step to rollover your 401 k to gold ira as a retiree your pension fund alone may not be enough to sustain your lifestyle.

A gold ira can reduce the volatility of your retirement portfolio and protect your purchasing power. Call us now 1 888 gold 160 1 888 465 3160 buy gold silver. Maybe you are intrigued by the benefits of investing in gold but still have more questions. The taxpayer relief act of 1997 made it possible for investors to hold certain eligible precious metals.

If you re looking for a 401k to gold ira rollover guide consider downloading our free gold ira investment manual. Gold irarollover 401kgold ira rollover 401kwatch our 3 part video series on gold ira rolloverstraditional 401 k plans generally offer several investment choices but they limit the asset. The 401k to gold ira rollover guide. What is a 401k gold ira rollover.

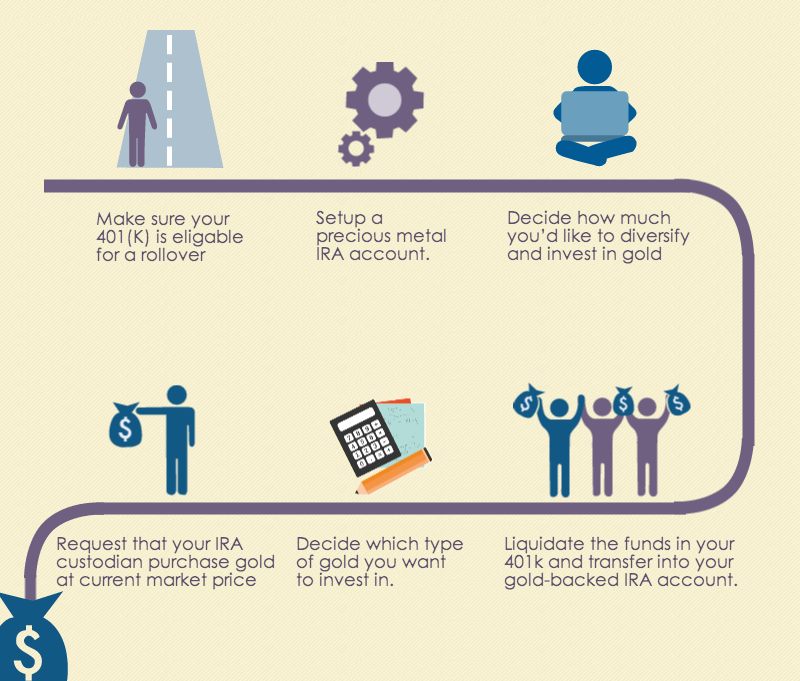

With the mounting global economic crisis and our domestic debt and deficit issues many savvy investors are converting 401k monies into precious metals espeically gold. Considering that the 401k is the most prevalent type of eligible retirement plan it s what we ll focus on in this article. For the visual learners out there we made this infographic showing you why and how to rollover your existing ira or 401k to physical gold. Transferring a 401k or 403b into precious metals.

Gold ira rollover rules. A self directed ira or alternative assets ira can only hold approved precious metals limited to gold silver platinum and. Steps to handle a 401 k to gold ira rollover. Goldco s top educational guide the 401k to gold ira rollover guide has helped thousands of new investors get a handle on a most confusing marketplace while introducing them to a little known tax loophole.

A gold ira individual retirement account allows investors to buy and hold physical precious metals in a retirement portfolio.