Working Capital Loans Definition

A business can t operate without the funds to buy inventory hire staff and get the word out to customers.

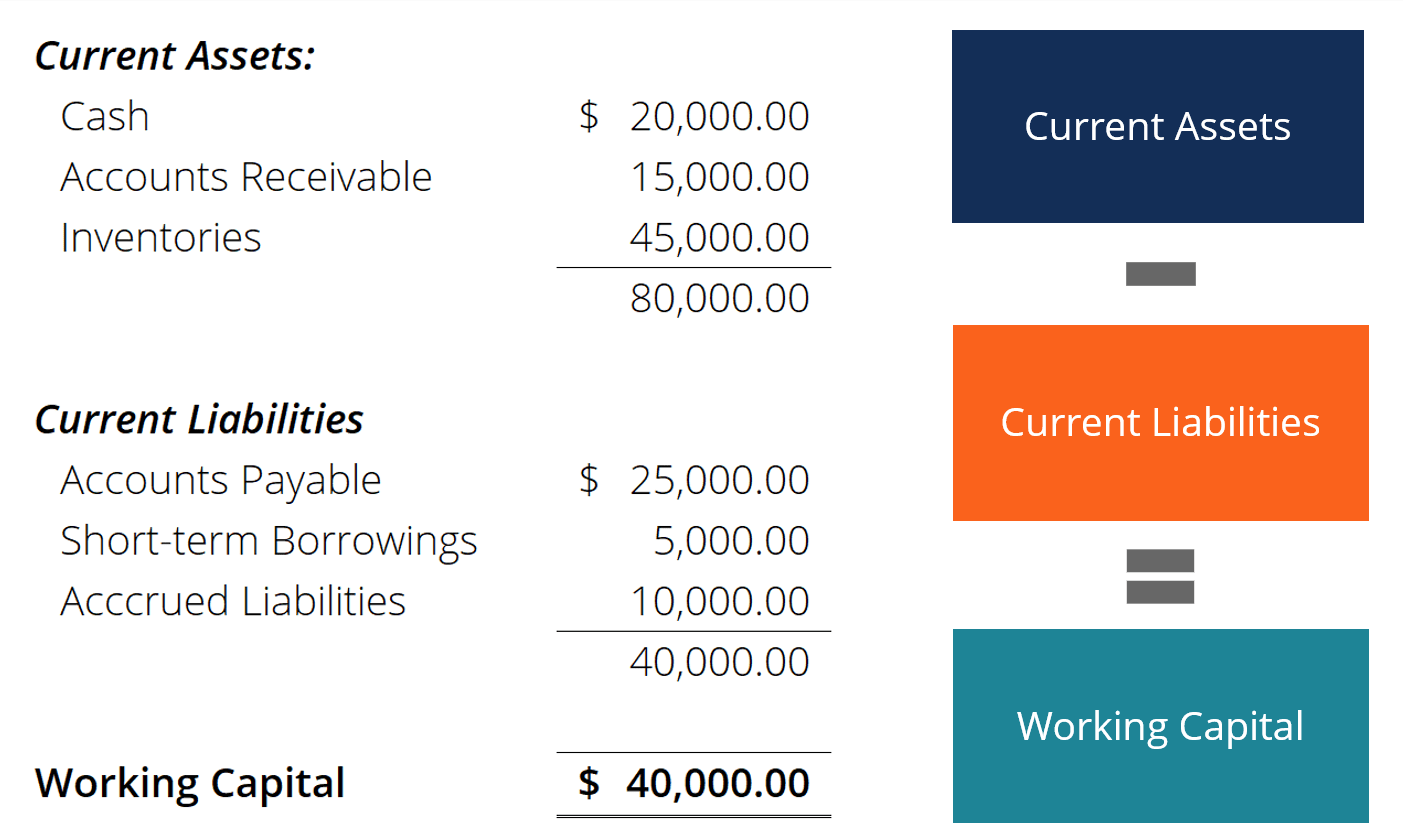

Working capital loans definition. Gross working capital is equal to current assets. For example suppose company xyz s current capital and human resources incur 1000 in monthly expenses from daily operations. One way to evaluate working capital is the extent to which current assets which can be readily turned into cash exceed current liabilities which must be paid within one year. Using an sba 7 a loan for working capital.

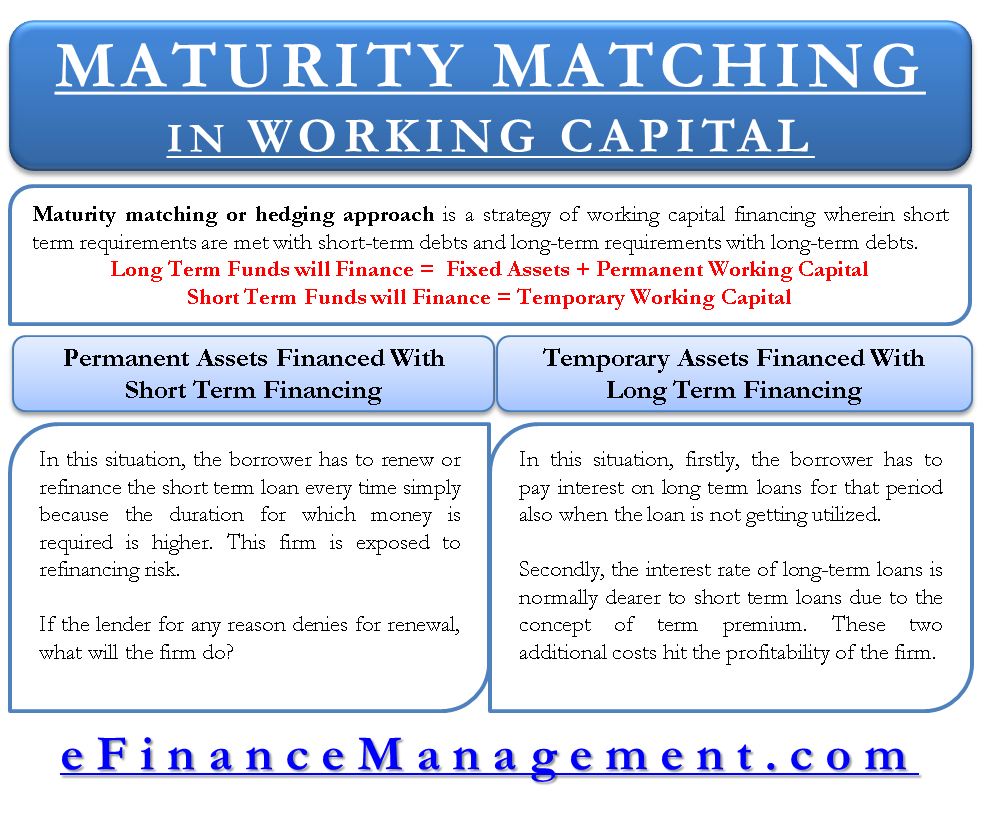

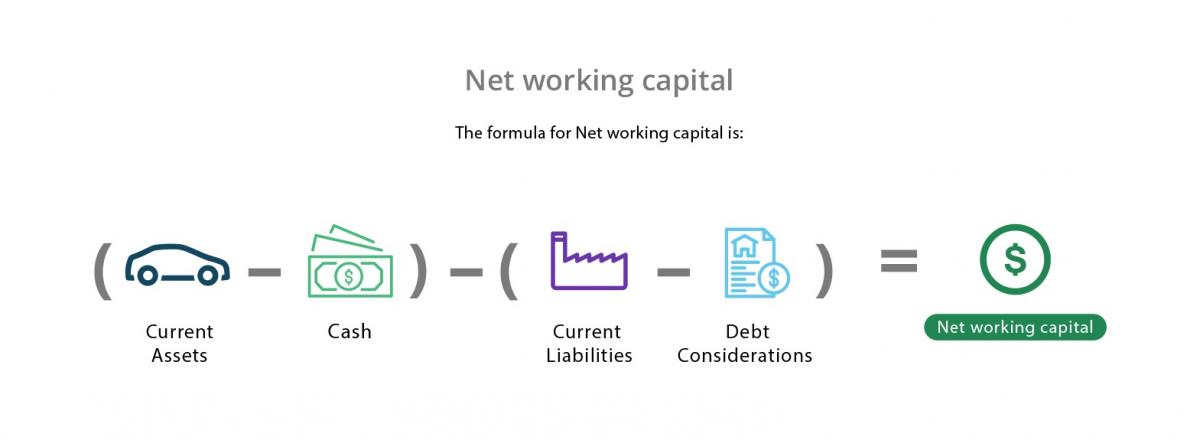

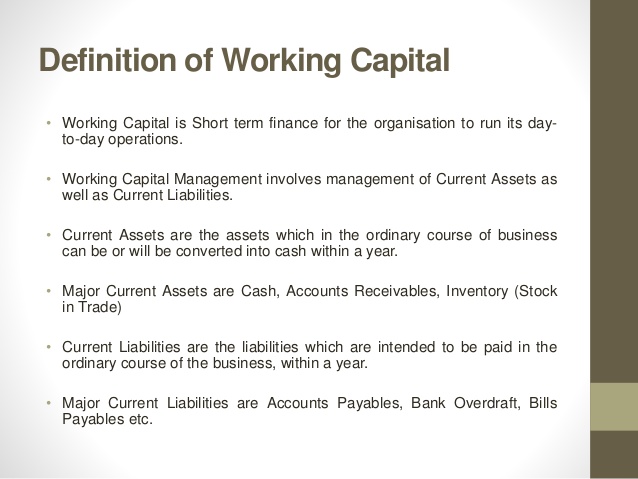

Working capital abbreviated wc is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities. Working capital is the money that allows a corporation to function by providing cash to pay the bills and keep operations humming. Working capital loans are not used to buy long term assets or investments. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital.

Working capital is typically used to pay for regular expenses such as utility bills employee payroll rent inventory and marketing costs. A working capital loan is a loan taken to finance a company s everyday operations. Working capital is a measure of both a company s efficiency and its short term financial health. Working capital loan is a loan taken by a company to finance its day to day operations like funds to cover the operational needs of the company for short duration like for any debt payments rents or payroll and it is not meant to meet the needs for long term investments or assets.

One of the best uses of the sba 7 a loan is to get more working capital for your business or startup. When it comes to sba loans sba express loans and sba 7 a loans can be used to fund working capital for business borrowers but sba 504 loans cannot. They are used to provide working. For sme working capital the sme definition refers to group revenue of up to s 100 million or maximum employment of 200 employees.

1 acra registered sole proprietorship partnership limited liability partnerships and companies are eligible to apply for the enhanced sme working capital loan. 3505 b because its line of credit constituted an ordinary working capital loan the court rejected this characterization because payroll checks were approved and initialed by a bank officer. Working capital loans are generally granted only to companies with a high credit rating and are only meant to be used until a company can generate enough revenue to cover its own expenses.

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)