Www Reversemortgage Com

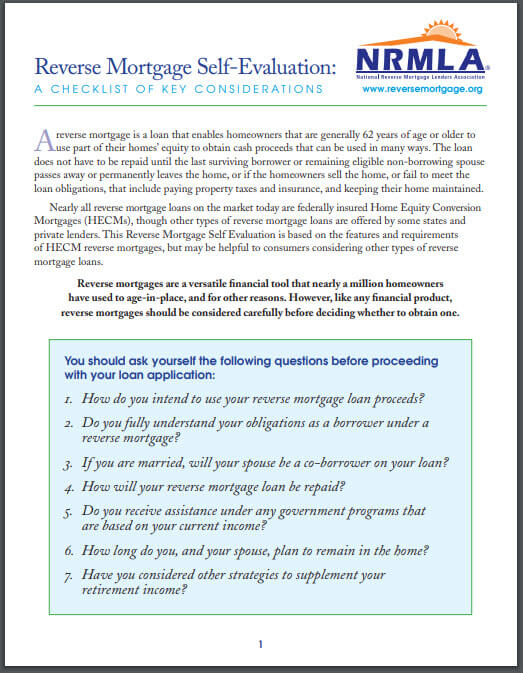

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Www reversemortgage com. These individuals have earned the crmp designation demonstrating knowledge and competency in the area of reverse mortgage lending. When you have a regular mortgage you pay the lender every month to buy your home over time. You don t need to make any regular payments on a reverse mortgage. Instead the loan is repaid after the borrower moves out or dies.

How do reverse mortgages work. A reverse mortgage loan uses a home s equity as collateral. If you ve thought about taking a reverse mortgage be aware that new rules might make it harder for you to qualify often considered a loan of last resort for older retirees reverse mortgages are there for homeowners who worry about outliving their savings expert jane bryant quinn explains the. Why a reverse mortgage.

A reverse mortgage is a type of loan that s reserved for seniors age 62 and older and does not require monthly mortgage payments. To our most valued customers. A reverse mortgage is a loan available to homeowners 62 years or older that allows them to convert part of the equity in their homes into cash. Modified tenure payment plan.

In a reverse mortgage you get a loan in which the lender pays you reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. Reverse mortgage loans are commonly used to pay for home renovations medical and daily living expenses. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. In fact we have a nearly paperless application process wherein you can apply online and use a process called docusign with electronic signatures to start your loan that do not require a loan application package be sent to you and we encourage everyone who will to use it.

Homeowners who have an existing mortgage often use the reverse mortgage loan to pay off their existing mortgage and eliminate monthly mortgage payments. Repaying the money you borrow with a reverse mortgage. We are open and are actively working on your reverse mortgage requests.

/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg)