What Is Premiums In Insurance

An amount added to an insurance policy with a low premium designed to cover higher than expected loss experiences.

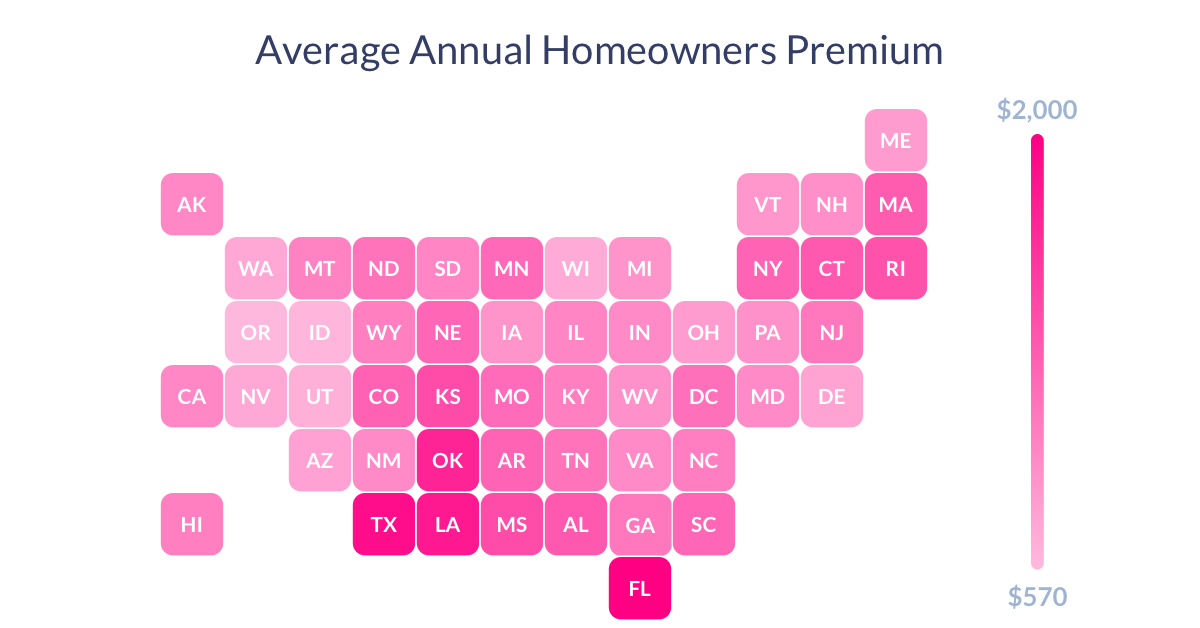

What is premiums in insurance. Your homeowners insurance premium is the amount of money you pay every year to keep your insurance policy active. The employer may amend the ir8a forms to exclude the insurance premium if the employer decides not to claim a tax deduction for the group insurance premiums in the corporate business tax filing. An insurance premium is the amount of money charged by a company for active coverage. Homeowners insurance premiums explained.

An insurance premium is the amount of money an individual or business must pay for an insurance policy. An insurance premium is the monthly or annual payment you make to an insurance company to keep your policy active. Homeowner s insurance premiums are determined by the location and age of the house. The loss constant helps protect insurers from losses associated.

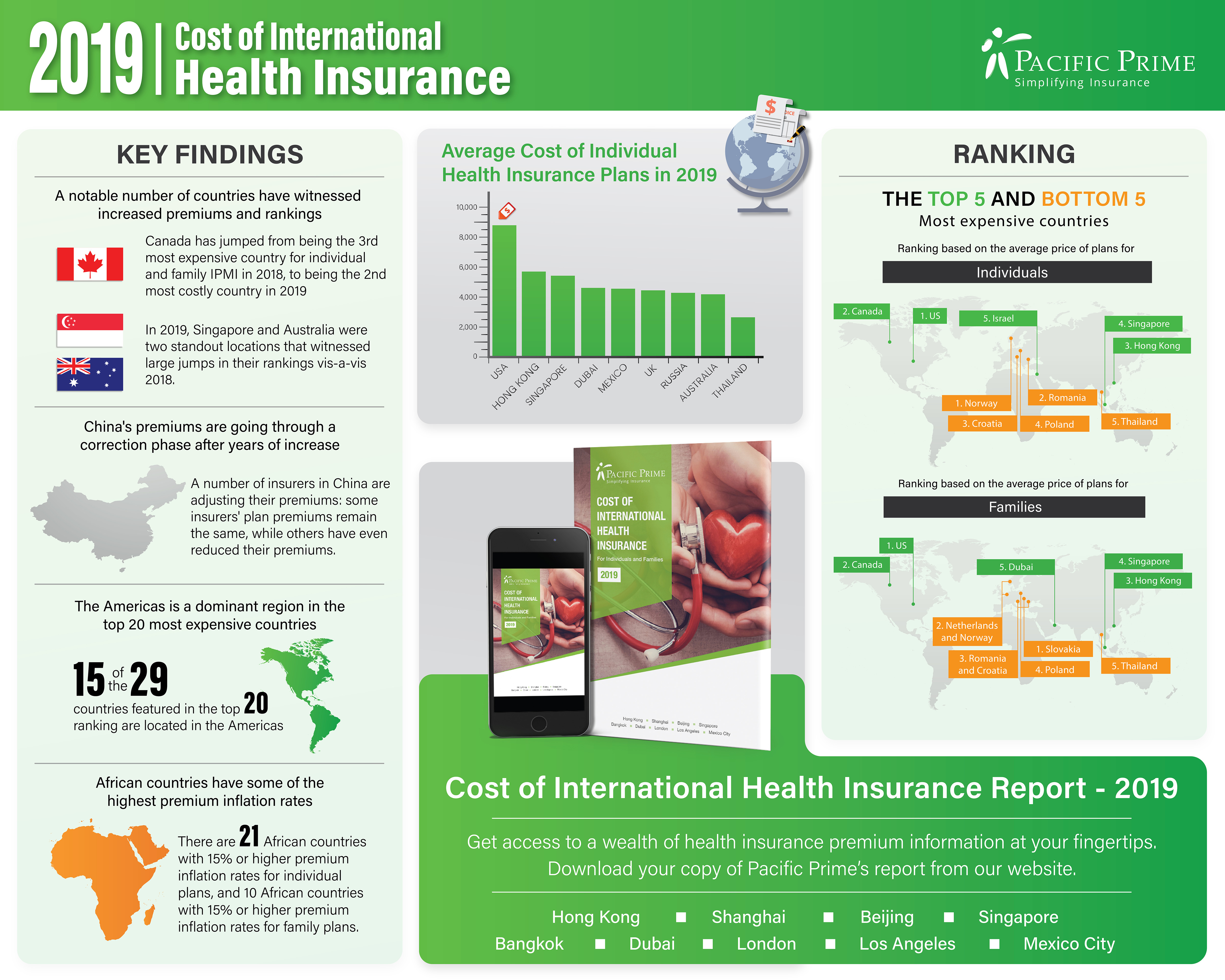

Insurance premiums will vary depending on the type of coverage you are seeking. Insurance companies consider many factors when setting car insurance premiums. The sum a person pays in premiums also referred to as the rate is determined by several factors including age health and the area a person lives in. People pay these rates annually or in smaller payments over.

For example a 16 year old boy in a brand new sports car will pay much higher insurance premiums than a 40. The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing. Premiums are required for every type of insurance including health disability. Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price.

Insurance premiums are paid for policies that cover healthcare auto home and life insurance. The share of group insurance premiums paid for the respective employees were included in their forms ir8a. Every insurer s goal is to balance the amount it charges you with how likely you are to require an insurance payout.

/GettyImages-1141164585-5486d44770c94a2784185a75be37a6fa.jpg)