Tiaa Cref Annuity Withdrawal

The transfer payout.

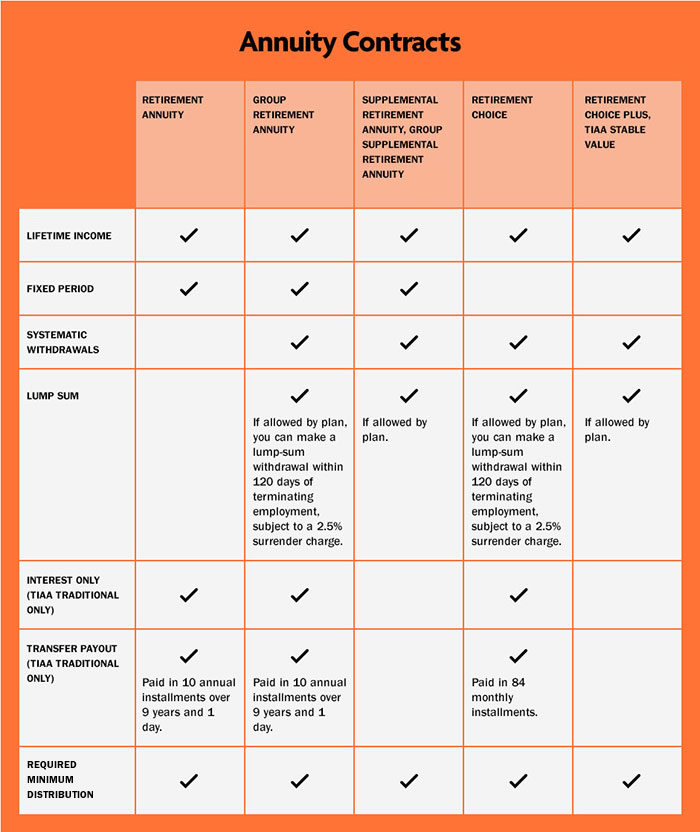

Tiaa cref annuity withdrawal. Tiaa cref has multiple withdrawal and transfer rules which are different depending on the type of contract type of accounts and amount in each account. There are different rules for a withdrawal from a tiaa traditional account that require completing separate forms. Sipc only protects customers securities and cash held in brokerage accounts. Annuity account options are available through contracts and certificates issued by teachers insurance and annuity association of america tiaa and college retirement equities fund cref new york ny.

Annuity contracts and certificates are issued by teachers insurance and annuity association of america tiaa and college retirement equities fund cref new york ny. But by 2017 this number had dropped to about one in five according to an nber study for the retirement and disability research consortium that followed some 260 000 employees with careers at universities hospitals. Apply if you withdraw the funds before age 59. Tiaa cref individual institutional services llc member finra and sipc distributes securities products.

Many upcoming retirees who have tiaa cref encounter confusion about how the tiaa traditional annuity option works and in particular how it works when you want to take your money out. The tiaa cref investment horizon annuity is a fixed annuity that requires at least 5 000 to open. Tiaa cref individual institutional services llc member finra and sipc distributes securities products. Tiaa offers fixed rate terms of anywhere from one year all the way up to ten years.

To clear up this issue it s helpful to explain the annuity as two separate phases with the first being the investment s accumulation phase and the second as the payout phase. J financial strength and high ratings of tiaa. In this article i will address one unique option for taking money out of the tiaa traditional account ndash. Annuity contracts and certificates are issued by teachers insurance and annuity association of america tiaa and college retirement equities fund cref new york ny.

If you want to make a withdrawal from your tiaa traditional account please call us. A cash withdrawal from your tiaa traditional account may not be available. Once your term has elapsed you can either withdraw your money place it in one or more different fixed term deposits ftds or do nothing and let another ftd of the same length begin. Prior to 2010 tiaa cref operated as a non profit.

Sipc only protects customers securities and cash held in brokerage accounts. Even in 2000 one out of two participants putting money in tiaa would eventually take their first withdrawal in the form of one of the annuity options the plan offers to retirees. This makes it very difficult for their own investors and advisors to make informed investment decisions. J low fees which means more of you money is working for you.