Va Refinance Requirements

Mortgages va loan requirements for 2020.

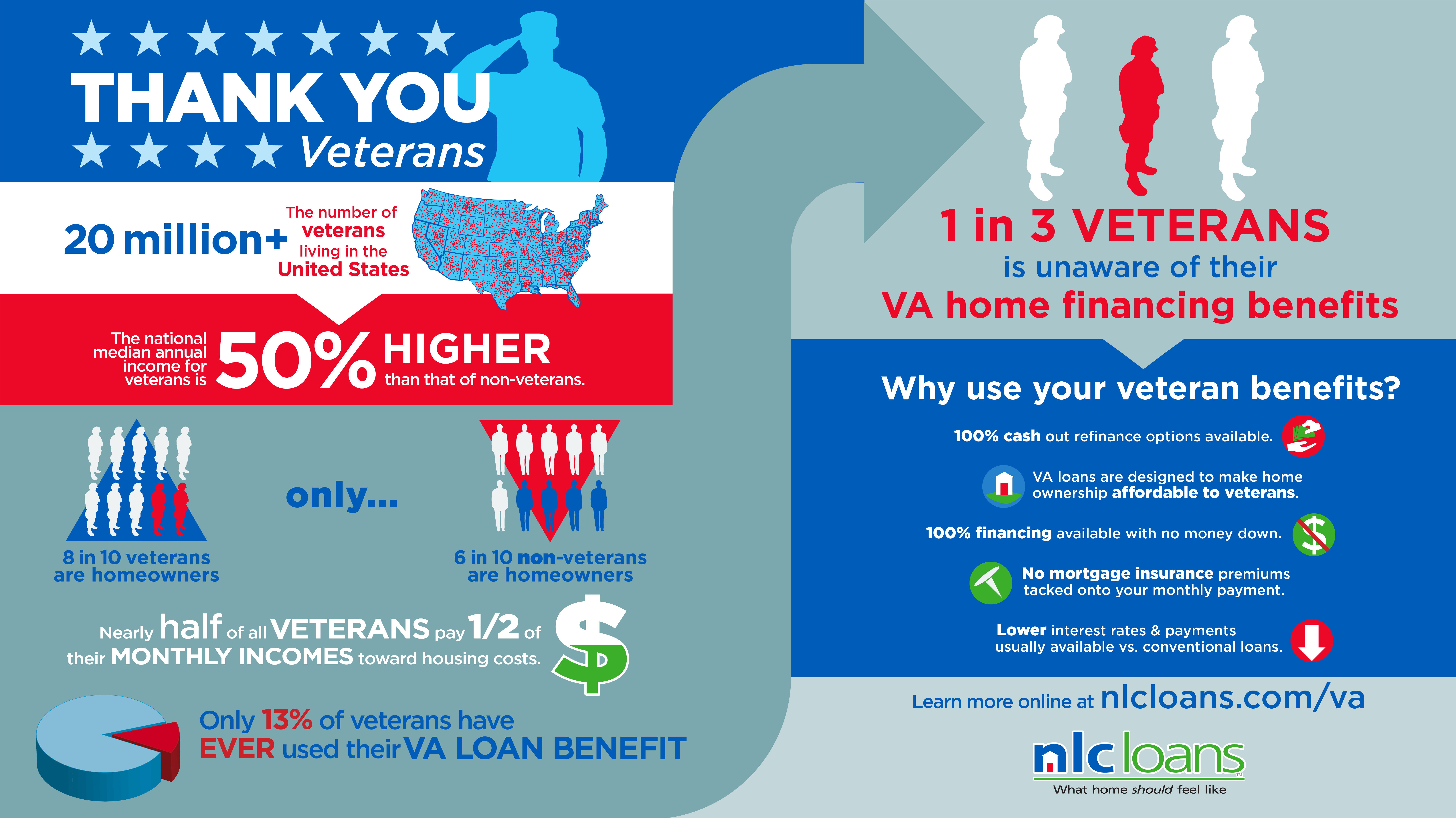

Va refinance requirements. A veteran must meet entitlement requirements meaning the veteran has logged enough service time. To refinance an existing va guaranteed or direct loan for the purpose of a lower interest rate. Va loan refinance rates. Va streamline refinance interest rate reduction loan irrrl as a veteran or active duty member of the military you may be eligible for veterans affairs va home loan benefits.

Va loans typically don t require a down payment but you still need decent credit and sufficient income to get approved. Find out how to apply for a certificate of eligibility coe to show your lender that you qualify for a va backed loan based on your service history and duty status. One of the most common home loan in canada is the five year fixed rate shut home loan as opposed to the u s. The va offers a special interest rate reduction loan irrrl for homeowners with current va loans.

Learn about va home loan eligibility requirements. If you want to take cash out of your home equity or refinance a non va loan into a va backed loan a va backed cash out refinance loan may be right for you. The department of veterans affairs backs va loans protecting lenders against defaulted loans. Va cash out loan requirements are more stringent so if you have a va loan currently or do not need cash out the va streamline refinance is probably a better option.

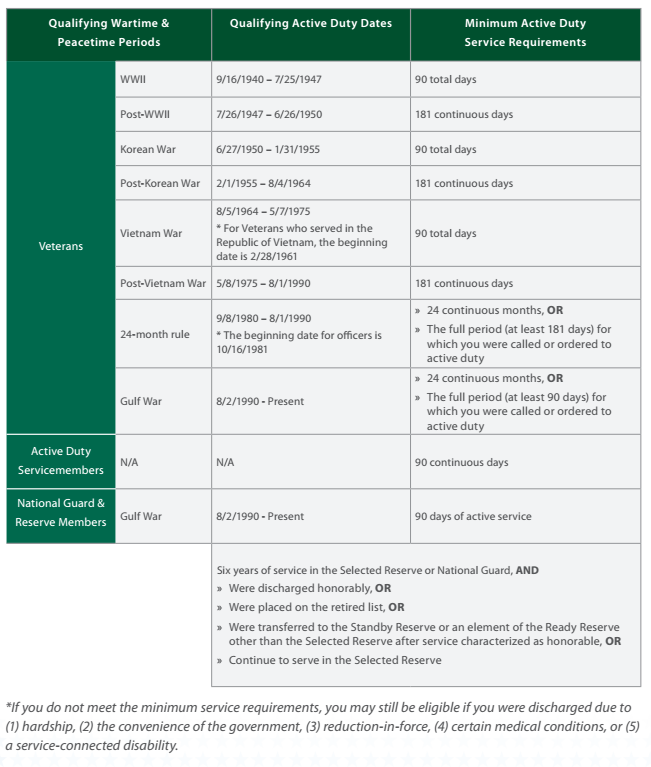

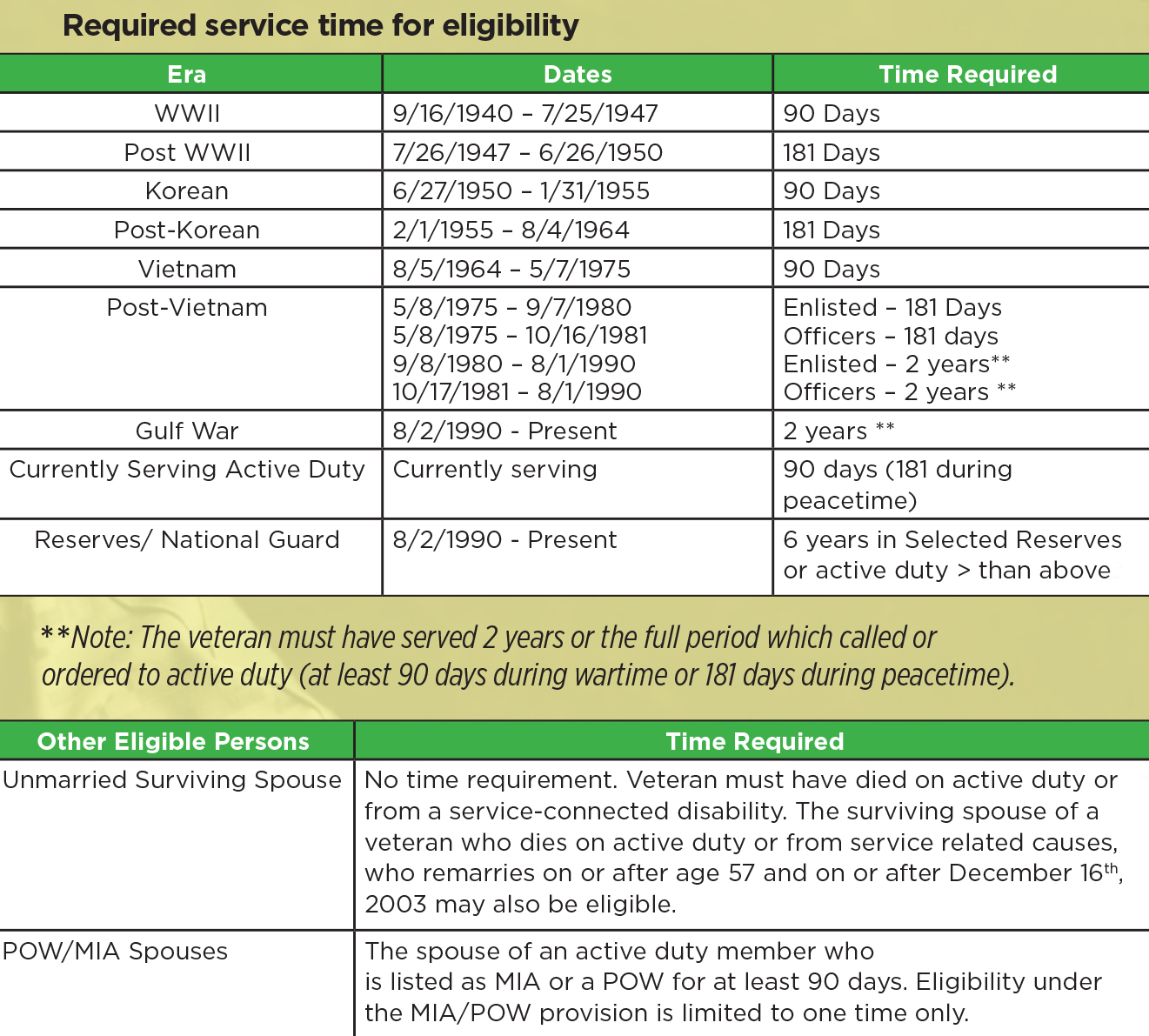

In contrast loan providers who choose to make nonconforming loans are exercising a greater threat tolerance and do so knowing that they deal with more obstacle in marketing the loan. A va backed cash out refinance loan lets you replace your current loan with a new one under different terms. If you have a va home loan then there is a good chance that you have already come into contact with unsolicited offers to refinance your mortgage that appear official and may sound too good to be true. Eligibility requirements for va home loans service during wartime.

2019 10 min read va irrrl rates and requirements for 2020 august 13. To refinance an existing mortgage loan or other indebtedness secured by a lien of record on a residence owned and occupied by the veteran as a home.