Refinance And Get Cash Back

Disadvantages of cash out refinancing.

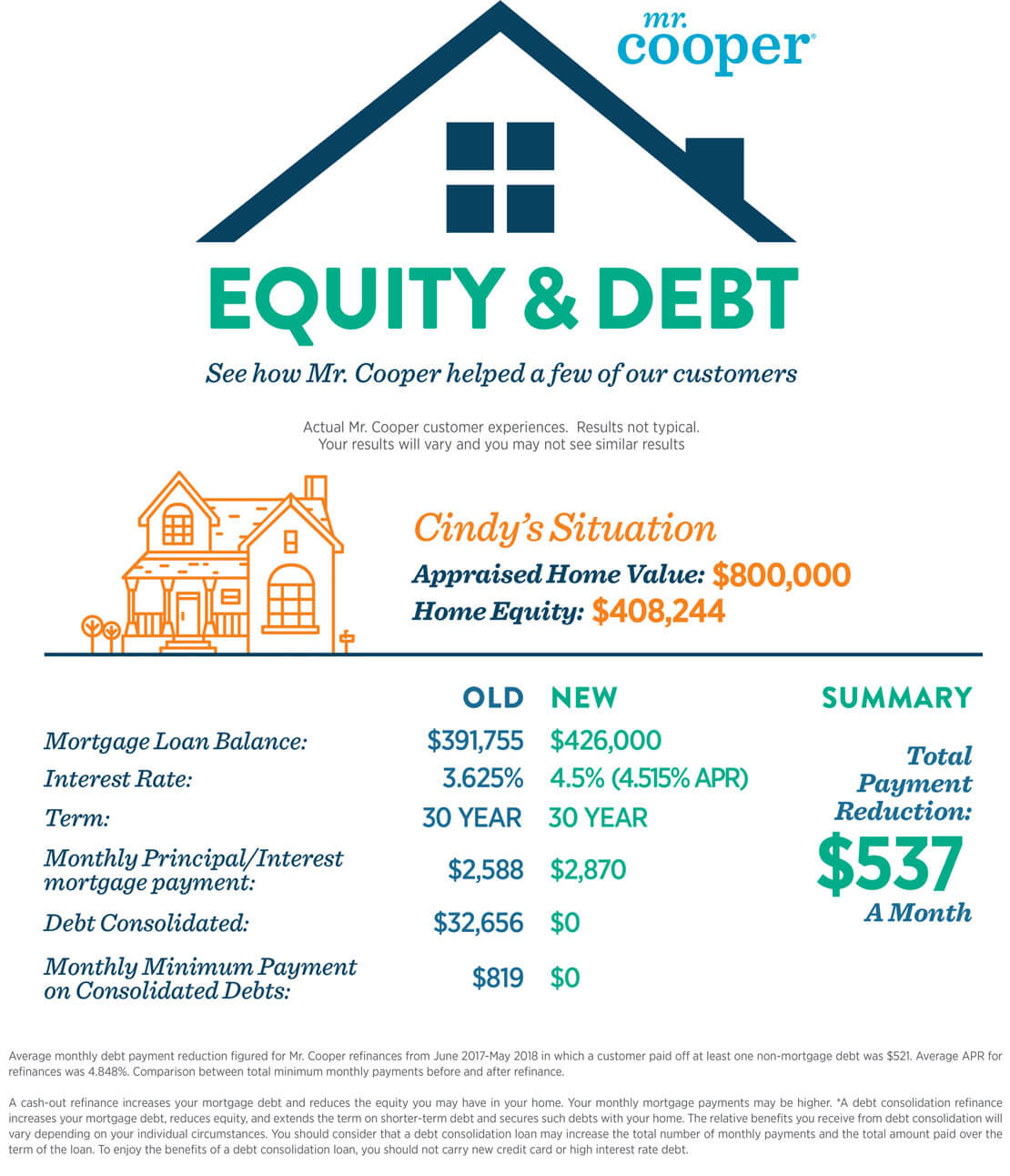

Refinance and get cash back. Use our calculator to find your potential rate and payment. Discover offers cash out refinance loans at low fixed rates for loan amounts ranging from 35 000 to 200 000. How to refinance get money back. You can secure a lower interest rate.

Based on the circumstances refinancing could be a great decision or a horrible decision. You still have to pay off the 16 000 you are borrowing. Homeowners access the equity in their homes for many different reasons. If the savings outweigh the fees refinancing is a good call.

Refinancing a loan will require you to pay the lender s fees but it may also save you money on future payments if you can get a lower interest rate. A cash out refinance can be a good idea assuming you get a good interest rate you know you can easily and ideally quickly pay back the new loan and you need the cash for a worthwhile cause such as home improvements or paying down high interest debt. You can start your search for refinancing right here by filling out the free refinance request form on our website. Cash back refinance mortgages are excellent ways to access large sums of tax free cash using your home s equity.

One of the big drawbacks of a cash out refinance is that you pay closing costs on the entire loan amount. If you have the equity you can use a cash back refinance to get money for debt. Yet new terms mean that you can do that in an affordable way in most cases. Why should you consider an auto loan refinancing to get cash back from the equity in your car.

Paying less towards interest and more towards the principal could save you a lot of money in the long run. Getting a mortgage with a lower interest rate in the main reason why people choose to refinance their home. You could also get a home equity loan if youâ d like to keep your existing mortgage. Get a lower interest rate on your mortgage this is the most common reason why most people do a traditional refinance and it makes sense for cash out refinancing too because you ll be.

So if you owe 150 000 on your mortgage and use a cash out refinance to borrow another 50 000 you re paying closing costs of 3 6 percent on the entire 200 000. This is called a cash out refinance. If you re looking to get cash back when you refinance you ll need to make sure there s equity in your vehicle and then find the right lender. Refinancing is a great way to get a better interest rate on an auto loan.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)