What Is An Exclusion In Insurance

Exclusions in insurance are provisioins that exclude coverage for expenses incurred by a specific event.

What is an exclusion in insurance. Many of us assume that if you have health insurance your health care costs are either covered or at least partially paid unfortunately this is not always the case this is where health insurance exclusions come into play. An exclusion is a policy provision that eliminates coverage for some type of risk. A roof exclusion is a special endorsement contained within your homeowner s policy. Exclusions in the context of insurance refer to certain provisions in an insurance policy that exclude coverage for expenses arising because of the occurrence of a specific event.

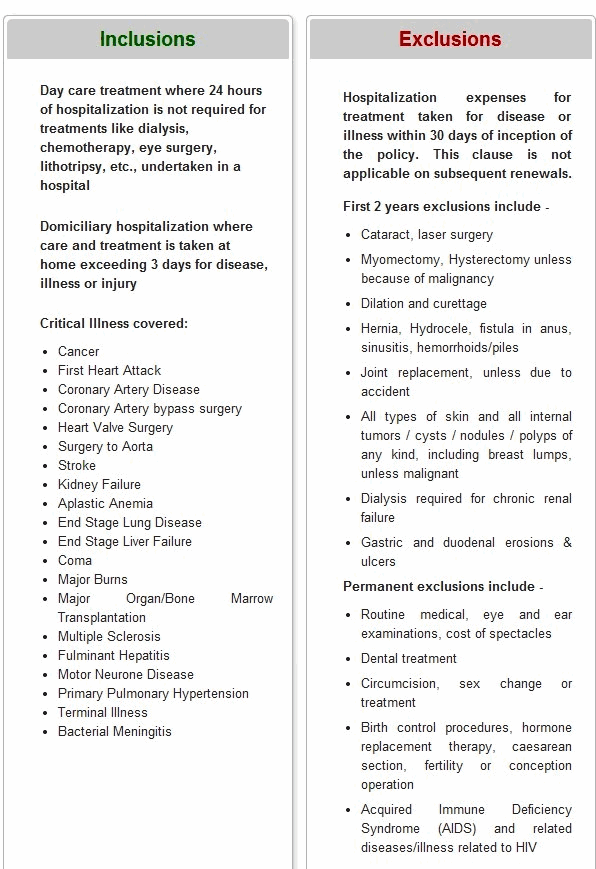

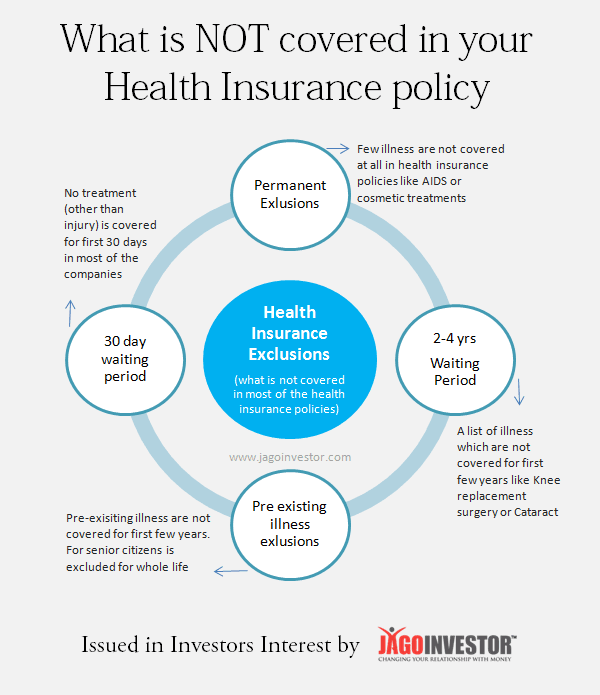

In many insurance policies the insuring agreement is very broad. In insurance exclusions help keep premiums fair by nullifying the possibility for large payments for a handful of insured individuals who are at risk for unusual catastrophic events. A health insurance exclusion refers to anything the insurance company will not cover ranging from a type of drug to a type of surgery. A very common endorsement exclusion has to do with dogs and liability and more specifically excluding dangerous breeds or canines with a history of biting.

All insurance companies exclude coverage of damages arising due accidents when racing. Exclusions in insurance helps keep premiums fair by eliminating the possibility for large payments for the few insured people who are at risk for unusual catastrophic events. Hence it is always advisable to check your policy document and read the terms and conditions related to inclusions and exclusions of car insurance before purchasing your policy online. Exclusions on definitions and conditions basically help narrow the scope of what your insurance company is trying to set forth in your policy.

The wording of the roof exclusion specifies that your insurance provider will not pay for damages to the roof as the result of wind hail rain and other such events. It is important to know your policy exclusions so that you are prepared when an incident occurs. It is often found on the declarations page along with any other exclusions. This exclusion of damage caused by self is most commonly followed by all insurance companies.

A car insurance exclusion involves risks or situations that are not covered in your car insurance policy. The sheer length of the list of general exclusions from most car insurance policies can seem a bit overwhelming at first but the reality is that most of them are commonsense and can be easily. Everyone excluded on the driver exclusion form will not have coverage under your car insurance policy for any claim resulting from an accident they cause while driving your car. Some of the situations that are permanently not covered.

These are always clearly mentioned in the policy documentation.

/conceptual-image-for-insurance-protection-in-illustration--929675680-5b88635ac9e77c0050f925d5.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/conceptual-image-for-insurance-protection-in-illustration--929675680-5b88635ac9e77c0050f925d5.jpg)