Va Home Lona

Learn more about va home loans.

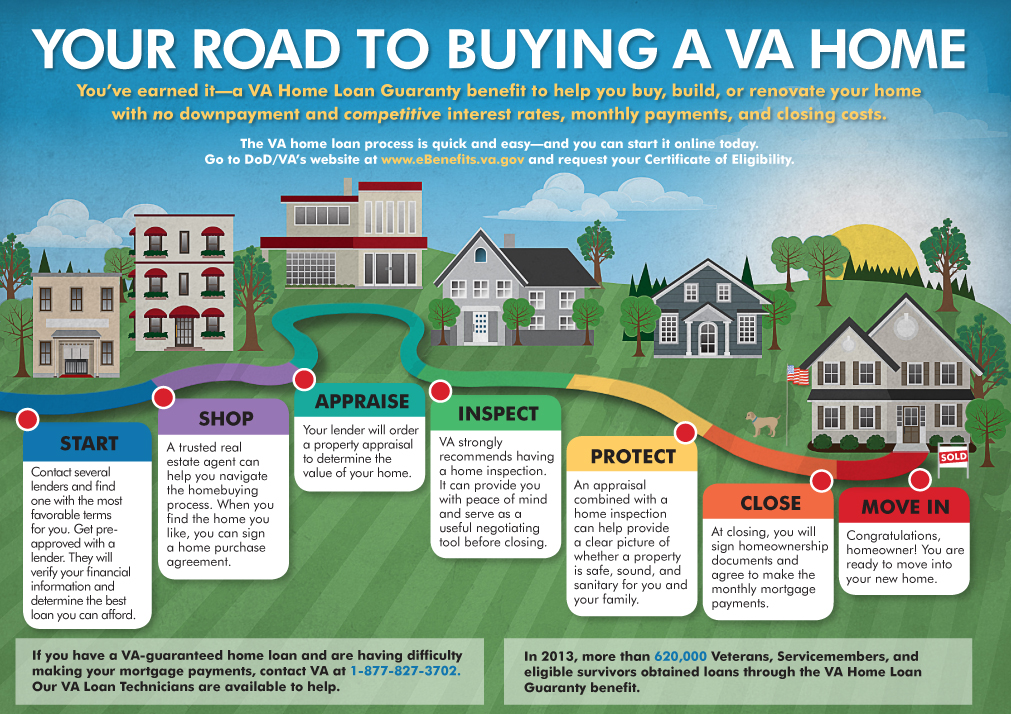

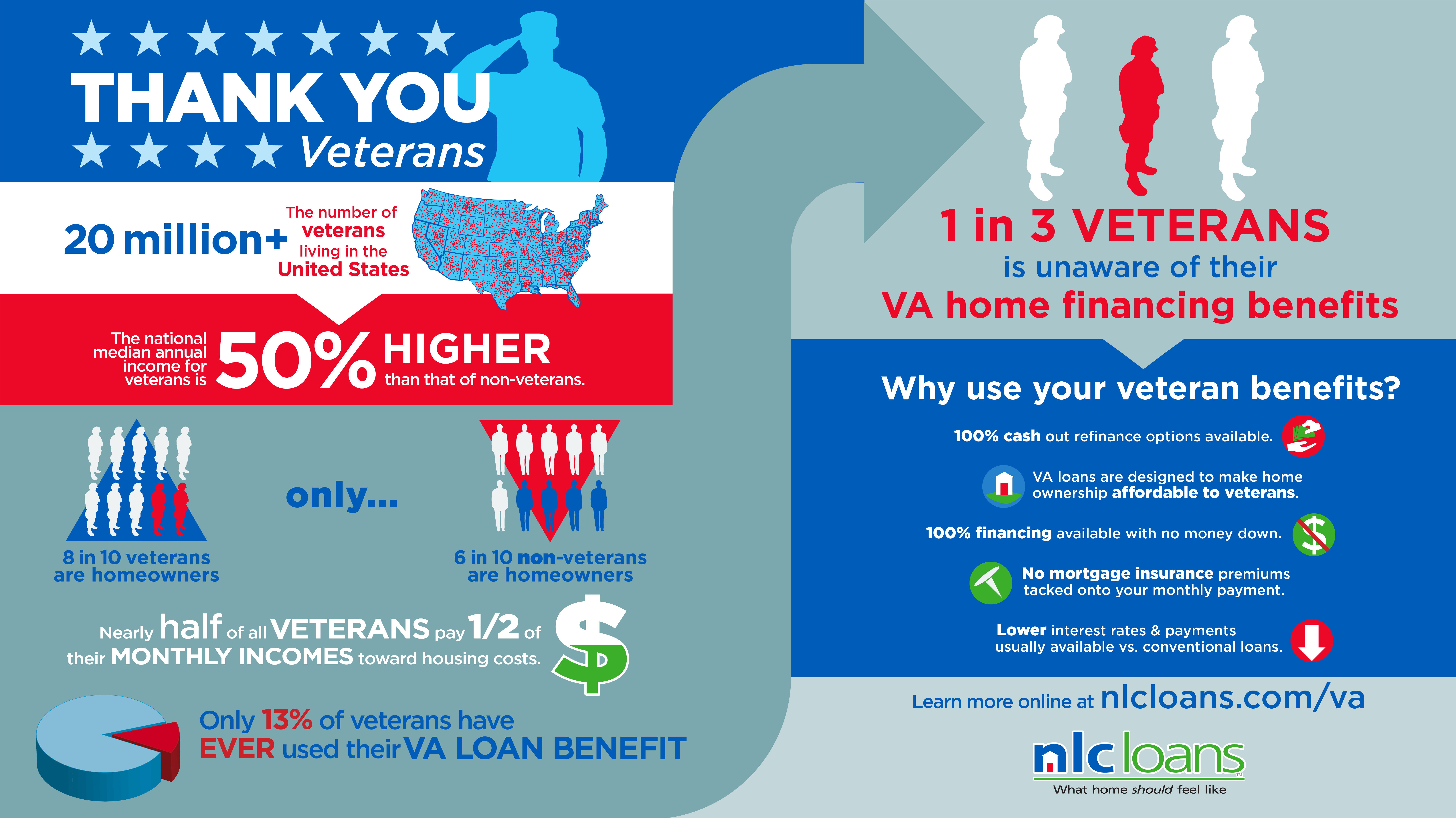

Va home lona. Department of veterans affairs va. Va loans are issued by private lenders such as a mortgage company or bank and guaranteed by the u s. As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy. Learn more about purchase and cash out refinancing.

Includes va loan limits taxes insurance and the latest mortgage rates. While the va does not lend money for va loans it backs loans made by private lenders banks savings and loans or mortgage companies to veterans active military personnel and military spouses who qualify. Find out how to apply for a certificate of eligibility coe to show your lender that you qualify for a va backed loan based on your service history and duty status. The home must be for your own personal occupancy.

We invite you to explore the various options for securing your and your family s future. Va loans have specific appraisal and home inspection requirements which allows buyers to feel more confident in the property they are purchasing parker points out. We offer many insurance options for service members and veterans. The va funding fee can be financed directly into the maximum loan amount for the county in which the home is located.

A va loan is a mortgage loan that s backed by the department of veterans affairs va for those who have served or are presently serving in the u s. Use our free va mortgage calculator to quickly estimate what your new home will cost. Va helps servicemembers veterans and eligible surviving spouses become homeowners. You must have satisfactory credit sufficient income and a valid certificate of eligibility coe to be eligible for a va guaranteed home loan.

We offer va home loan programs to help you buy build or improve a home or refinance your current home loan including a va direct loan and va backed loans. The va home loan was created in 1944 by the united states government to help returning service members purchase homes without needing a down payment or excellent credit. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs. Learn more about insurance benefits.

The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries.

/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)