Rehab Program For Student Loans

The rehab program is controlled by the department of education.

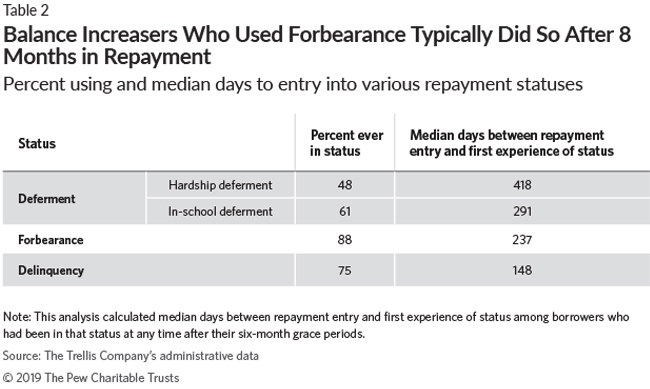

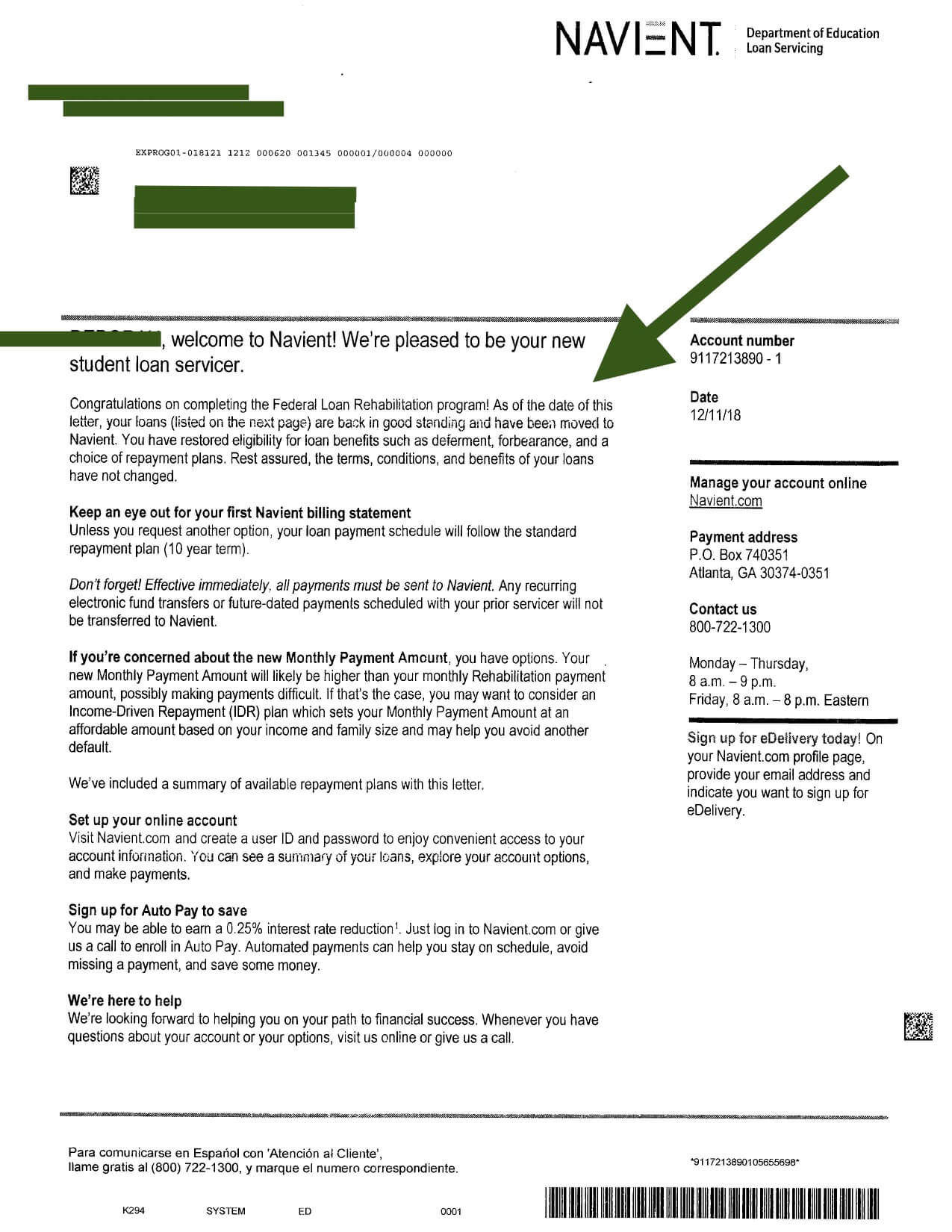

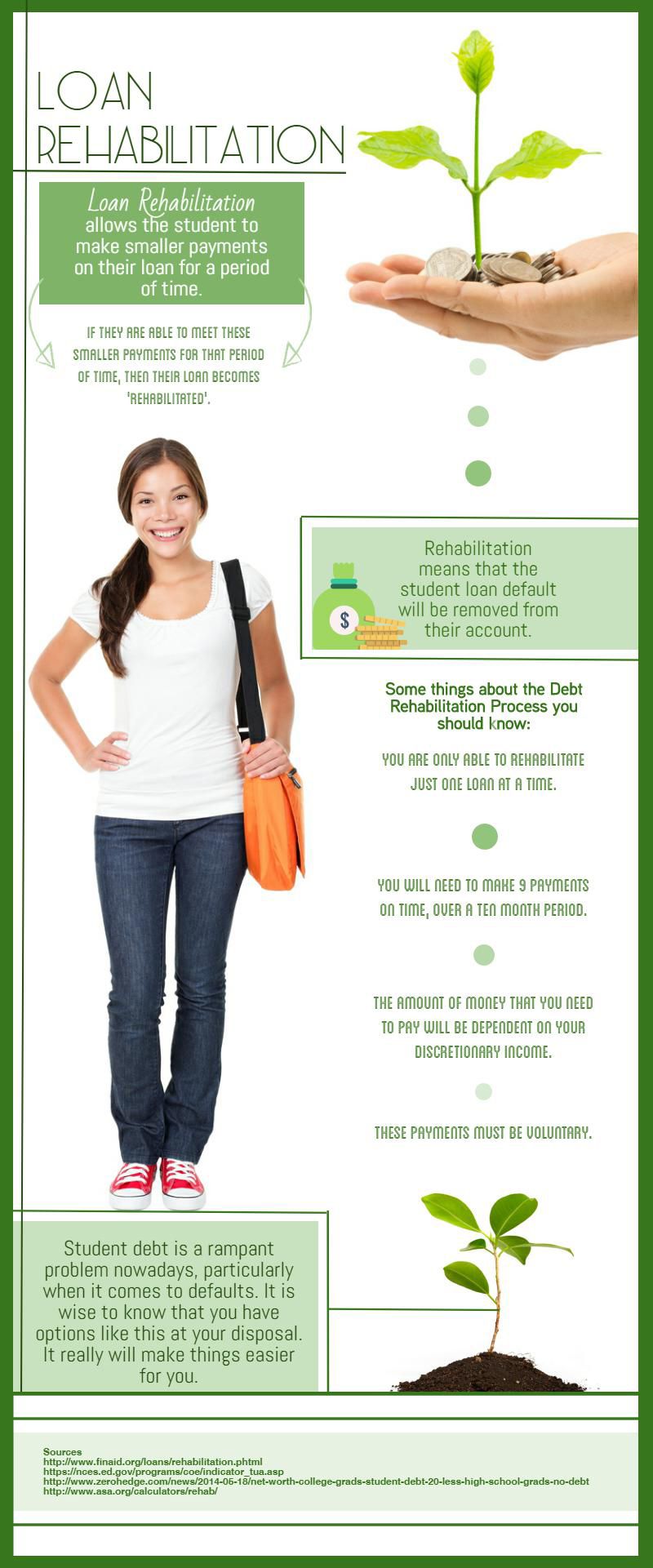

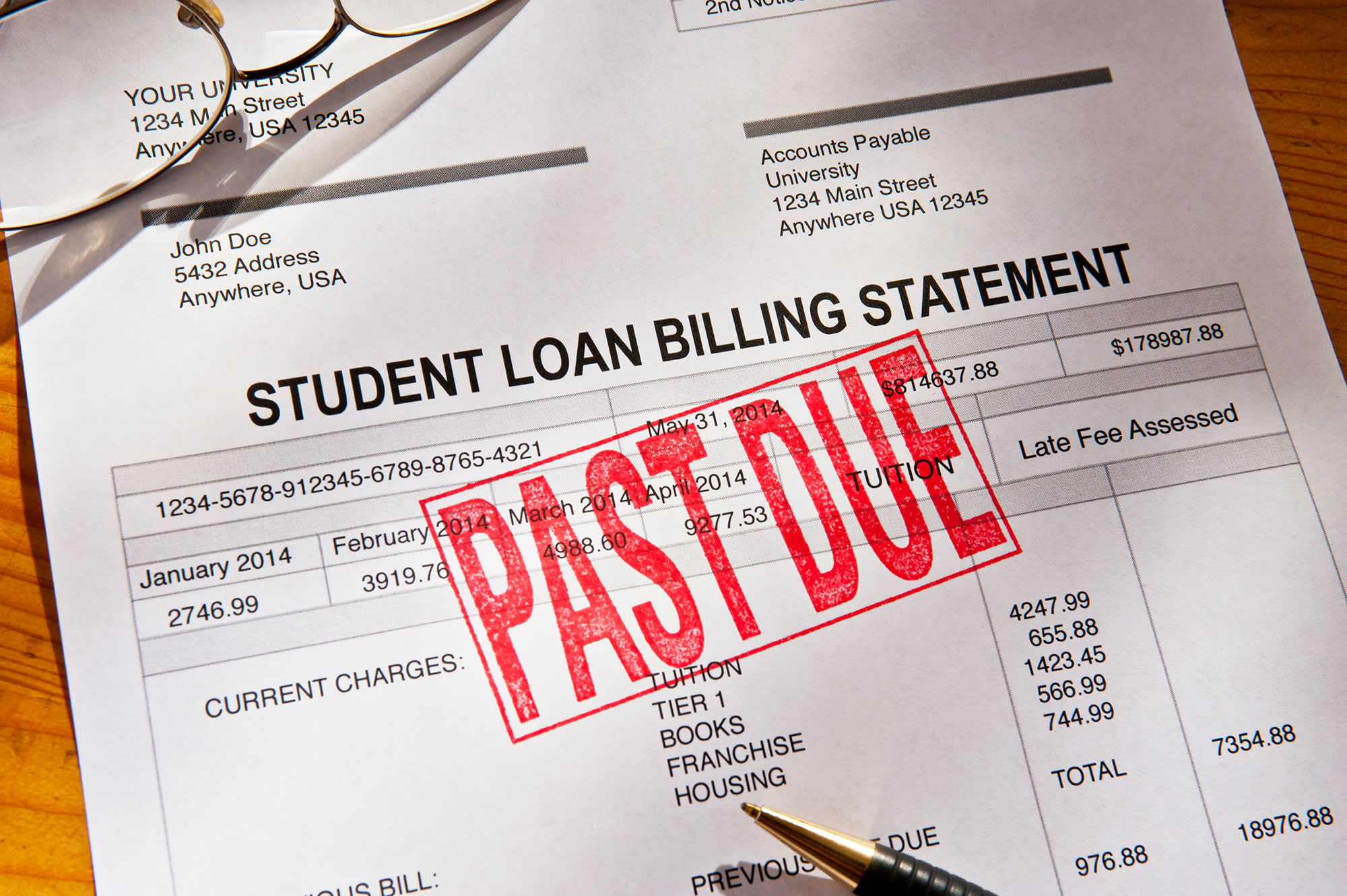

Rehab program for student loans. How to use the federal student loan rehabiliation program to get your loans back on track. Federal student loans allow borrowers to defer payments for a long as three years if they have financial hardships or are enrolled in post secondary school. Student loan rehabilitation is a program that lets a borrower bring her federal student loans current after defaulting. Each option has its pros and cons but either should help get your federal student loans out of default and allow you to avoid the stress of dealing with collections agents wage garnishment and tax offsets.

The payment amount is typically agreed upon by both the lender and the borrower to be an affordable payment that the borrower can make. Student loan rehabilitation is a one shot opportunity for borrowers to get federal student loans out of default. A student loan rehabilitation is typically a 9 10 month payment program where the borrower will make agreed upon payments to rehabilitate the student loans to remove the default status. Student loan rehabilitation or consolidation.

If your federal student loans are in default meaning that you ve missed 270 days of payments you can take action in one of two ways. The rehabilitating lender will establish a new repayment term of 10 years 120 months or up to 30 years 360 months for consolidation loans minus the nine months of payments you make to qualify for rehabilitation. The federal student loan rehabilitation program offers borrowers who have defaulted on their student loans a way to get out of default and back into repayment but it does something even better than that because it also removes the default status from your credit report as well. Private student loans are not eligible for rehabilitation.

Student loan rehabilitation programs are another alternative. The department usually doesn t handle the collection of the defaulted student loans themselves.

/wagegarnishmentonstudentloans-ca7480519d754671acaa9751a2790cde.png)