Sale Annuity

In an installment sale the seller defers recognition of gain on the sale of a business or real estate to the tax year in which the related sale proceeds are received.

Sale annuity. Beyond annuity features investors are faced with yet another choice lately. Their sales are regulated both by finra and the securities and exchange commission sec. The part of any gain on the sale of an annuity contract before its maturity date that is. For example say your annuity that covers you for life and you re 40 years old.

Our structured sale annuity ensured installment sale may be the capital gains tax and income stream solution you have been looking for. There are three ways you can sell your annuity. Annuities have traditionally been. Our tailored approach is adapted to your situation with a range of possible options including occupied life annuity unoccupied life annuity bare ownership which allows you to rent a property in the event of early release of the premises by the life tenant or forward sale which concerns younger vendors by limiting the period of payment of annuity by the payer.

Structured sale annuity is the method of selling real property or business with the aim of securing a guaranteed income stream and deferring gains on the proceeds. A partial sale a sale in its entirety or lump sum sales. Here s how they compare. Just as it sounds this option is for those looking for the maximum sum of money.

How selling your annuity for cash works. Find out how our revolutionary structured sale ensured installment sale is changing the way people think about selling appreciated real estate and closely held businesses. A structured sale or structured installment sale is a special type of installment sale pursuant to the internal revenue code. With this option you are choosing to sell your annuity or structured settlement in its entirety ending any chance of periodic income payments in the future.

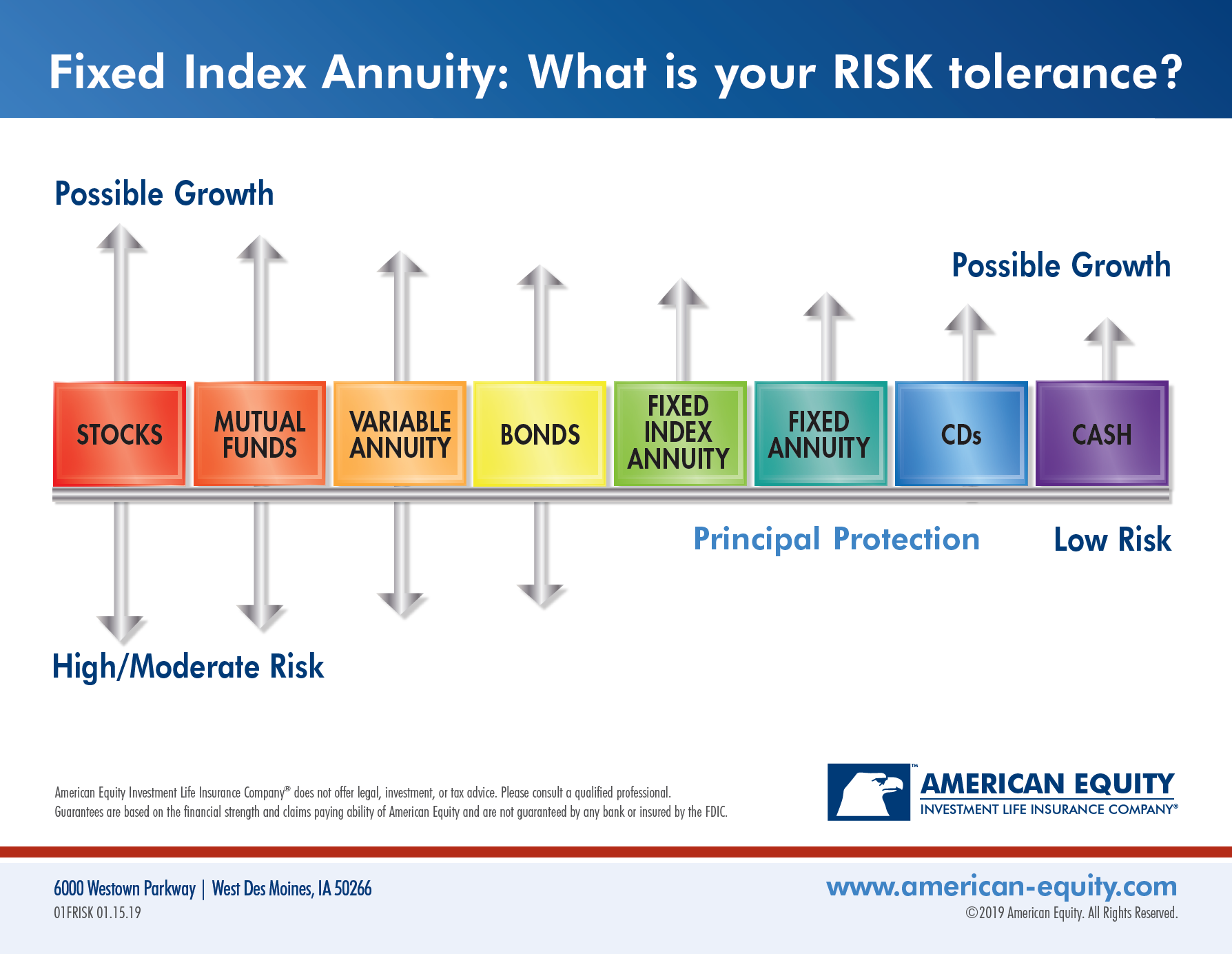

Whether to secure a contract through a commission based sale or a fee based advisor. Deferred variable annuities are hybrid investments containing securities and insurance features. These annuities offer investors choices among a number of complex contract features and options. Conversely structured sale annuity is an ensured installment sale or structured sale process that offers a regular stream of income based on the agreed structured sale annuity rates.

Due to the complexity and confusion surrounding them which can lead to questionable sales practices variable.