Types Of Iras Rollover

Roll over a traditional 401 k into a traditional ira tax free.

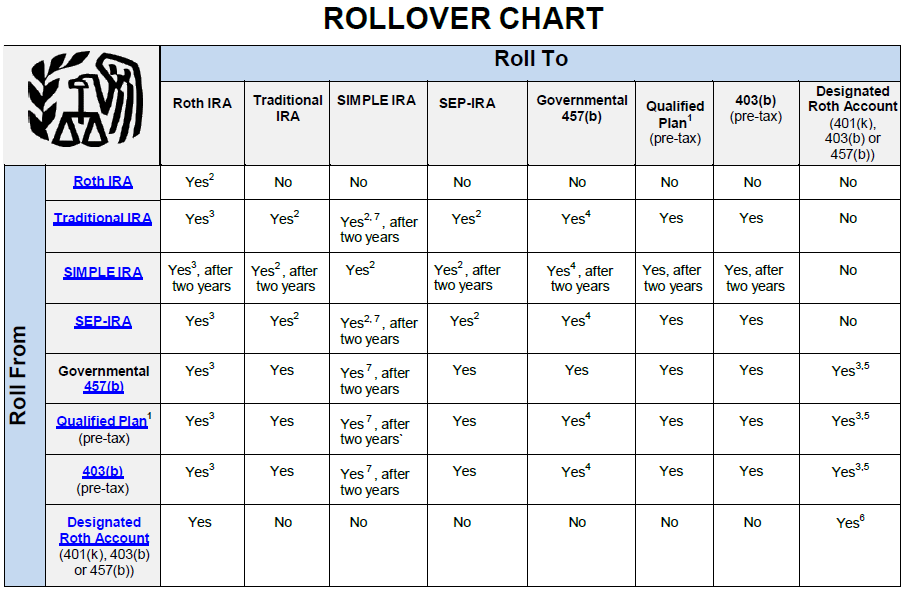

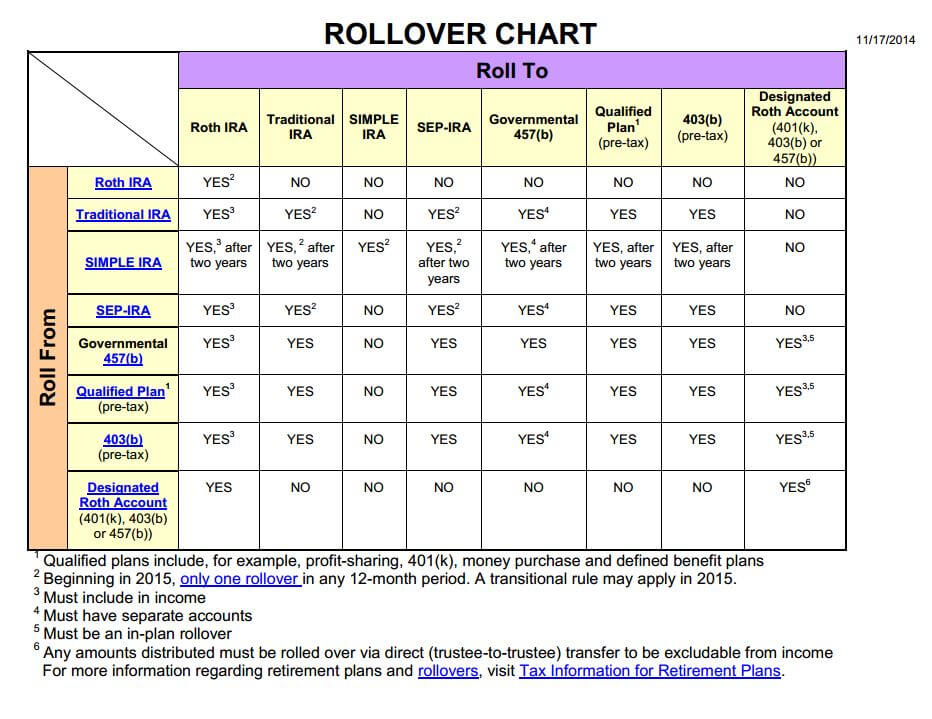

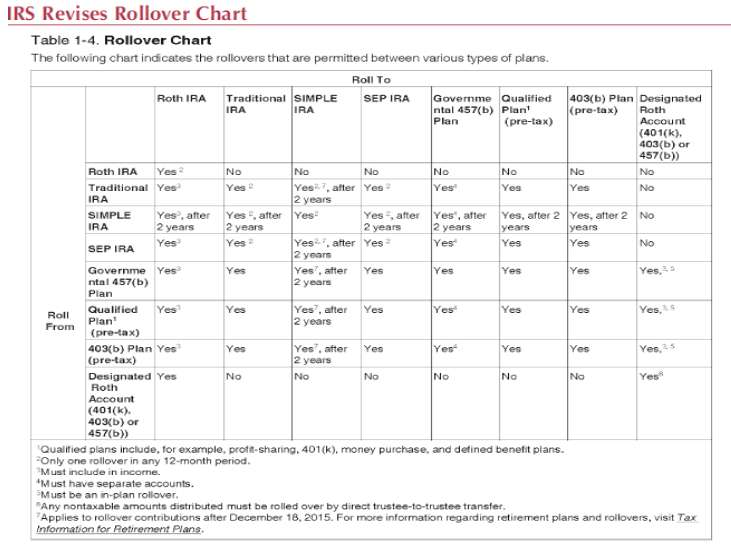

Types of iras rollover. An individual retirement account ira in the united states is a form of individual retirement plan provided by many financial institutions that provides tax advantages for retirement savings. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. What you can do. Choosing one for your rollover depends on the type of account you have now and other factors such as when you want to pay taxes.

A rollover ira is a very specific version. Here are the basics on contributions tax. Switching jobs can prompt one of the most common types of rollovers. The best known iras are the roth and traditional.

A special type of traditional individual retirement account into which employees can transfer assets from their former employer s retirement plan when they change jobs or retire. If you have small ira accounts in many places and your employer plan offers good fund choices with low fees using this reverse rollover option can be a way to consolidate everything in one place. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover.

Roll over a roth 401 k into a roth ira tax free. Rollover iras are commonly used to hold 401 k 403 b or profit sharing plan assets that are transferred from a. Can i roll over my ira into my retirement plan at work. The purpose of a rollover is to maintain the tax deferred status of those assets.

Both roth and traditional iras offer advantages. Find answers to commonly asked questions about iras and work retirement plans rollovers and converting a traditional ira to a roth ira. One option is an individual retirement account or ira. Although most people think of an ira rollover as moving funds from a 401 k to an ira there is also a reverse rollover where you move ira money back into a 401 k plan.

/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

/GettyImages-1017300682-3086d9bb0cc942df8fc62401a5286372.jpg)