What Does Business Insurance Cover

Business insurance refers broadly to a class of insurance coverage intended for purchase by businesses rather than individuals.

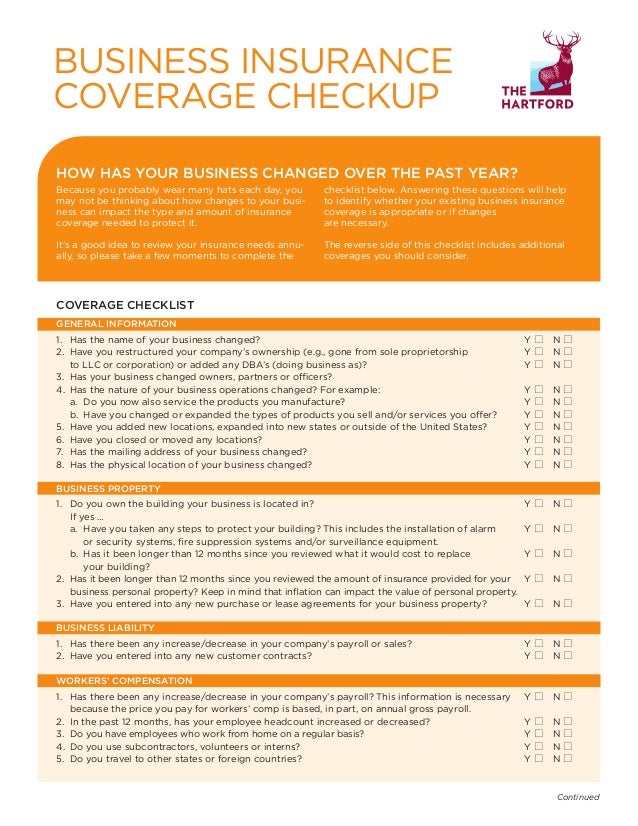

What does business insurance cover. What does business insurance cover. Find out how general liability insurance can help protect your small business from a broad range of accidents. To find the source of the breach and mitigate the damage. There s a range of different types of business insurance to cover various business risks.

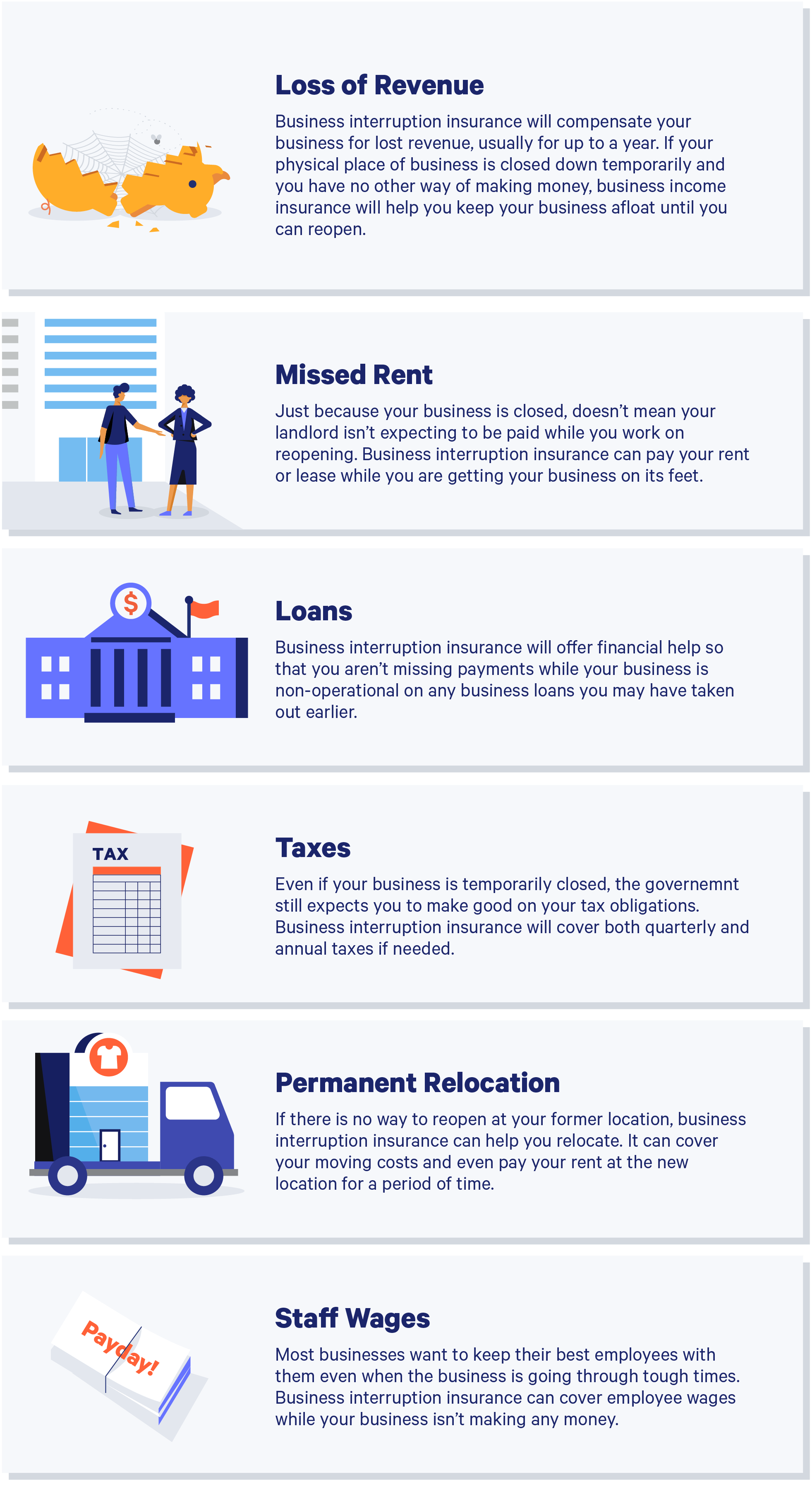

Generally it is sold in increments of 1 million and is used only when liability on other policies. This applies to the building and belongings within the business even if some of those items belonged to customers. To ensure that enough liability coverage is in place for extreme circumstances like a lawsuit that exceeds 1 million in damages many businesses buy a commercial umbrella liability policy. Business interruption insurance helps replace lost income and pay for extra expenses when a business is affected by a covered peril.

This insurance can cover different kinds of claims including homeowner s or auto insurance. Losses from certain natural disasters extreme weather events or floods may not offer your business coverage. Business insurance is great so long as you understand what it doesn t cover. Business insurance covers lawsuits as long as you have the appropriate business liability insurance for your situation and enough liability coverage to pay your legal costs.

If you re worried about the loss of items such as laptops then it s business equipment insurance you want to consider. Data breach insurance helps protect your business from the costs of cyber threats or attacks if your business is attacked coverage from the hartford can help cover the costs. And for public relations to manage your company s reputation through the crisis. Public liability insurance can cover compensation claims made against you by a member of the public for injury or damage caused by your business.

Business interruption coverage sometimes called business income coverage is typically part of a business owners insurance policy read on to learn how business interruption coverage can help your business recover after a loss. Businesses seek insurance to cover potential damage to property to. Unfortunately there are many different types of theft and depending on your business many things a thief could steal. Get a quote today.

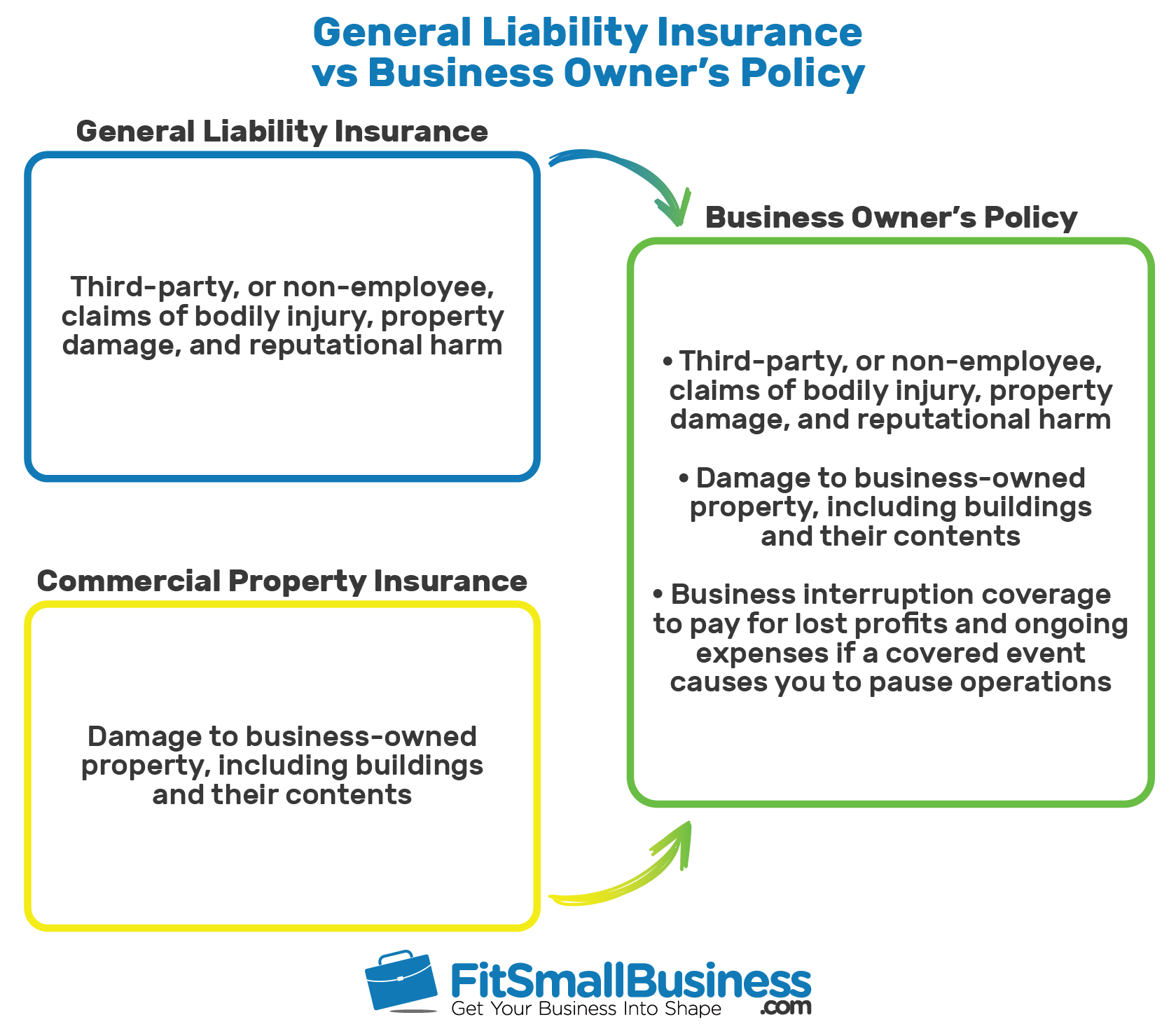

What does general liability insurance cover. General liability helps protect your business from claims of bodily injury property damage advertising injury and more.

/business-interruption-insurance-186783504-dc2ed469d7a84fa682ff2ebb229b1efb.jpg)