Types Of Bankruptcies For Corporations

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1196682295-ea397b86ea1a437d97f93fdab7b68eac.jpg)

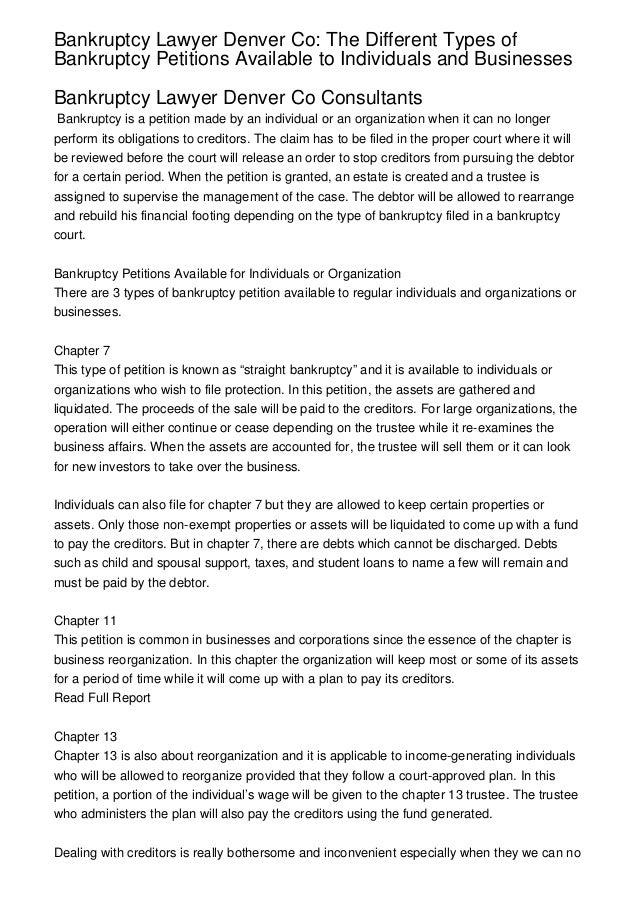

Chapter 7 bankruptcy for llcs and corporations chapter 7 bankruptcy can help corporations and llcs going out of business by providing an orderly liquidation of the business.

Types of bankruptcies for corporations. By cara o neill attorney filing for chapter 7 bankruptcy can be a valuable option for corporations and limited liability companies llcs that are going out of business. In 2002 worldcom filed for one of the largest bankruptcy ever. The owner is responsible for all assets and liabilities of the firm. Chapter 7 is what most people mean when they say i m filing for bankruptcy.

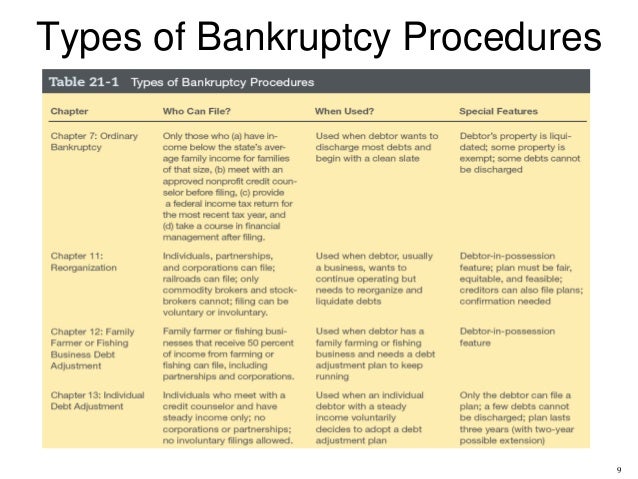

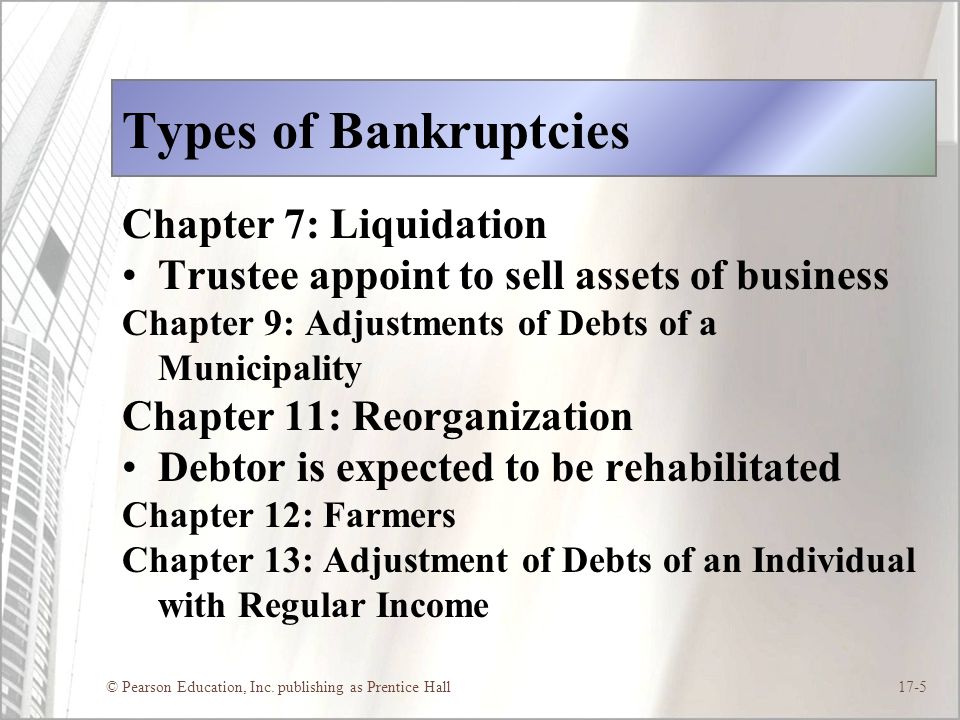

Business bankruptcies are usually described as either liquidations or reorganizations depending on the type of bankruptcy you take. Sole proprietorships are legal extensions of the owner. There are four types of bankruptcy available to non governmental entities. This would include individuals spouses sole proprietor businesses partnerships and corporations including limited liability companies.

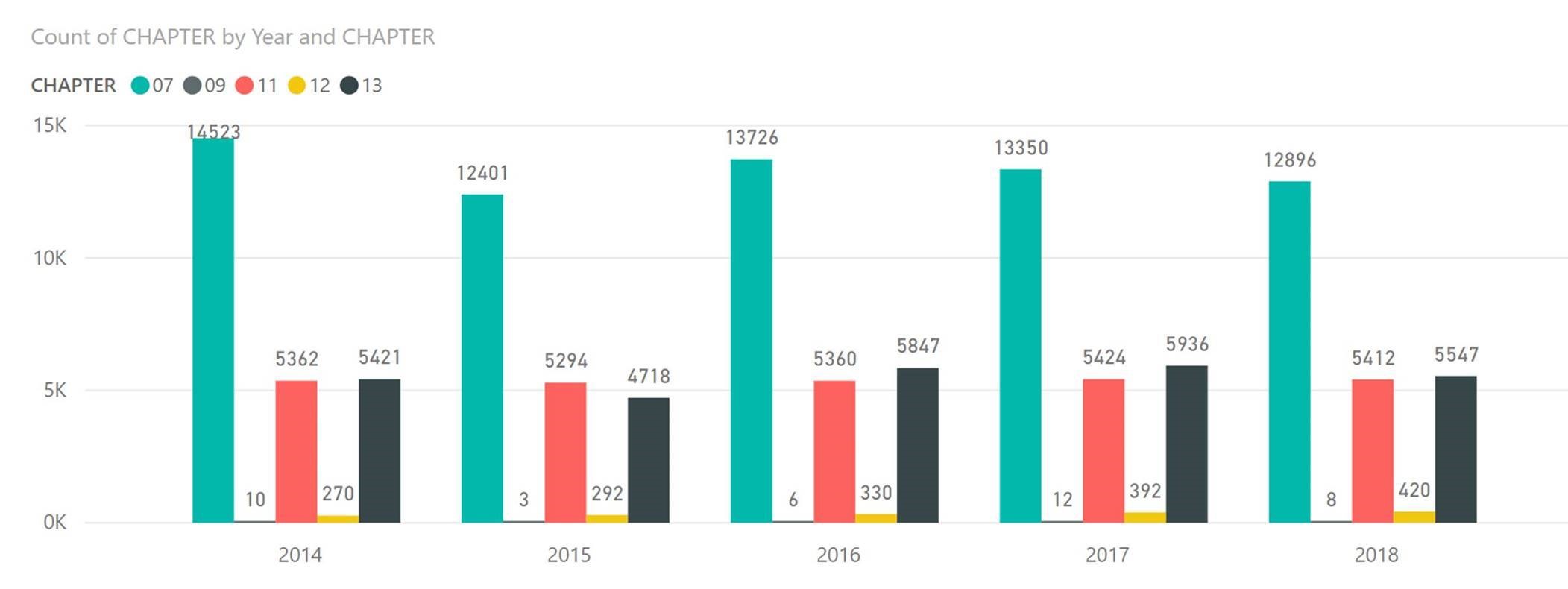

There are three types of bankruptcy that a business may file for depending on its structure. The four types of bankruptcy are named for their respective chapters in the united states bankruptcy code. Worldcom had 41 billion of debt while it filed for chapter 11 bankruptcy. There are primarily five diverse types drawn by the bankruptcy code of the united states including chapter 7 9 11 12 13.

For the most part chapter 11 bankruptcy is used to reorganize a business or corporation. Chapter 7 bankruptcy the most common type is chapter 7 bankruptcy. When the owners of a business file for bankruptcy an automatic stay is instantly put in place to prevent any attempts by creditors to collect money owed to them by the company. A company filing chapter 11 hopes to return to normal business operations and sound financial health.

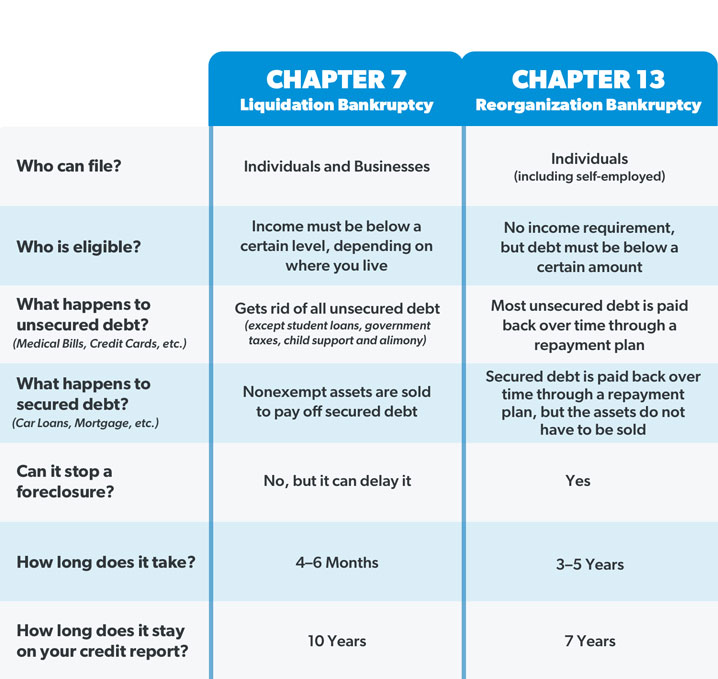

Since the other types of bankruptcies are specifically geared toward certain individuals or businesses most people only qualify for chapter 7 or chapter 13.

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

:max_bytes(150000):strip_icc()/All-US-Retail-Chapter-11-Bankruptcies-and-Going-Out-of-Business-Sales-GettyImages-171268919-56a7f8d55f9b58b7d0efbf6c.jpg)

/bankruptcy-3596095b06bf4a4a82d27ebb4a314f0e.jpg)