Selling Annuities

It s essential for the insurance industry and its agents to be upfront and transparent about how the selling agent gets paid and how much.

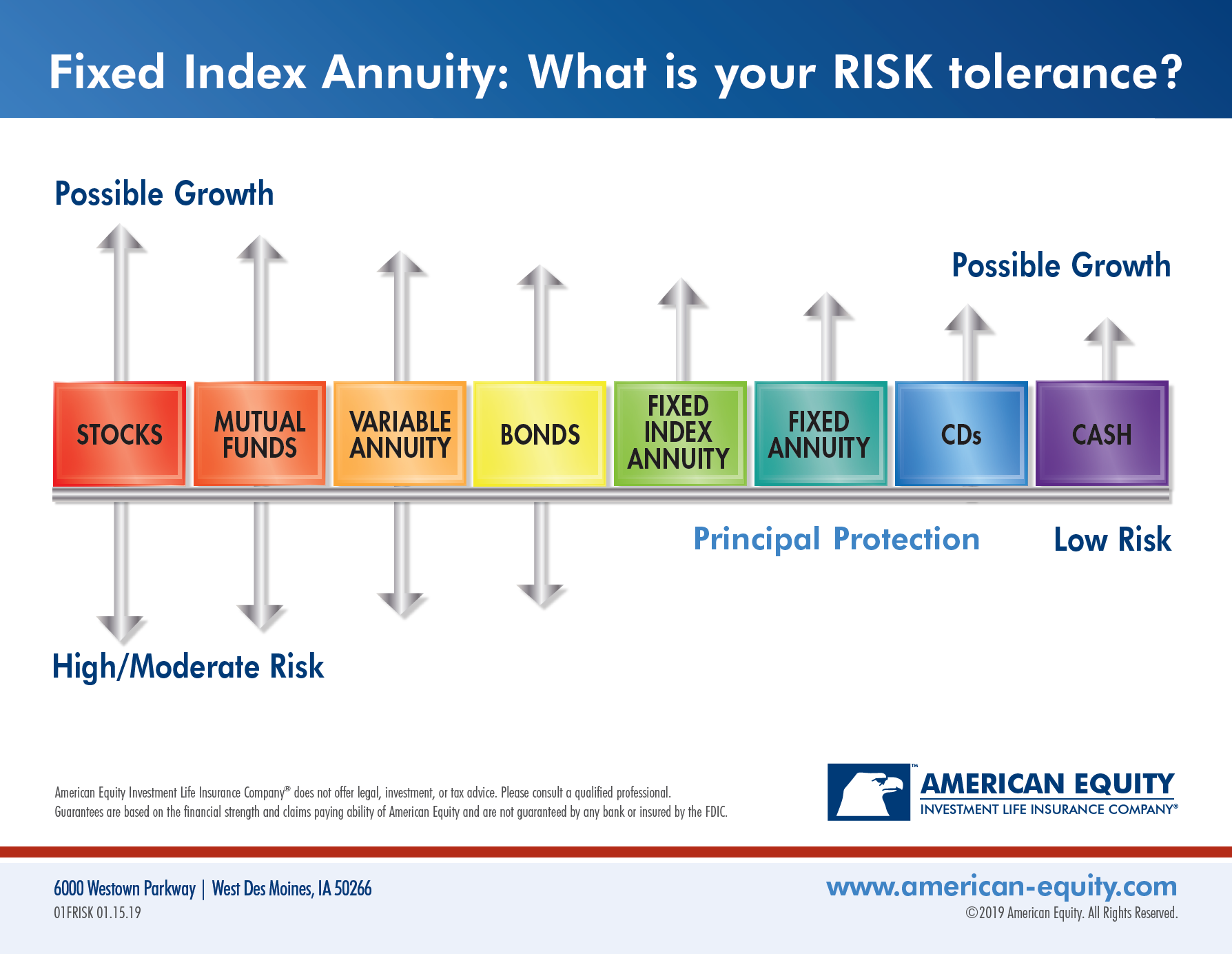

Selling annuities. Make sure you are well educated before you start selling annuities. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you either immediately or in the future. Selling a structured settlement or annuity is a legal process and can be intimidating. Single premium immediate annuities spias longevity annuities also called deferred income annuities or dias fixed rate annuities also called multi year guarantee annuities or mygas qualified longevity.

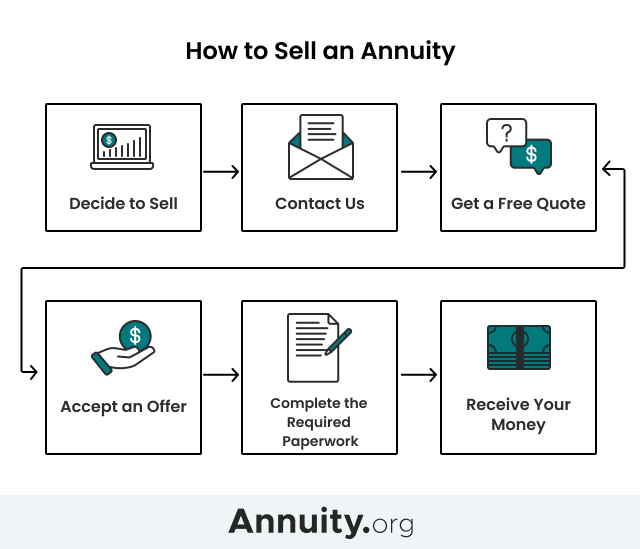

Selling annuity payments could be the solution for an array of financial woes. Whether that includes buying a new house paying for a new car paying for college tuition or even balancing medical expenses cashing out a portion of your annuity could be the solution to avoiding unnecessary debt. Below are the 6 simple steps to selling annuities online. Learn the answers to commonly asked questions about selling your structured settlement below.

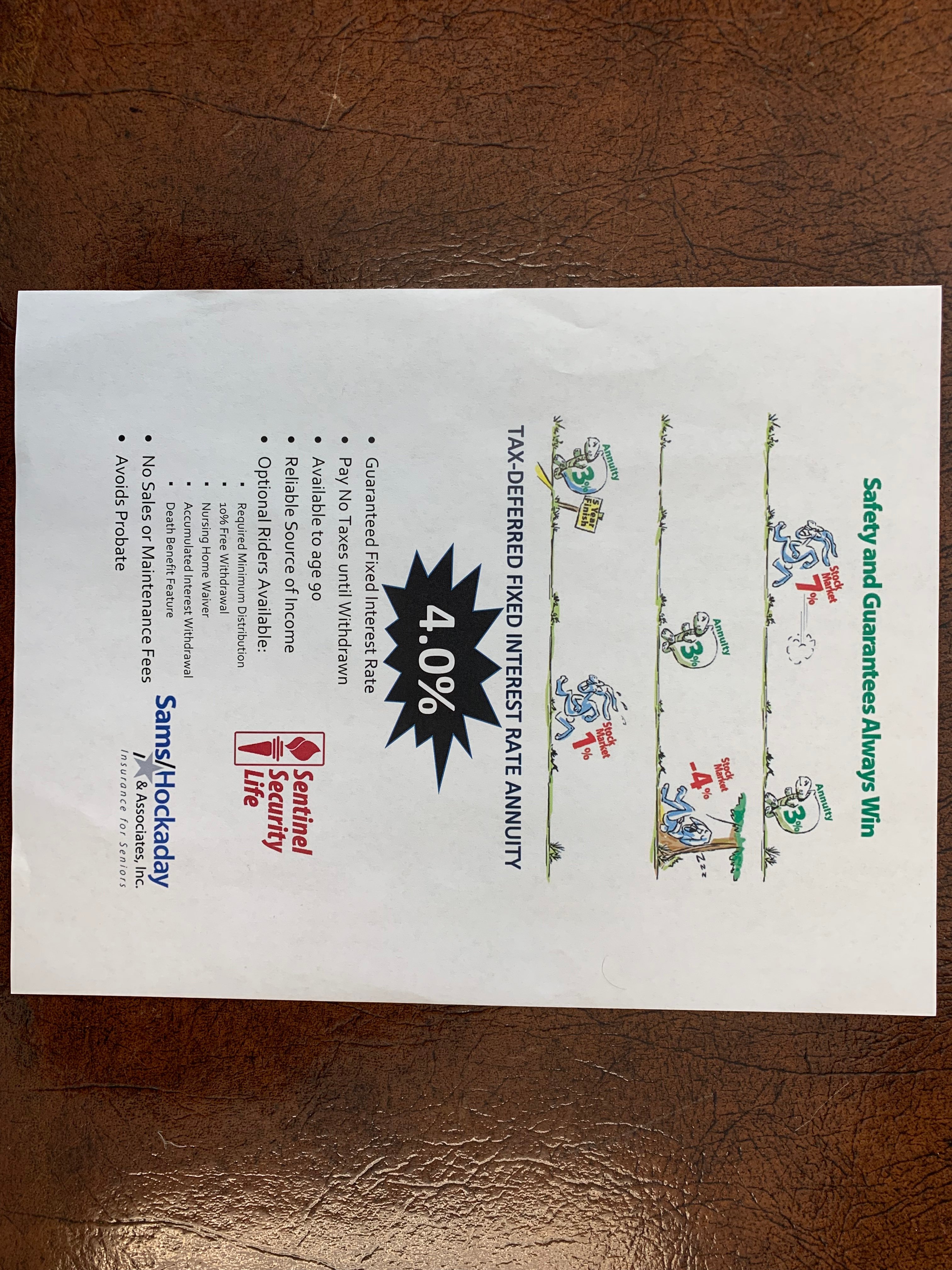

In contrast to selling annuities purchased through insurance companies selling the rights to structured settlement payments is a legal process that requires court approval. This article was updated in march 2020 with michael sams 2019 annuity production numbers. For an agent to sell fixed annuities they only need a life insurance license issued by their state of residence fixed annuities are primarily represented by five different products. Most annuity settlements payout for a guaranteed period and life there after.

You can purchase an annuity to draw payments against in retirement as a supplement to tax advantaged or taxable savings accounts. Those particular payments are contingent on the payee being alive. This is a growing trend as more and more consumers are comfortable making purchases online especially the younger demographics. If you are receiving life contingent pays and would prefer a lump sum of cash call today selling annuities structured for life is possible.

But what if you want to sell your annuity and get immediate cash. You buy an annuity by making either a single payment or a series of payments. This article was also updated in june 2020 with links to new articles about equitable s fia offerings as well as an updated link to the brand new all star program website. Here s why selling your annuity is something you might consider.

Changes have been made in the industry but it s still important to ask questions about commissions if you re considering an annuity. Offering another layer of protection for sellers structured settlement protection acts the state and federal laws that safeguard the rights of settlement holders govern the practices of purchasing companies. 5 agents advice for getting started selling annuities.

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)