Selling Annuities For Cash

You can sell your annuity or structured settlement payments for cash now.

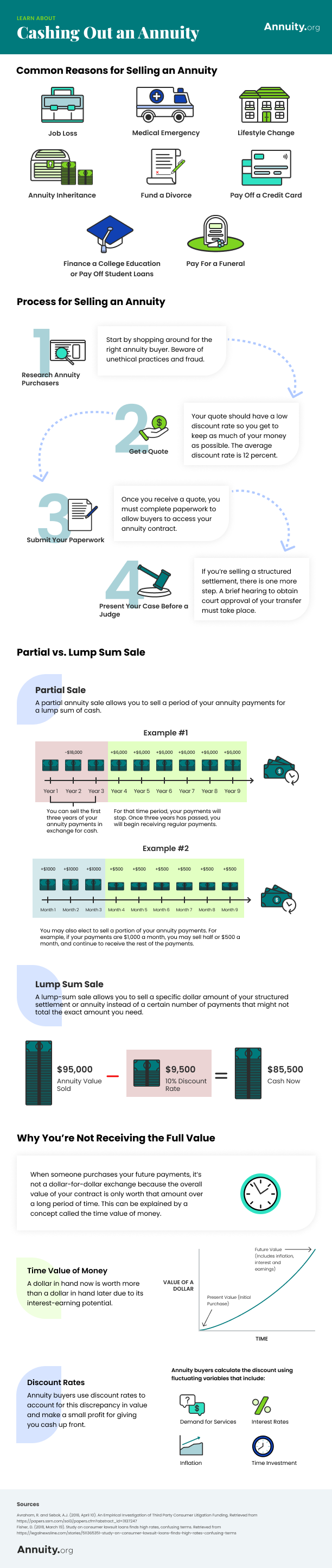

Selling annuities for cash. Selling annuity payments for cash many people who have or are considering annuities are concerned about credit risk. In exchange for quick turnaround on cash annuity buyers will charge a fee and sell your annuity at a discounted rate for profit. First and foremost selling your annuity does not guarantee a full payout equal to the initial value of the contract. There are options for selling annuity payments and it is important to review them in order to choose the right one for your needs.

The amount of the lump sum you receive will depend on various factors such as the amount of your annuity your payment schedule and the discount rate. The cash you receive on the sale of your annuity will be taxable in the same way as any other income you receive in that tax year. The basic choice is whether to cash in some or all payments. An annuity is an insurance contract you can use to create an income stream.

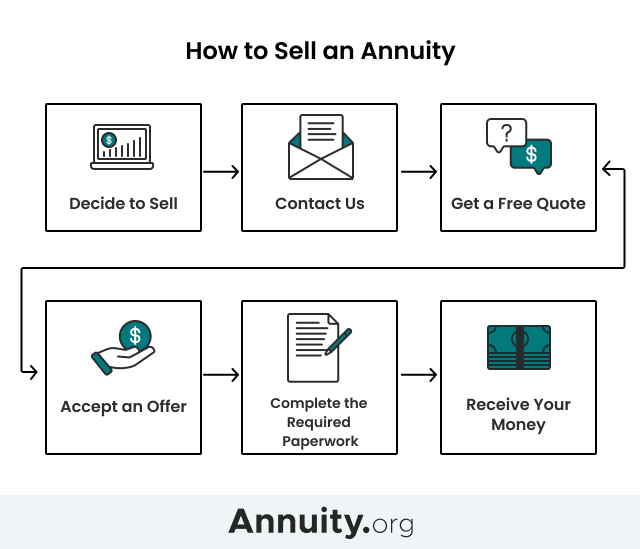

On top of that inflation tends to whittle the value of your purchase so most annuity holders sell their annuities at a loss. The discount rate determines the fee the company charges in order to make profit on the sale and will directly impact how high your lump sum is. Selling annuity payments in exchange for a lump sum of cash is simple convenient and can be completed in just a few steps with some assistance from an established company with several years of experience in the field. How much cash can i get if i sell my annuity.

Here s why selling your annuity is something you might consider. But what if you want to sell your annuity and get immediate cash. Annuities can be sold in portions or in entirety. Whether that includes buying a new house paying for a new car paying for college tuition or even balancing medical expenses cashing out a portion of your annuity could be the solution to avoiding unnecessary debt.

That s because deductions can bite into your income. You can purchase an annuity to draw payments against in retirement as a supplement to tax advantaged or taxable savings accounts. Selling your annuity payment does have tax implications. With annuities of no more than 10 000 sellers can anticipate around 2 000 at the time of writing.

How much can i make selling annuities for cash. A partial sale allows you to receive a lump sum of money for a portion of your annuity payments. In other words there are concerned about will happen to their annuity if the insurance company that provided the product goes out of business.