Refinance High Interest Student Loans

Splash financial is a student loan refinance lender operating in all 50 states.

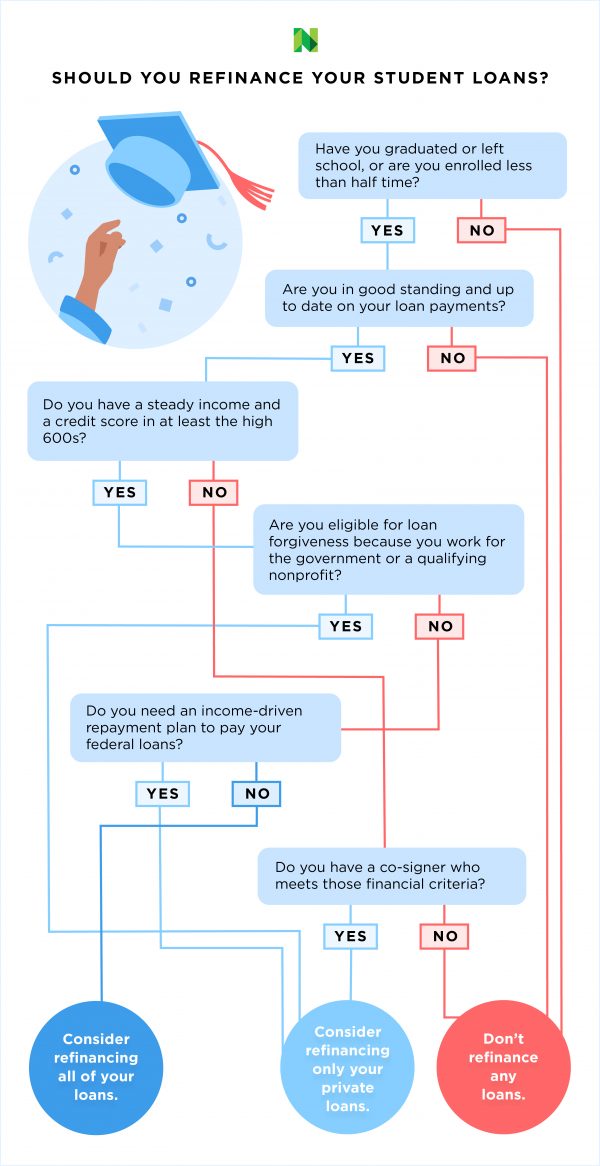

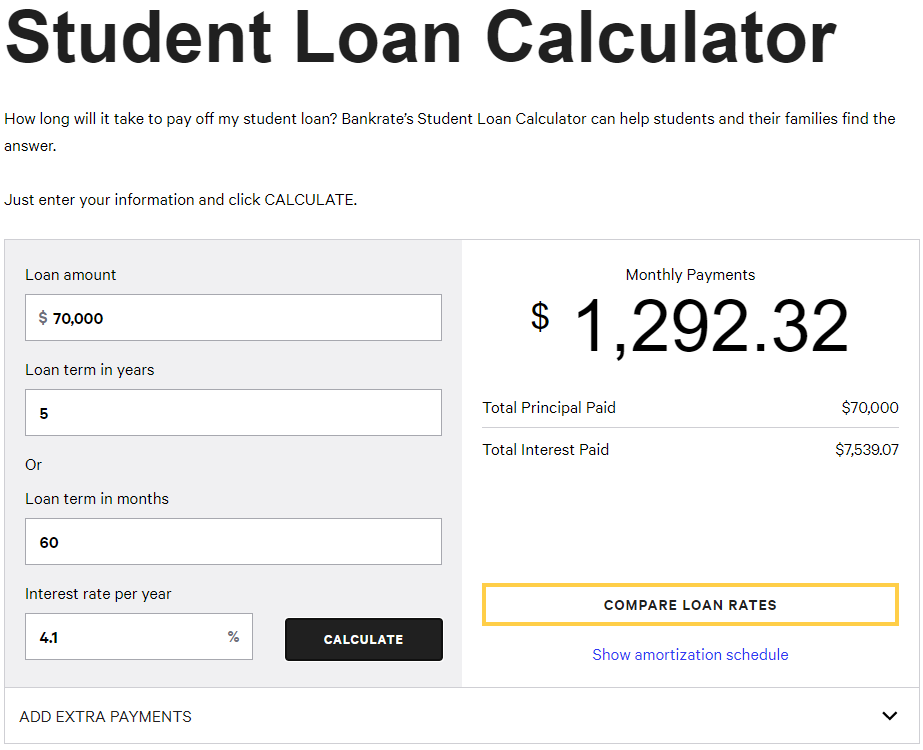

Refinance high interest student loans. What is a high interest rate for student loans. Online marketplace credible can help you compare student loan refinance. However you can lessen the burden of your high interest student loan by refinancing it. The fixed interest rate for direct subsidized and unsubsidized loans for undergraduates is 4 53 for the 2019 20 school year and will likely change for 2020 21 student borrowers.

Parents and people with grad school loans can also save money by refinancing plus loans which have higher interest rates than other federal student loans. There are many different reasons why one might want to do this but ideally you ll obtain a new. You can refinance your loan with a consolidated student loan another personal loan or a mortgage. You could lower your monthly payments or consolidate multiple loans into one simple low interest monthly payment.

Here s how it works. You may be able to refinance high interest student loans to save considerable money and make the payback process easier. Many people who refinance their student debt repay their student loans faster or use the money they save for other big purchases. Student loan refinancing can mean big savings in the right circumstances.

Student loan refinancing has several advantages including a lower interest rate single monthly payment fixed or variable interest rate flexible 5 20 year loan repayment term one student loan. Refinancing is available for federal private and parent plus loans including undergraduate graduate mba law. Federal student loan interest rates are reset annually. If your private or federal student loans have an interest rates of 4 or higher refinancing will likely save you money.

A new private company typically a bank credit union or online lender pays off the student loans you. The variable interest rates are calculated by adding a margin ranging from 0 98 to 3 80 for the 5 year term loan 2 35 to 3 85 for the 7 year term loan 2 40 to 3 90 for the 10 year term.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)