Who Needs General Liability Insurance

Get a quote and buy online in under five minutes.

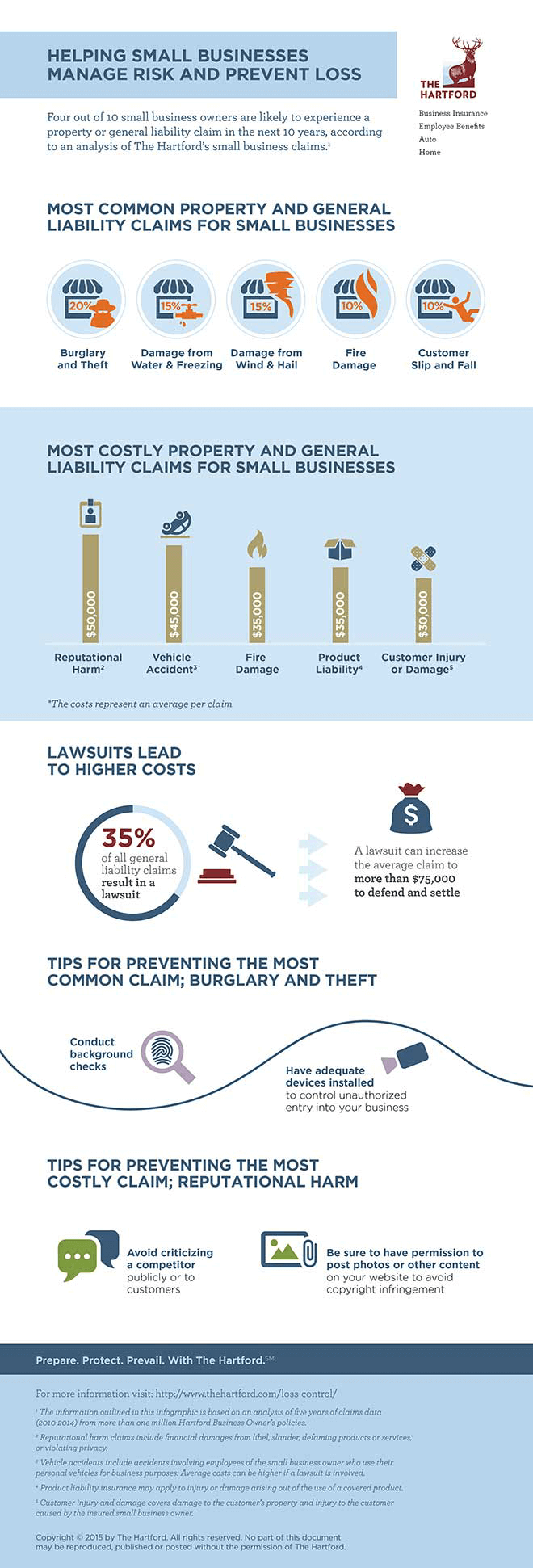

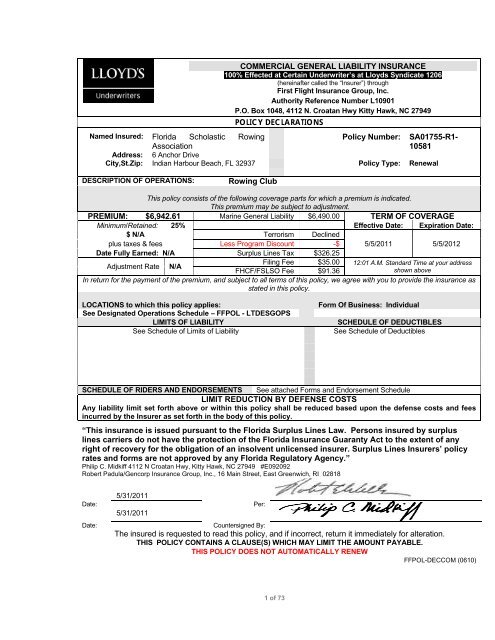

Who needs general liability insurance. General liability insurance is an essential coverage that many businesses need because it helps protect them from certain lawsuits. If you visit clients premises or have clients visit you you need the coverage. If that s the case simply business can help you determine how much coverage your business may need. Business location also has a bearing on the level of coverage needed.

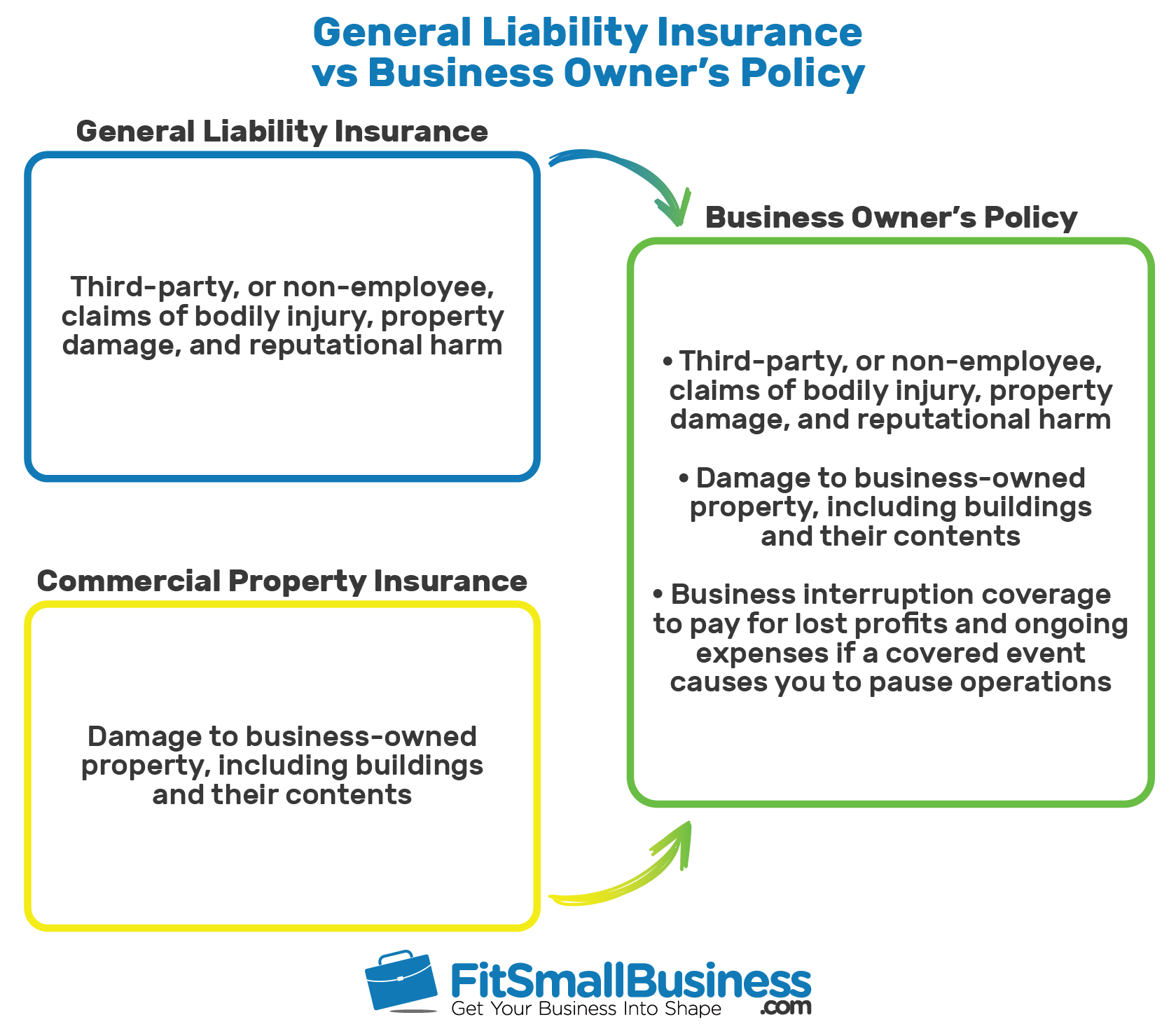

General liability insurance covers you and your business if you re sued for negligence causing a bodily injury or damage to somebody s property even if you haven t done anything wrong. General liability insurance for as low as 12 50 month with apollo insurance. Cgl is the most essential insurance for a business. General liability insurance is often combined with property insurance in a business owners policy bop but it s also available to many contractors as a stand alone coverage through the progressive advantage business program.

General liability insurance also referred to as commercial general liability cgl insurance or business liability insurance protects a business against the risk of accidents like bodily injury and property damage that happen to a third party. As a contractor or small business owner you need some form of business liability insurance to safeguard your livelihood. Gl insurance which is also referred to as commercial general liability cgl insurance covers costs associated with third party accidents property damage and bodily injury. As a contractor or small business owner you need some form of business.

Keep in mind that general liability insurance can also help you secure large government contracts or even customers who want proof of insurance. When in fact you do need a separate policy to cover cyber. Who needs general liability insurance. As a contractor or small business owner geico can help you get the coverage your business needs.

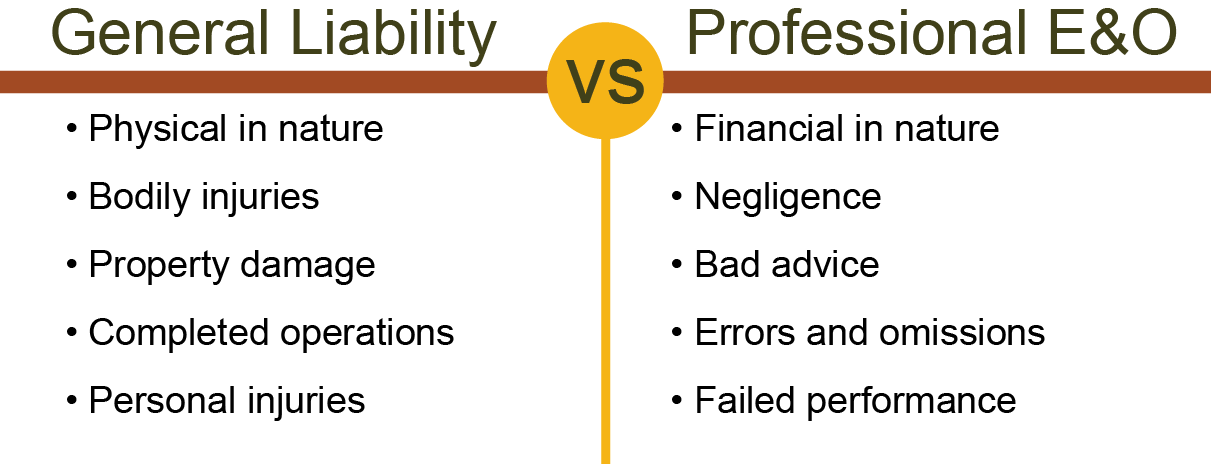

General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries. Also known as business liability insurance or commercial general liability insurance it can help cover the costs of certain lawsuits brought against your company including. The difference between general liability and cyber is that general covers physical damages while cyber covers any damages incurred by the breach including security forensics. General liability insurance is often packaged with commercial property insurance in a business owners policy bop but it s also available mono line to contractors and other specialty businesses.

Most however think that a general liability policy will cover this risk and they don t need a cyber policy. However both types of businesses need general liability insurance.