Refinance A Student Loan

This term gets confused for consolidation because many people consolidate multiple private loans into one new loan.

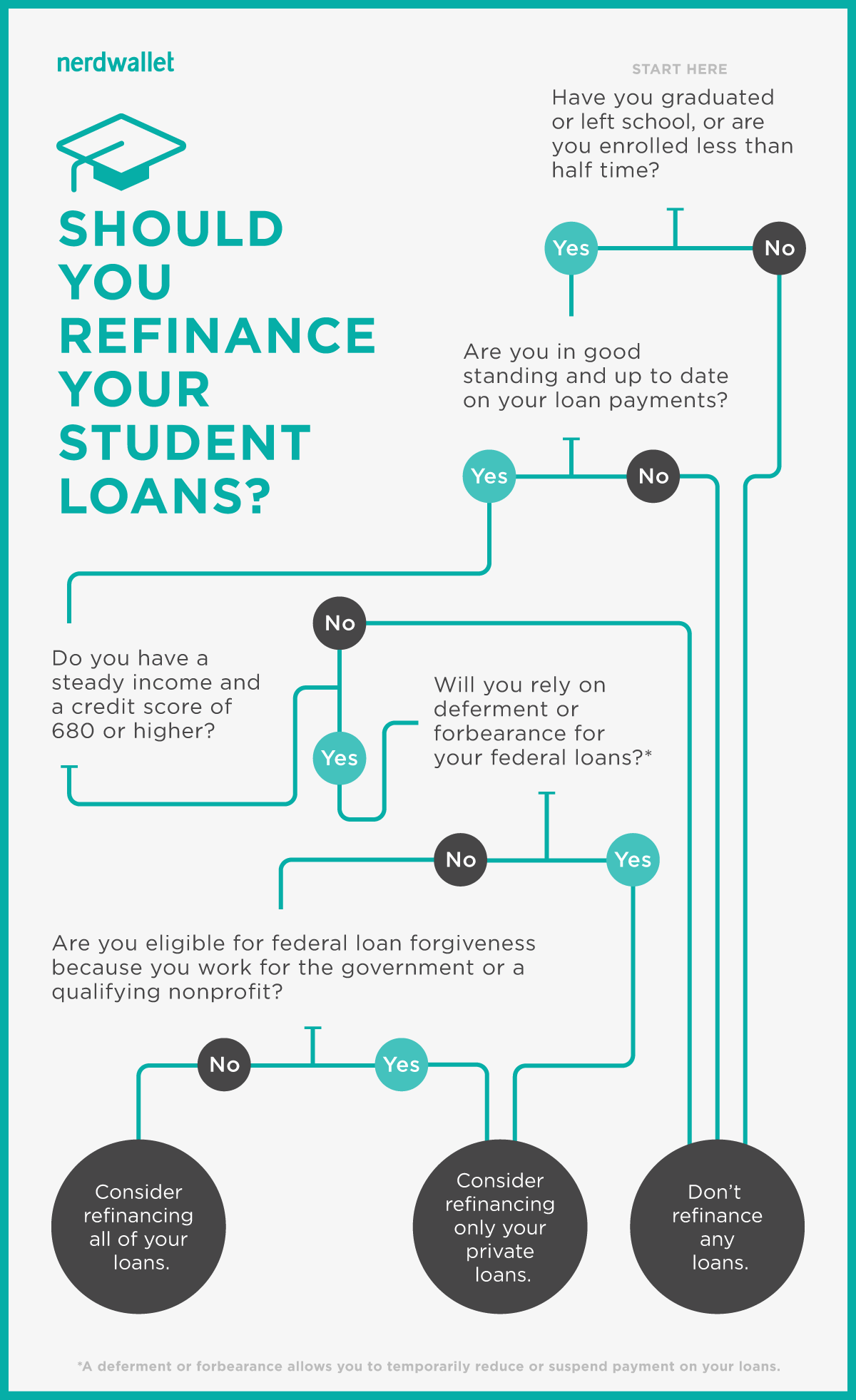

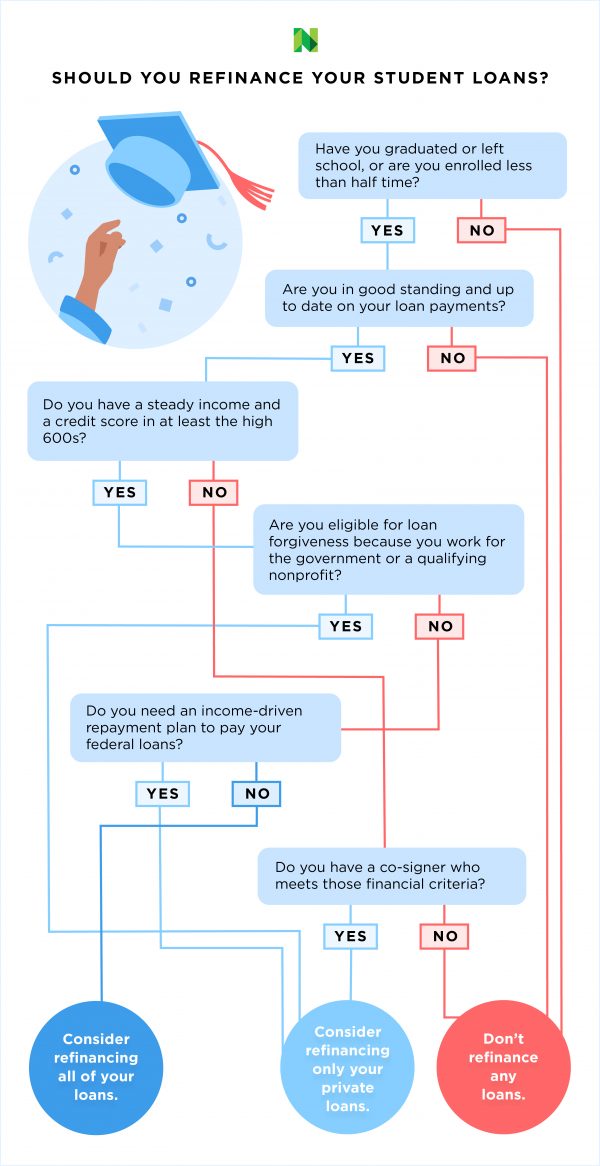

Refinance a student loan. You can also choose new repayment terms to pay off your debt faster or lower your monthly bills. Student loan refinancing is the process of taking out a private loan to replace your other student loans. If you feel bogged down by your student loan debt and finances are tight there are several factors that might motivate you to refinance student loans. Student loan refinancing allows you to consolidate both your private and federal loans including parent plus loans select a repayment term that makes sense for you and often get a lower interest rate.

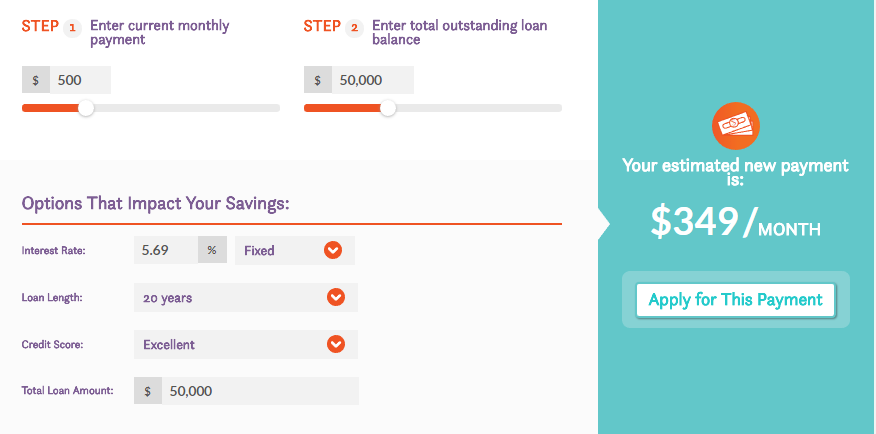

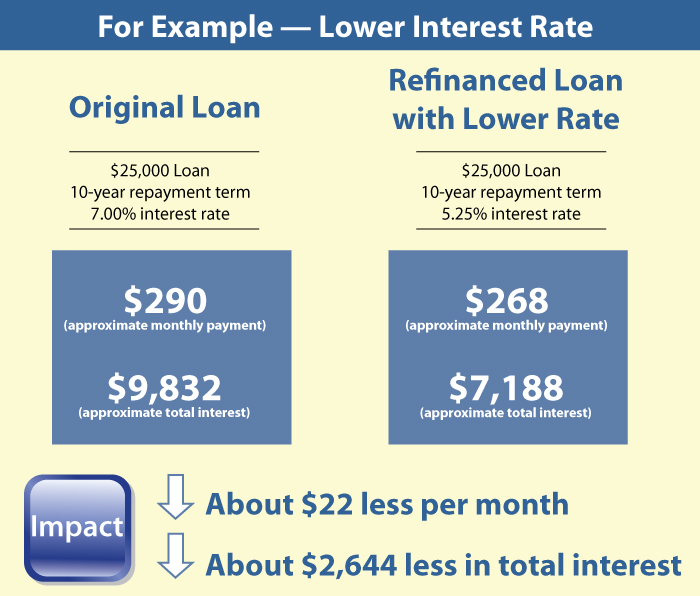

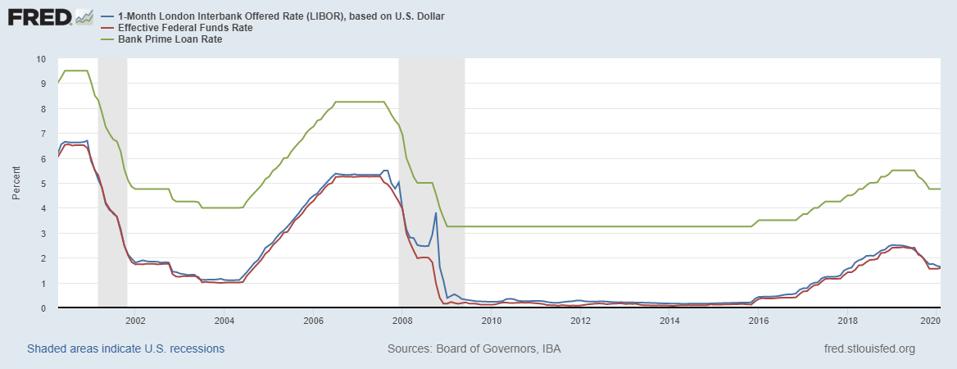

When you refinance student loans a private lender repays your loans private federal or both and issues a new loan based on your creditworthiness. If you can qualify for a better interest. Banks and online lenders offer fixed or variable. When you refinance student loans you lower your payments by consolidating your private or federal student debt into a new loan with a lower rate.

When you refinance student loans you take out a new loan from a private lender to pay off one or more of your old loans. If you qualify you could snag a lower interest rate on this new loan. For one student loan refinancing is a form of debt relief and can help ease the burden of your debt load and provide solutions to several issues that make it difficult to pay off your loans.