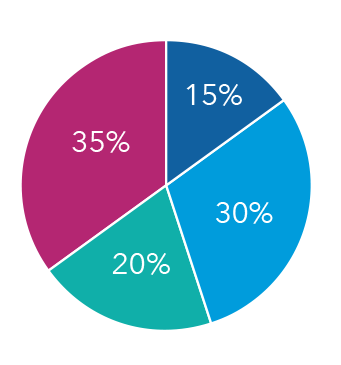

Retirement Fund Allocation

The fund s allocation between t.

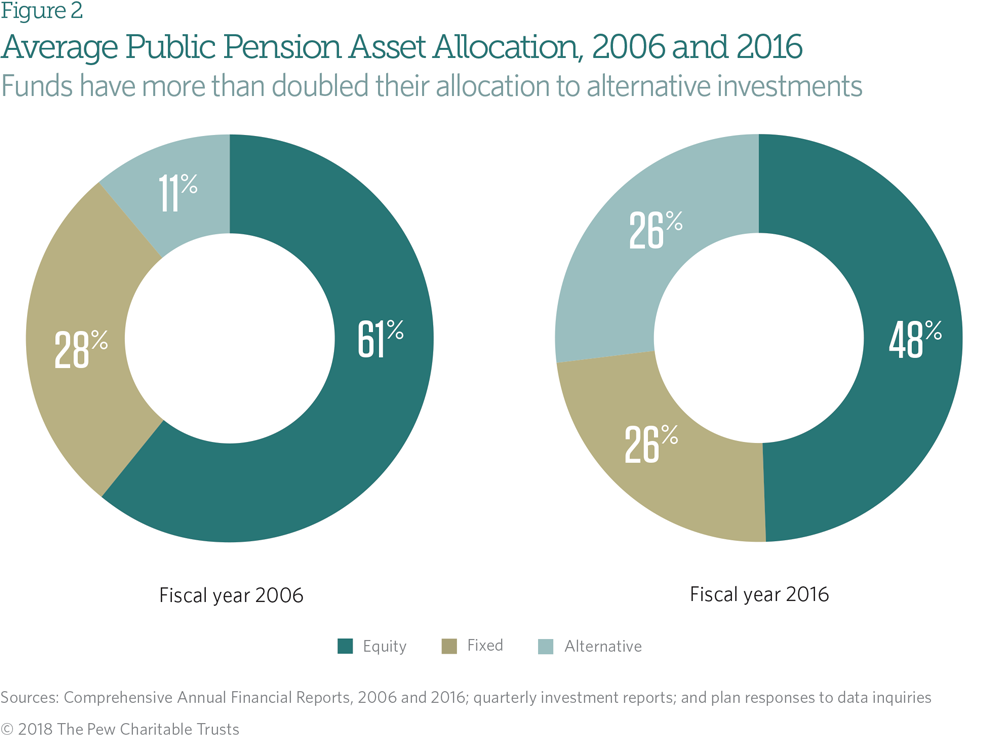

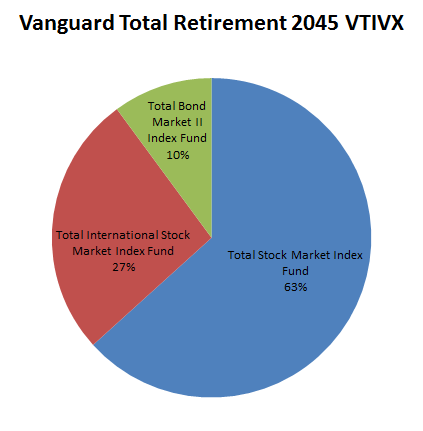

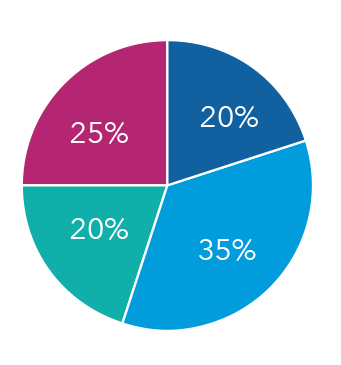

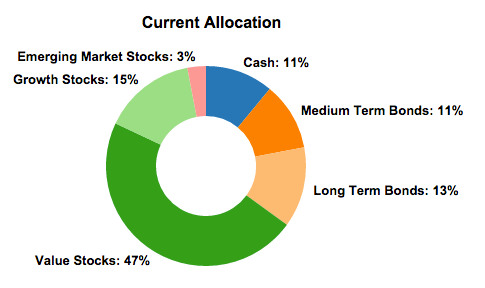

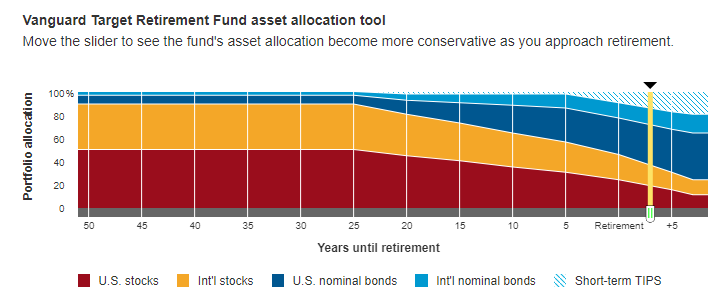

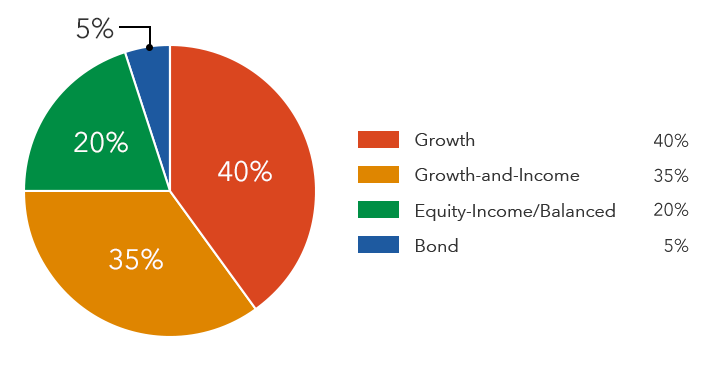

Retirement fund allocation. The funds managers gradually shift each fund s asset allocation to fewer stocks and more bonds so the fund becomes more conservative the closer you get to retirement. Retirement income funds are mutual funds that are designed to provide income for an investor who is retired. The managers then maintain the current target mix freeing you from the hassle of ongoing rebalancing. You can also use the american funds asset allocation models as a guide when choosing your investments.

The average vanguard target retirement. A step by step guide to asset allocation in retirement. Rowe price stock and bond funds will change over time in relation to its target retirement date. My just short of 100k mortgage but i find i sleep better with 4 years retirement funding in cash plus a 25k emergency fund.

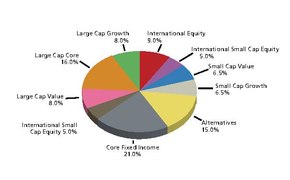

In most cases the overall strategy involves keeping market risk low and to keep volatility to a minimum while still achieving average returns that can match or slightly outpace inflation which averages about 3 in the long run. The fund categories shown growth growth and income equity income balanced and bond are commonly found in retirement plans. The key to smart retirement investing is having the right mix of stocks. This collection of sample portfolios was designed for investors based on their retirement time frames.

Best vanguard funds for retirement. What is a mutual fund. Conservative allocation funds the very nature of conservative investing is aligned with smart retirement investing. Investor class r class advisor class trrcx cusip 74149p309 fund added to your subscriptions and watch list.

The funds achieve this by using an all in one approach that holds a mixture of stocks bonds and cash in order to provide a combination of total returns for retirees. For example a small cap growth stock fund or an emerging market fund will likely be more volatile than a broad large cap index fund. For example if a target fund has an 80 stock and a 20 bond asset allocation but the investor purchases a certificate of deposit with 10 of their retirement assets this effectively decreases. My retirement withdrawal strategy uses a bucket approach and the cash is in my ira s bucket 1 and a savings account.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-03_2-fd04b9b6304943548dfbff345f920cda.png)