Reverse Mortgae

Use our free reverse mortgage calculator to determine how.

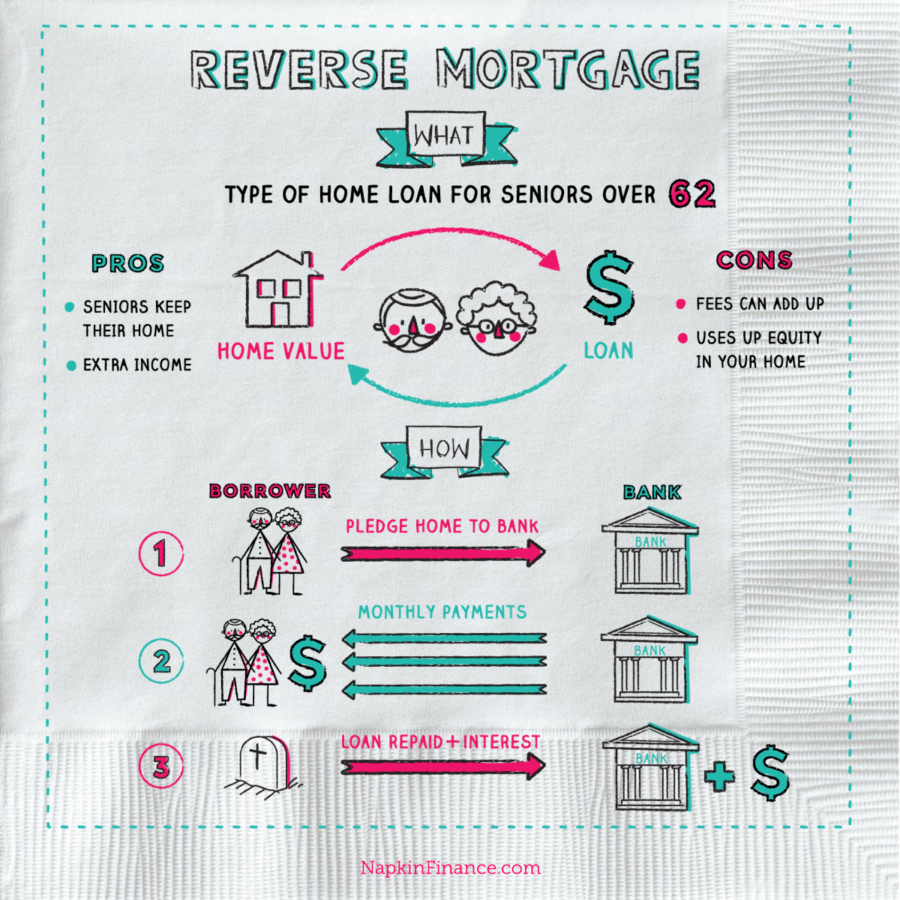

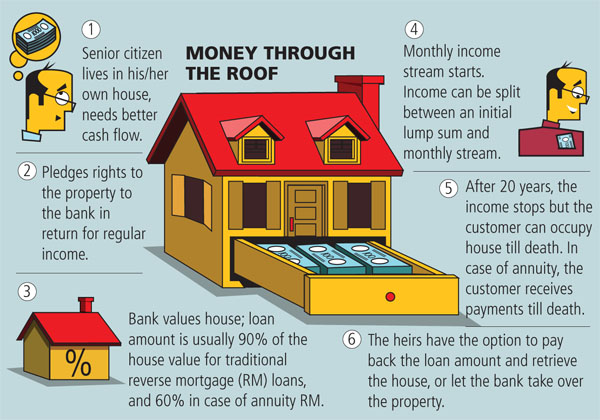

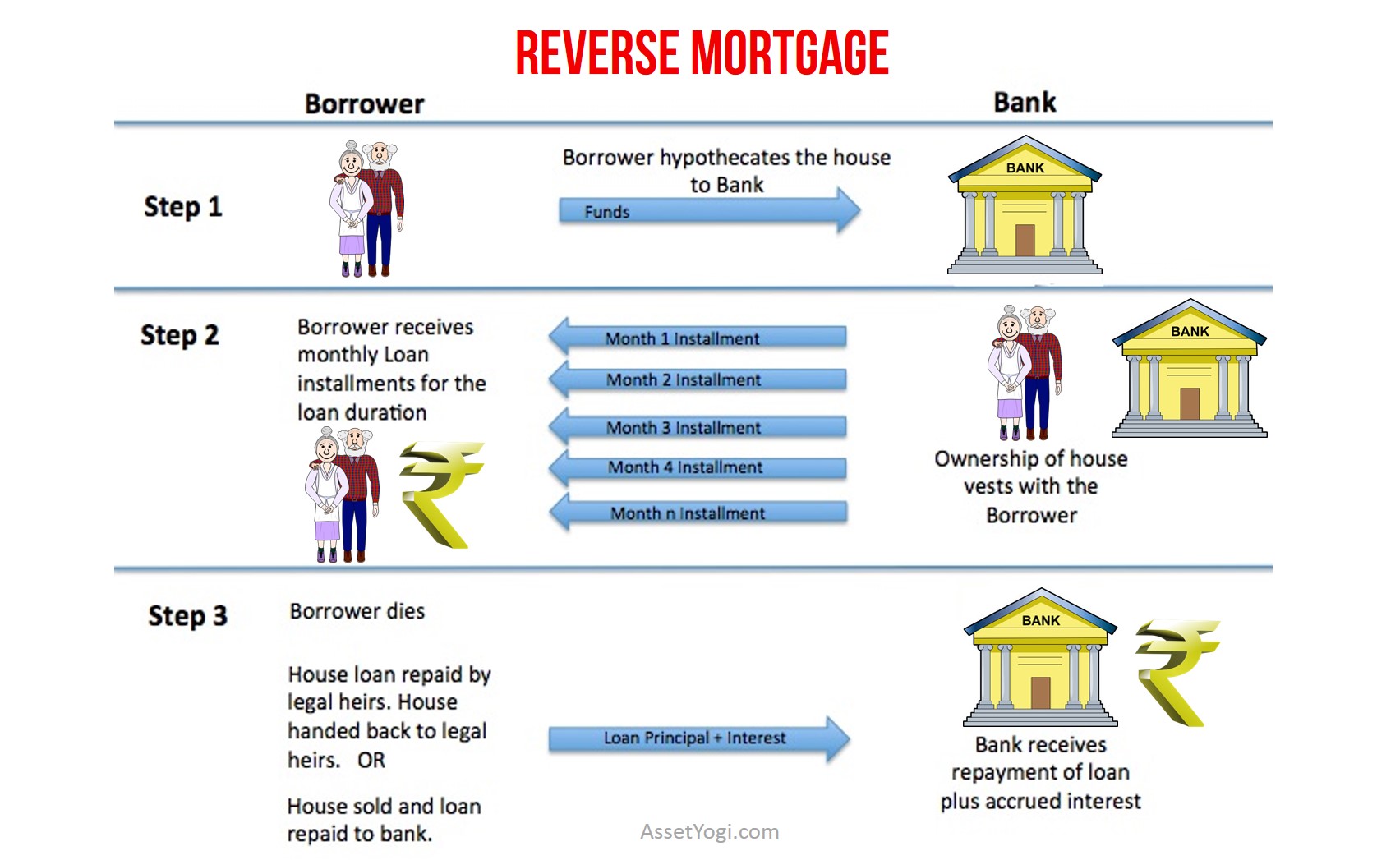

Reverse mortgae. The reverse mortgage programme is operated by hkmc insurance limited hkmci a wholly owned subsidiary of the hong kong mortgage corporation limited which enables people aged 55 or above to use their residential properties in hong kong as security to obtain reverse mortgage loans under a reverse mortgage loan the borrower will receive monthly payouts over a fixed payment term. Modified tenure payment plan. A reverse mortgage is a type of loan that s reserved for seniors age 62 and older and does not require monthly mortgage payments. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. By borrowing against their equity seniors get access to cash to. Borrowers are still responsible for property taxes and homeowner s insurance. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.

You may be able to borrow up to a certain percentage of the current value of your home. This is sometimes called equity release. Thinking about borrowing a reverse mortgage. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Reverse mortgages can use up the equity in your home which means fewer assets for you and your heirs. A reverse mortgage which is a loan that allows homeowners to borrow money against their home s equity can give senior homeowners the income they need to maintain their lifestyle pay off debt cover home improvement expenses or meet other financial goals. Instead the loan is repaid after the borrower moves out or dies. A reverse mortgage is a loan available to homeowners 62 years or older that allows them to convert part of the equity in their homes into cash.

A reverse mortgage is a type of mortgage loan that s secured against a residential property that can give retirees added income by giving them access to the unencumbered value of their properties. A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in.