Roll Over 401k To Ira Tax Implications

The tax rules for 401 k rollovers can be simple or complex.

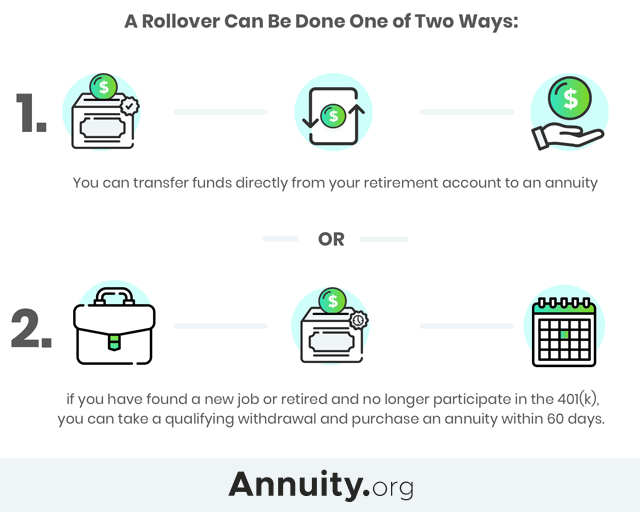

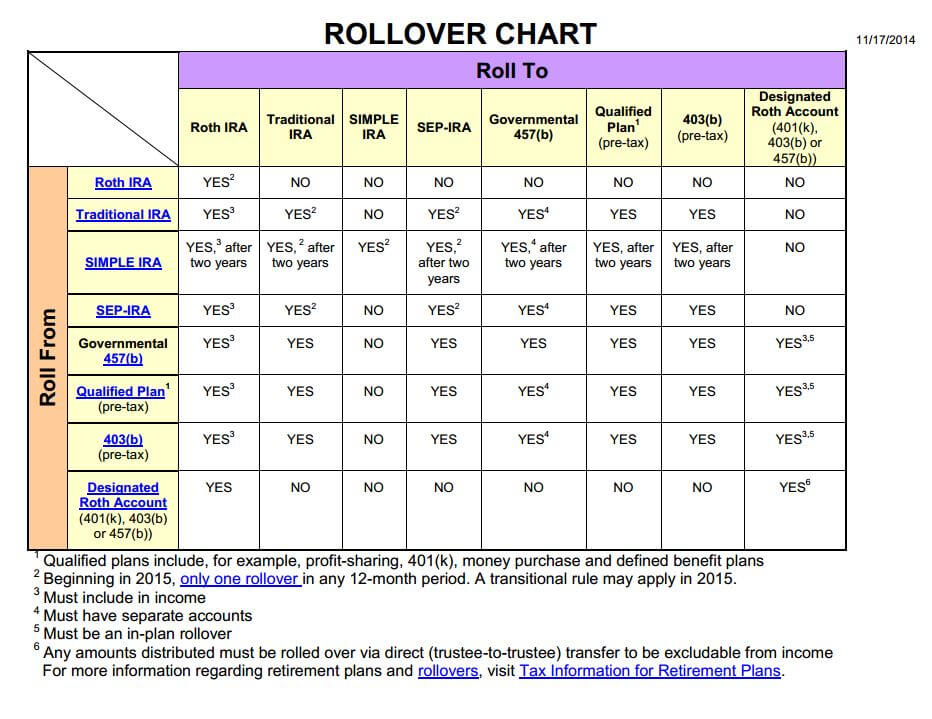

Roll over 401k to ira tax implications. You should be able to roll over your 401 k plan account into a roth ira but be sure you first understand the tax consequences of doing so. Such rollovers says the phoenix companies financial website are tax free transactions. As mentioned above you generally won t have to pay any taxes on your 401 k to ira rollover. One other tax consideration.

Generally 401 k rollover tax implications only come into play when you re rolling. Tax consequences of a 401 k to ira rollover. If you have a 401 k and want to roll it over into an ira you may or may not have to pay taxes on the rollover. The tax consequences of 401 k rollovers depend on the option you pick.

While rolling a 401 k into a traditional ira is generally a fairly seamless process transferring a traditional 401 k to a roth ira is bit more complicated due to the tax implications involved. The only time you ll have to deal with taxes is if you have a traditional ira and want to rollover to a roth ira.