Rolling Ira To Roth

For some savers the lure of moving assets to a roth individual retirement account from a traditional ira or 401 k plan often boils down to the tax free income it will deliver in their golden years.

Rolling ira to roth. Note also if you have assets in a designated roth account i e roth 401 k and would like to roll these to an ira the assets must be rolled into a roth ira. More understanding the 5 year rule. As with traditional ira conversions to roth iras if you are required to take an rmd in the year you roll over into an ira you must take it before rolling over your assets. Rolling a roth 401 k into a roth ira isn t that different from completing a normal rollover from a 401 k to an ira says dave lowell a certified financial planner cfp based in the salt lake city area.

There are lots of good reasons to make the switch but watch out for the taxes. You contact your employer s 401 k provider and request a rollover lowell said. Have taxable income to weigh it against which means that if much of your income is tax free due to it coming from a roth ira. While rolling over funds can translate into tax free income.

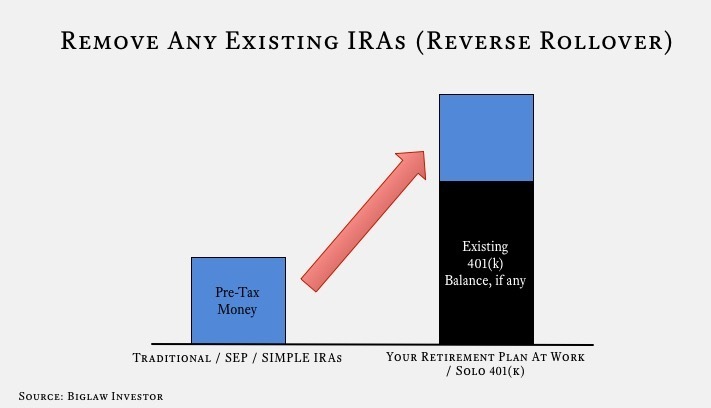

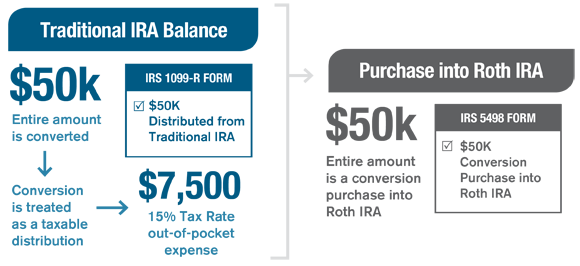

A roth ira rollover transfers money from a traditional ira into a roth. A roth ira conversion is a movement of assets from a traditional sep or simple ira to a roth ira which is a taxable event. Rolling over a traditional ira to a roth ira makes good financial sense for many people. If you do not have an investment portfolio outside the ira the only way to pay the tax on the roth ira conversion is to take the tax out of the ira proceeds before rolling over.

You could save a lot of money on taxes in the long run.

/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg)