Rollover 401k To Ira Or Roth

You contact your employer s 401 k provider and request a rollover lowell said.

Rollover 401k to ira or roth. A roth 401 k can be rolled over to a new or existing roth ira or roth 401 k. Are you eligible to receive a distribution from your 401 k 403 b or governmental 457 b retirement plan. Same goes for a roth 401 k to roth ira rollover. You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover.

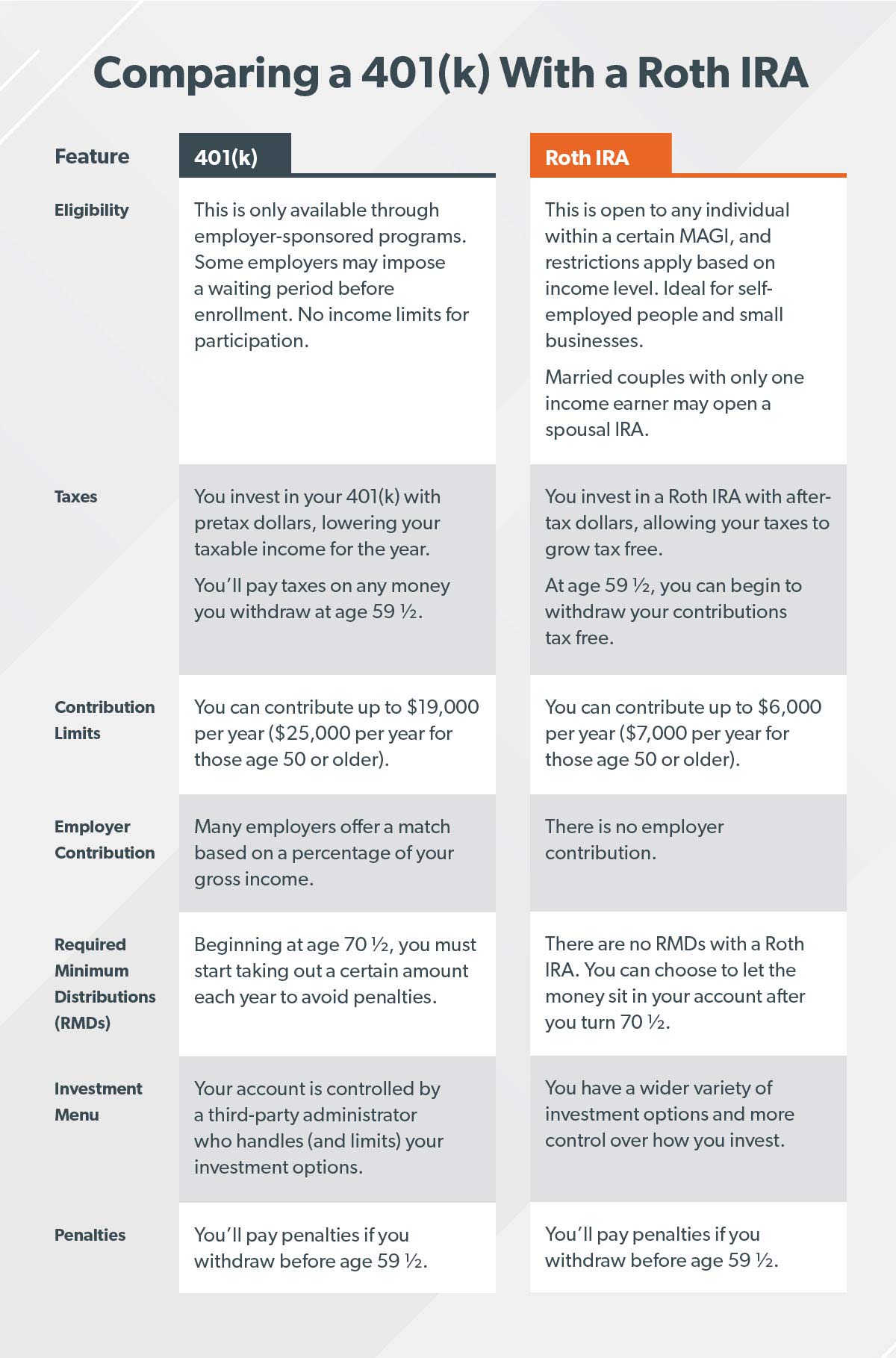

Rolling over a roth 401 k to a roth ira can make sense in the right circumstances but you need to be aware of the rules. Choosing one for your rollover depends on the type of account you have now and other factors such as when you want to pay taxes. You may want to note the differences between roth iras and designated roth accounts before you. Roll over a roth 401 k into a roth ira tax free.

What you can do. As a rule a transfer to a roth ira is most desirable since it facilitates a wider range of investment options. When you rollover funds from a roth 401 k to a roth ira it s the age of the roth ira that sets the clock for the 5 year rule. If you plan to roll your 401 k into a roth ira you will need to open a brokerage account.

Roth iras can only be rolled over to another roth ira. Roll over a traditional 401 k into a traditional ira tax free. 3 brokerage options to rollover your 401k into a roth ira. Rolling a roth 401 k into a roth ira isn t that different from completing a normal rollover from a 401 k to an ira says dave lowell a certified financial planner cfp based in the salt lake city area.

Can i roll over my ira into my retirement plan at work. However since the irs puts income limits on roth participants a 401 k rollover is one of the few opportunities more affluent savers have to acquire a roth ira. A rollover ira can be a traditional ira with the same withdrawal rules or you can open a rollover ira that s a roth that s what you would do to roll money from a roth 401 k. You can roll over eligible rollover distributions from these plans to a roth ira or to a designated roth account in the same plan if the plan allows rollovers to designated roth accounts.

It s also important to understand the income limits on a roth ira to make sure you re eligible. Both roth and traditional iras offer advantages. Fortunately you can choose from several different options on this front with the best option for your needs depending on your investing goals and strategy. Beyond the type of ira you want to open you ll need choose a financial institution to invest with.