Self Insured Health Insurance Deduction

The self employed health insurance deduction allows self employed individuals to deduct their health insurance premiums on the front of form 1040 as an adjustment against income.

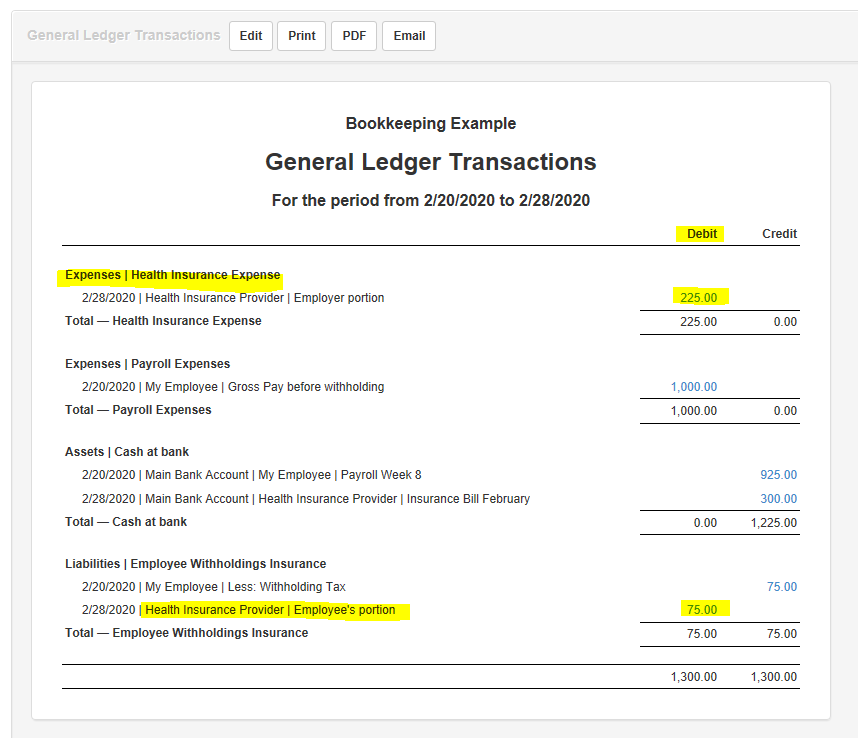

Self insured health insurance deduction. It s no longer relevant as the process with turbotax has changed. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. Health insurance premiums are treated as an ordinary and necessary business expense and are reported on line 24 of form 1120. Irs chief counsel memo 200524001.

A child includes your son. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. Self employed health insurance deduction. Medicare premiums are an allowable deduction if you re self employed and there are two ways to do this.

I submitted this query in 2016. The deduction for self employed health insurance does not reduce the amount of income subject to self employment tax. Amounts paid into the reserve fund are not deductible. Additionally if you itemize deductions on a schedule a your medical and dental expenses on line 1 should be reduced for the amount of self employed health insurance deduction taken so that these premiums are not double counted.

In a self insured plan an employer is only afforded a deduction for stop loss premiums administrative expenses and actual claims paid during the year. This deduction will show up on schedule 1 line 16. A worksheet is provided in the instructions for form 1040 to calculate the deduction and a more detailed worksheet can be found in publication 535. The first is with the self employed health insurance deduction when you enter the expenses related to your self employment enter your medicare premiums in the less common expenses section not the ssa 1099 section.

The insurance also can cover your child who was under age 27 at the end of 2018 even if the child wasn t your dependent. Read on if you wish but no need to come to my rescue as the issue is no longer an issue. This may be advantageous because it allows you to pick which of your businesses will be the sponsor at the start of each year. If you qualify the deduction for self employed health insurance premiums is a valuable tax break.

Some other tips for claiming the deduction enter your self employment health insurance deduction on line 29 of form 1040. Do i enter health insurance premium payments in the expenses section of schedule c for self employed health insurance premium deduction if i already entered data in the personal section. And that will help to keep you healthy and happy in 2019 and beyond.

/self-employment-health-insurance-deduction-3193015-final-c6496da4c8c64e838ee4875236d13c41.png)