Sell A Structured Settlement

Your protection is also the reason you must have your sale approved by a judge.

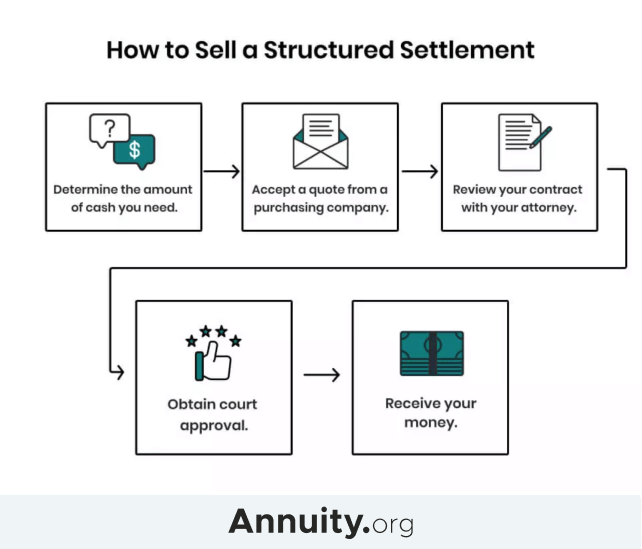

Sell a structured settlement. The terms of your settlement and the laws in your state will determine whether you can sell your payments. There are only a few basic steps in the whole process of selling a structured settlement. 1 pay off high interest debt 2 pay for education 3 purchase a home or vehicle and 4 pay medical bills. Some of the leading companies that you can sell a structured settlement to are.

Why sell a structured settlement. Selling your settlement payments is a major decision and choosing the best buyer can make a huge difference in how much you benefit from the transaction and how quickly the process is completed. Sell structured settlement advisors can get you more for your future payments. Sell a structured settlement cash is a process where you will need help from a trusted company.

Simply put people sell structured settlements because some unexpected event or situation changed from the time it was set up. We can help you get unshackled from your investment annuity payment schedule. And we offer the most money for your payments guaranteed. Selling a structured settlement is a money loser every time.

That s why rsl funding works closely with new clients to determine if selling a structured settlement for cash is the right course of action. Wentworth has made the process of selling structured settlement payments as efficient as possible. Selling a structured settlement in 2020 means its time to stop and think. With more than two decades of experience purchasing structured settlement payments j g.

Accelerating investment annuity payments. Make sure you properly research the right company to help you. Deciding whether or not to sell structured settlement payments is the right move boils down to your individual situation. In contrast to selling annuities purchased through insurance companies selling the rights to structured settlement payments is a legal process that requires court approval.

A trusted structured settlement buyer like drb capital can discuss your needs and offer the right fit for your plans. The top reasons people chose to sell payments are. Selling your structured settlement payments. Offering another layer of protection for sellers structured settlement protection acts the state and federal laws that safeguard the rights of settlement holders govern the practices of purchasing companies.

State laws that fall under the structured settlement protection acts are intended to protect settlement recipients from unethical structured settlement buyers. I want to sell what next. Choosing the right buyer for your structured settlement. Frequently recognized as one of the best settlement purchasing companies in the united states we have the resources and the knowledge to streamline the process.

What you need to know before you sell.