Selling Annuity Payments

If you have received a settlement that includes an annuity payment we can help you to discover whether or not you qualify to sell your future annuity payments to get some or all of your cash at once.

Selling annuity payments. Selling annuity payments could be the solution for an array of financial woes. Whether that includes buying a new house paying for a new car paying for college tuition or even balancing medical expenses cashing out a portion of your annuity could be the solution to avoiding unnecessary debt. Selling annuity payment makes your life easier by placing your financial future in your hands. However in some instances there is tax liability when those annuity payments are sold so it s important to plan accordingly.

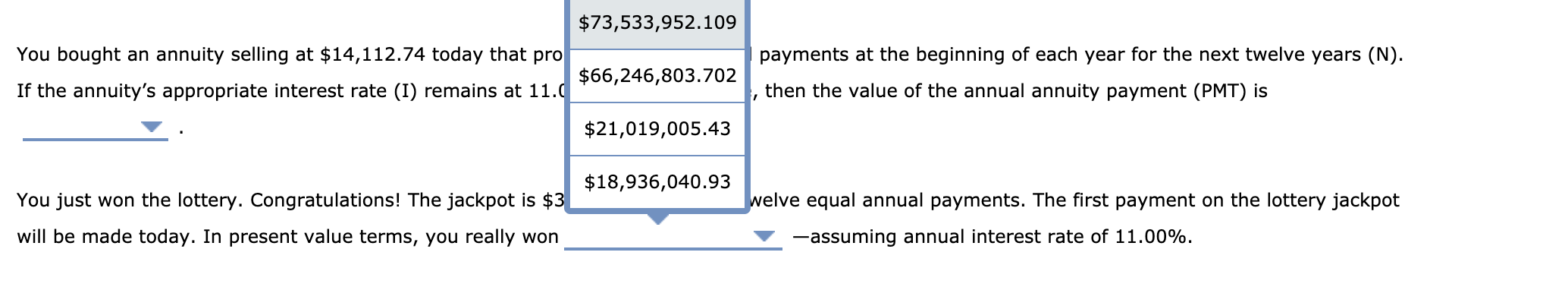

An annuity is an insurance contract you can use to create an income stream. First and foremost selling your annuity does not guarantee a full payout equal to the initial value of the contract. Tips on selling your annuity or structured settlement. Selling my annuity payments.

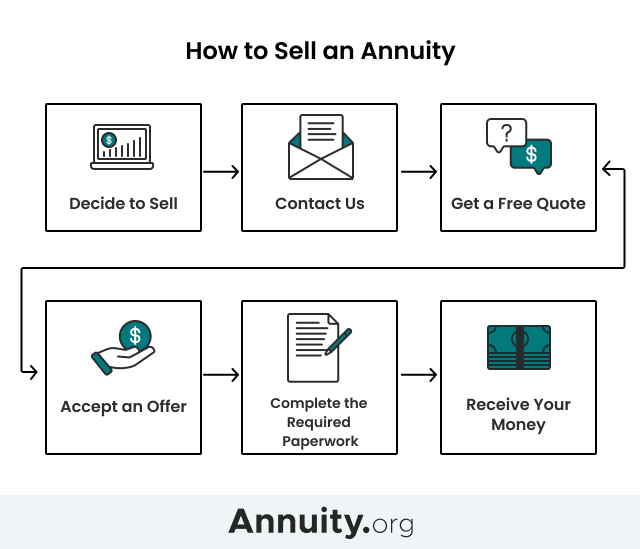

Entirety refers to selling all the annuity payments and helps you by eliminating. As usual it s advisable to consult a qualified tax professional before selling annuity payments. How to sell annuities. Selling annuity payments in exchange for a lump sum of cash is simple convenient and can be completed in just a few steps with some assistance from an established company with several years of experience in the field.

The primary annuity type that drb capital is able to help you with is an annuity that comes from a lawsuit. Here s why selling your annuity is something you might consider. The process of selling annuity payments typically includes. Selling the annuity payment reduces financial woes.

If your financial needs have changed recently selling the rights to these payments in exchange for a lump sum payout from a company that specializes in buying annuities can give you some financial flexibility. 2 you can sell a portion of your scheduled annuity payments which involves selling part of each regular payment you receive this is also known as a partial buyout while you keep the balance. In exchange for quick turnaround on cash annuity buyers will charge a fee and sell your annuity at a discounted rate for profit. We offer free expert advice on how you can make the most of an annuity or structured settlement and how and where you can sell your payments.

You can purchase an annuity to draw payments against in retirement as a supplement to tax advantaged or taxable savings accounts. You can choose whether you want to sell the entire annuity payment partial or the lump sum of the annuity payment. You can sell your annuity or structured settlement payments for cash now. Selling your annuity payment does have tax implications.

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)