Set Up An Ira Online

That s why i ll choose the roth ira over the traditional ira every single time.

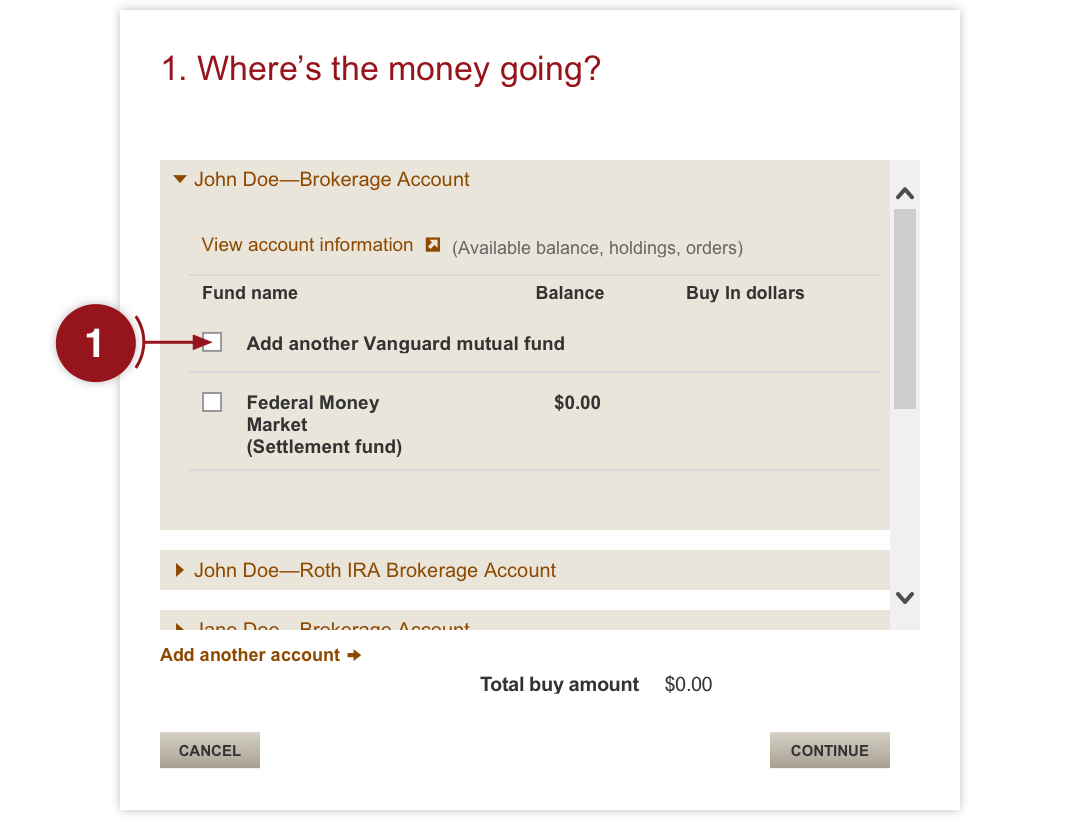

Set up an ira online. Your answer will help determine whether you should set up an ira with an online broker or a robo advisor. A simple easy way to get investment advice and ongoing portfolio management through an online platform with advice from a financial advisor if and when you need it. Name beneficiaries for your ira. We ll send instructions once your ira is open avoid the 20 annual account service fee by registering your accounts online and signing up for e.

The setting every community up for retirement enhancement secure act has changed the distribution options for certain beneficiaries who inherit an ira on or after january 1 2020. Consider setting up automatic transfers. If you want to choose and manage your investments you ll need an online broker. In fact online brokers might cut you special deals on your ira accounts.

Are free to sell and up to 49 95 to buy online or through the. But before signing up make sure that there are. While a roth ira isn t for everyone you might be surprised at how beneficial it can be and how easy it is to set up. Standing for individual retirement account.

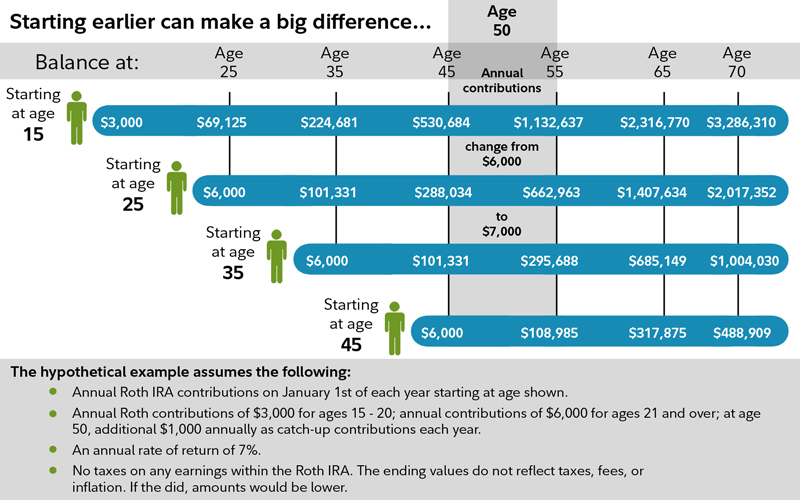

This is something to look for when evaluating online brokers. You ll just need your bank account and routing numbers found on your bank checks. If you re 50 or older and need to catch up you can add an extra 1 000 for a total of 7 000. Intuitive investor ira account view details full service brokerage ira view details an online brokerage account for managing your own investments including making low cost trades.

The standard online 0 commission does not apply to large block transactions requiring special handling restricted stock transactions trades placed directly on a foreign exchange transaction fee mutual funds futures or fixed income investments. At the best brokers. Your beneficiary category will determine your options for distributing the money. Managed by a professional may be best served by an ira set up by a.

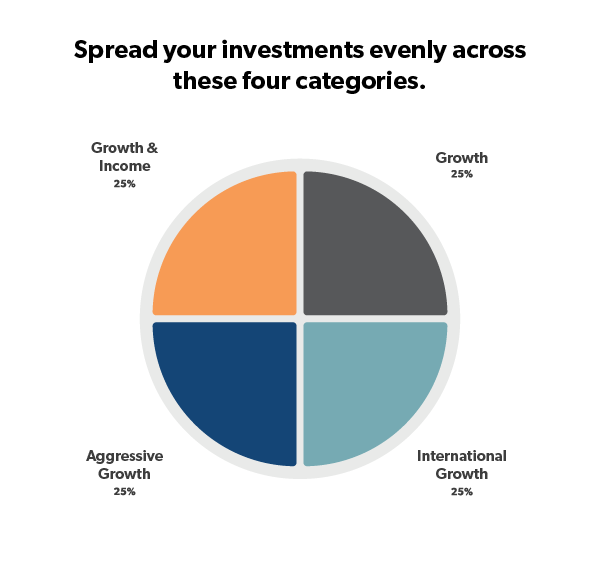

No extra fees or higher commissions. For 2020 you can invest 6 000 in either a traditional ira or a roth ira. 10 of the best stocks to buy this year. Nearly all the online brokers are equipped to set up all these accounts.

:max_bytes(150000):strip_icc()/IRAproviders-5c42006dc9e77c000173d373.jpg)

/how-to-invest-in-real-estate-with-a-self-directed-ira-4057066-f5cd0b277c2d44db935f441fb523dcc5.gif)