Setting Up A Roth Ira For Your Child

It s also an incredibly flexible tool with possible uses ranging from holding your emergency fund to serving as a down payment on your first house and even paying college tuition.

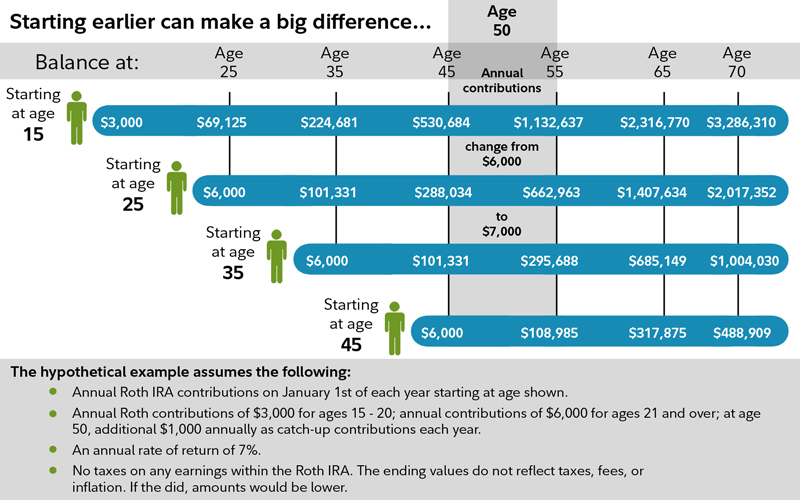

Setting up a roth ira for your child. How to set up a roth ira for your child. So a roth ira can help your kids or even their kids with college costs. Early experience like that can be invaluable in helping your child make wise financial decisions. The roth ira is one of the most powerful retirement tools available giving you the benefits of tax free growth and tax free withdrawals.

A roth ira can show them the true value of compounding. A child s ira has to be set up as a custodial account by a parent or other adult. Up to 10 000 in investment earnings from a roth ira can be withdrawn tax and penalty free toward a first time home. For example your son or daughter can take up to 10 000 worth of investment earnings out of the account without facing any tax consequences if the money is used to purchase a home.

Plus with an early ira or roth ira you are setting your kids up with a financial life that they can build upon and learn from a few years earlier than their peers. Roth ira earnings can be used for qualified. Still the irs makes a few exceptions. In fact one of the most interesting ways to use a roth ira is as a.

After the roth ira has been funded for five years your child can take out up to 10 000 in earnings to buy a first home tax and penalty free. Have her put 2 000 of those earnings in a roth ira says philip weiss principal at apprise. If your adult child is eligible but not contributing because of lack of funds or just not concerned about saving for retirement you can give him or her the money each year. Assume your teen earns 4 000 this year.

Types of iras for kids two different types of iras are suitable for children. Once your child reaches age 59 5 he or she can make penalty and tax free withdrawals from the roth ira as long as it has been open for at least five years.

/Opening-a-Roth-IRA-for-Kids-56a090c93df78cafdaa2c714.jpg)