Small Business Indemnity Insurance

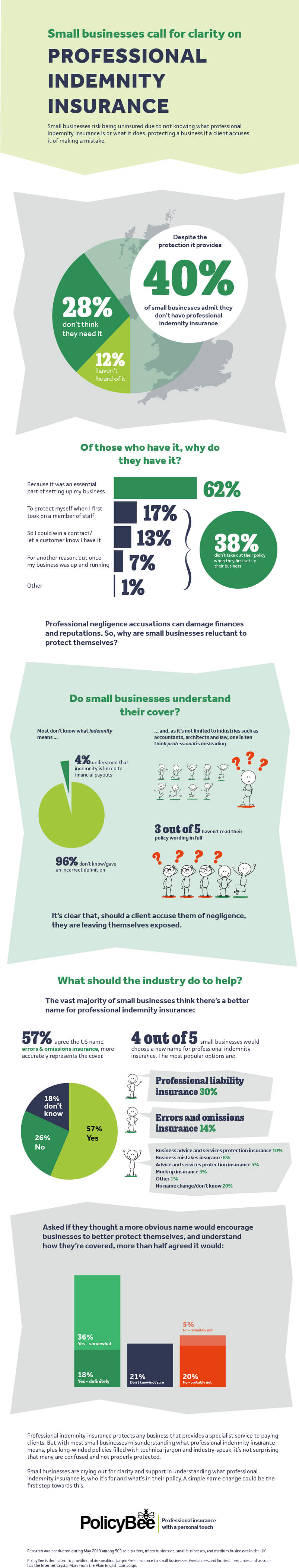

Insurers will set your premiums for professional indemnity insurance based on factors such as.

Small business indemnity insurance. Compare professional indemnity insurance quotes. 24 7 legal advice is also available throughout. At youi we provide a simpler and sharper approach to helping you get your business liability insurance sorted. This includes legal costs up to 100 000 so you can claim back the expense of your defence even if you lose the case.

If a client claims a mistake your business made caused them injury or financial loss professional indemnity covers the cost of your legal defence and damages you have to pay. We don t charge any fees for cancellations. Qbe provides professional indemnity insurance to a wide variety of businesses and to businesses of all sizes from small to large multi national businesses. Bigger businesses generally have more at stake when it comes to financial and reputational losses so you ll generally need higher levels of cover if your client is a big company.

Professional indemnity is designed to protect businesses that give professional advice or provide services to clients. They offer specialist expertise in legal construction technology emerging professions and traditional professions. We can help you find the protection that suits you and your business needs and compare deals to help you find a great deal. We do that by making sure we offer quality small business insurance backed up with great service and the ability to lodge a claim 24 7.

Professional indemnity coverage is still available as part of gio mobile business protect. Professional indemnity and public liability insurance both protect your business against third party claims resulting from liabilities that arise from your business activities. Electronic equipment insurance covers your electronic items from theft destruction or damage. Talk to an insurance broker or insurer about your options.

If your business faces high levels of risk then insurers are. Nature of the work you do. Cyber liability insurance protects your business against cybercrime. As an insurer of over 60 000 businesses we re here to help get you back on your feet when you ve been knocked down.

If you re self employed or are a small business owner you should consider taking out a professional indemnity policy. The key difference is that public liability insurance covers you for bodily injury and property damage whereas professional indemnity covers you for the professional service provided to clients. From 1 july 2020 gio is not selling new standalone professional indemnity insurance policies. While around 38 pay around 51 100 per month for their business liability insurance.

From our analysis we have found that around 48 of our small business customers pay less than 50 per month. Existing policies will continue to be supported during the period of insurance. Size and type of business.