Va Loan New Home

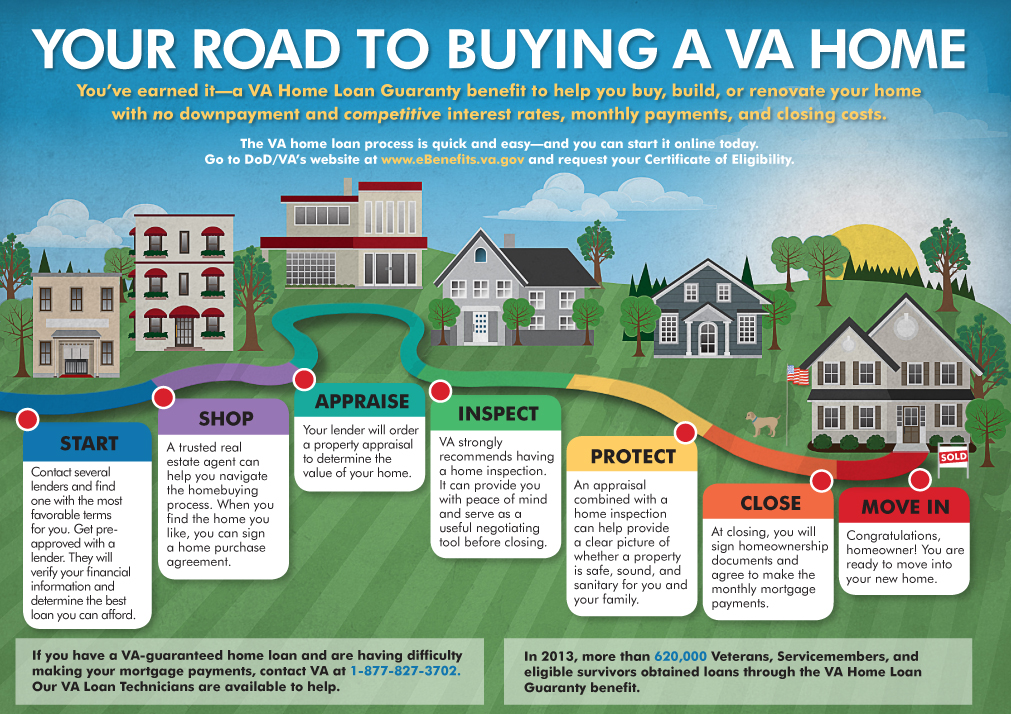

As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy.

Va loan new home. A home must be your primary residence when you first make the purchase which is why you cannot use a va home loan to purchase a vacation home even if you plan to visit regularly. What are the va home loan limits by year and county. Va home loan limits are the same as the federal housing finance agency fhfa limits. You must have satisfactory credit sufficient income and a valid certificate of eligibility coe to be eligible for a va guaranteed home loan.

An award winning former journalist chris writes about mortgages and homebuying for a host of sites and publications. View current loan limits. An essential guide to maximizing your home loan benefits. A va home loan is the greatest benefit given to our veterans.

No mortgage insurance or down payment is required. The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries. A va loan is a mortgage loan that s backed by the department of veterans affairs va for those who have served or are presently serving in the u s. Better terms and interest rates than other loans from private banks mortgage companies or credit unions also called lenders.

2020 va home loan limits. A va backed purchase loan often offers. In this article we re going to take a look at the new changes coming to the va loan program in 2020. Read all about the new rules.

When i got my va home loan and moved into my new house the first five pieces of mail that showed up in my shiny new mailbox were letters from finance companies to refinance my va loan. You really need to plan to live in the home you buy full time not part time says michele hammond private client home lending advisor for jpmorgan chase in new york. The home must be for your own personal occupancy. The va will no longer place limits on the size of va loans thanks to new rules that kicked in on january 1.

While the va does not lend money for va loans it backs loans made by private lenders banks savings and loans or mortgage companies to veterans active military personnel and military spouses who qualify. These are called conforming loan limits. The ability to borrow up to the fannie mae freddie mac conforming. Va helps servicemembers veterans and eligible surviving spouses become homeowners.

Va loans got turbocharged in 2020.

/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/SAZB7AUDLBEYNDO2EKBNCWEKB4.jpg)