Solvency Ratios

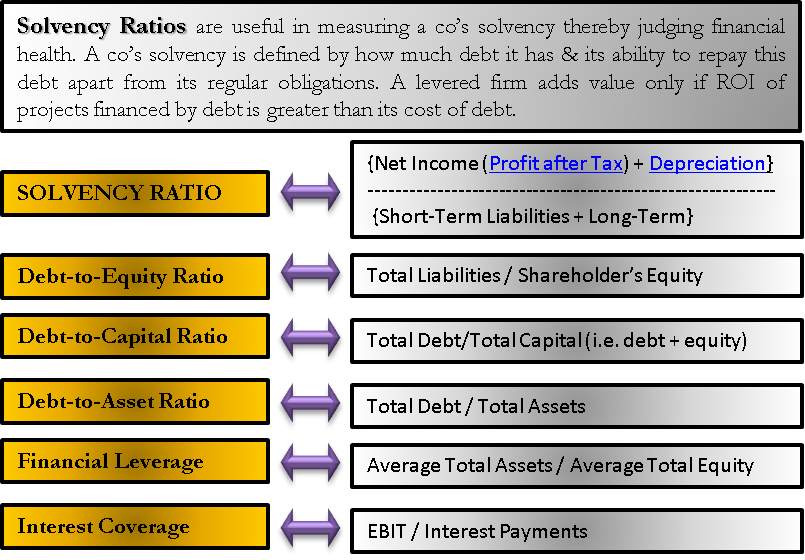

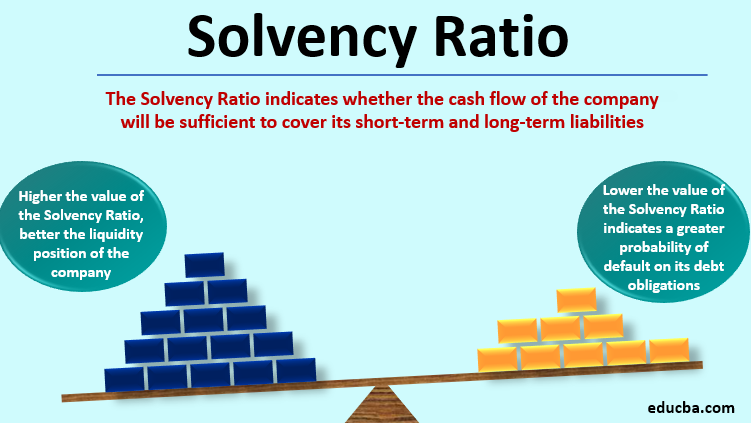

Solvency ratio is one of the various ratios used to measure the ability of a company to meet its long term debts.

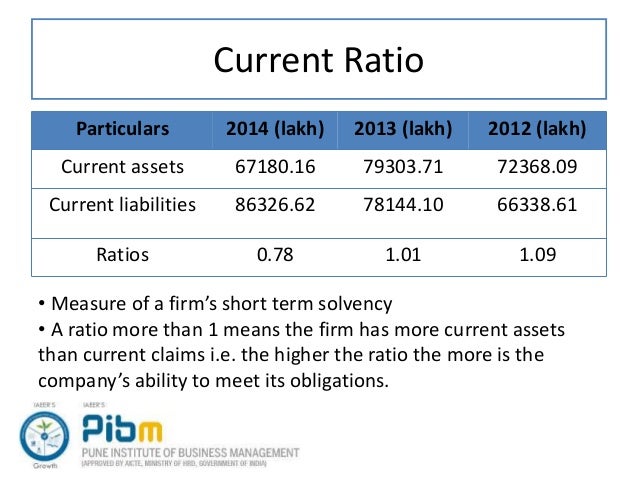

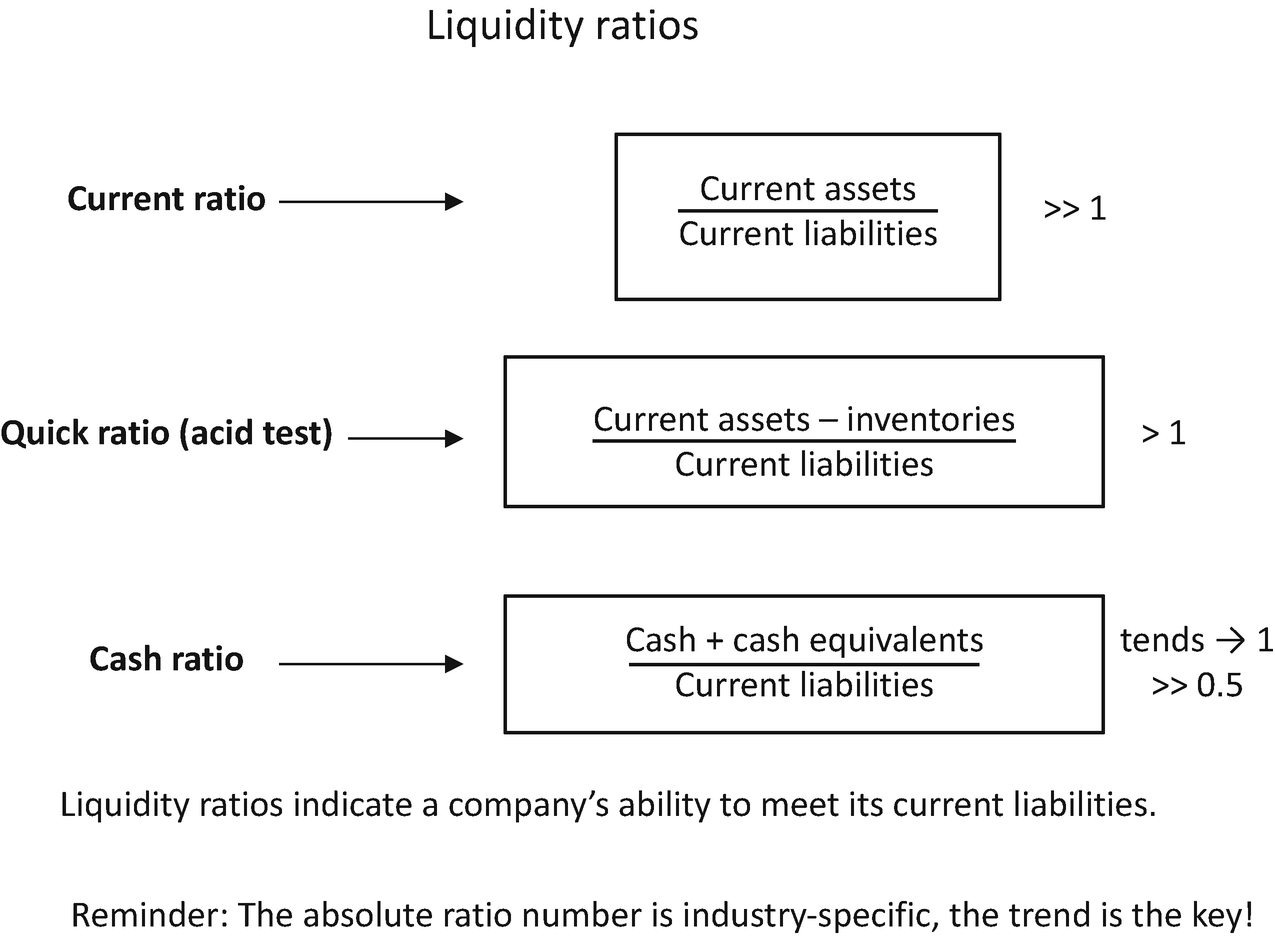

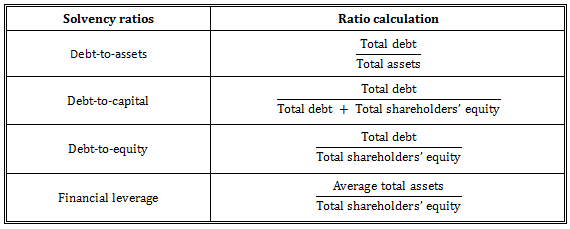

Solvency ratios. Liquidity ratios compare current assets with current liabilities i e. In other words solvency ratios identify going concern issues. Many people confuse solvency ratios with liquidity ratios. Hence solvency ratios compare the levels of debt with equity fixed assets earnings of the company etc.

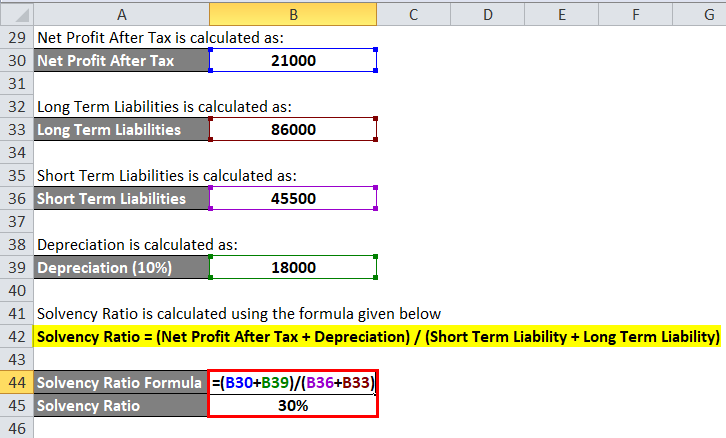

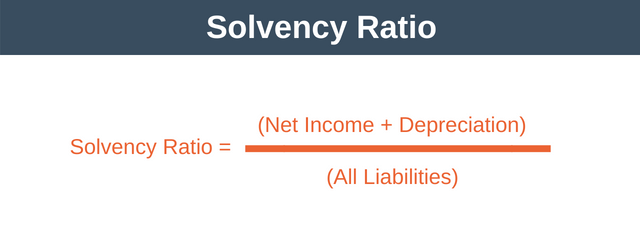

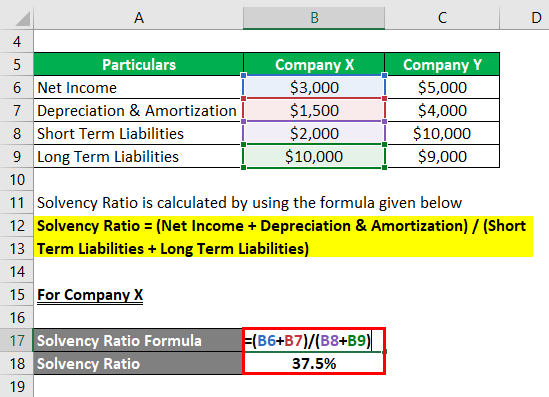

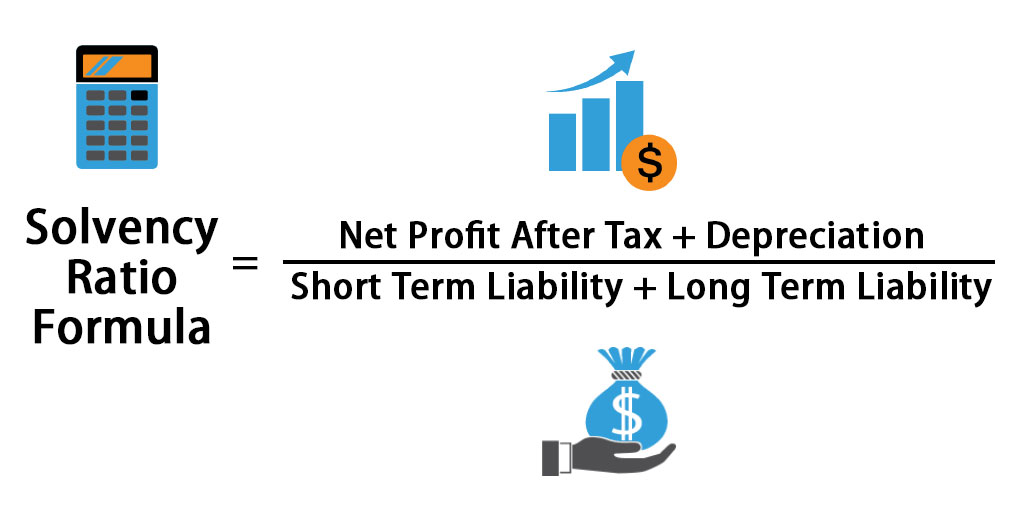

One thing to make note of is the difference between solvency ratios and liquidity ratios. List of important solvency ratios are discussed below followed by a numerical example. Solvency ratios measure how capable a company is of meeting its long term debt obligations. Moreover the solvency ratio quantifies the size of a company s after tax income not counting non cash depreciation expenses as contrasted to the total debt obligations of the firm.

Calculating solvency ratios is an important aspect of measuring a company s long term financial health and stability. The solvency ratio is a comprehensive measure of solvency as it measures a firm s actual cash flow rather than net income by adding back depreciation and other non cash expenses to assess the. 1 long term debt to equity ratio this solvency ratio formula aims to determine the amount of long term debt business has undertaken vis à vis the equity and helps in finding the leverage of the business.

/what-are-solvency-ratios-and-what-do-they-measure-393211-v3-5c93aed046e0fb0001376ea2.png)

/what-are-solvency-ratios-and-what-do-they-measure-393211-v3-5c93aed046e0fb0001376ea2.png)

%20P3%20Solvency%20Ratio.jpg)