Simple Ira Employer Match Limits

The salary reduction contributions under a simple.

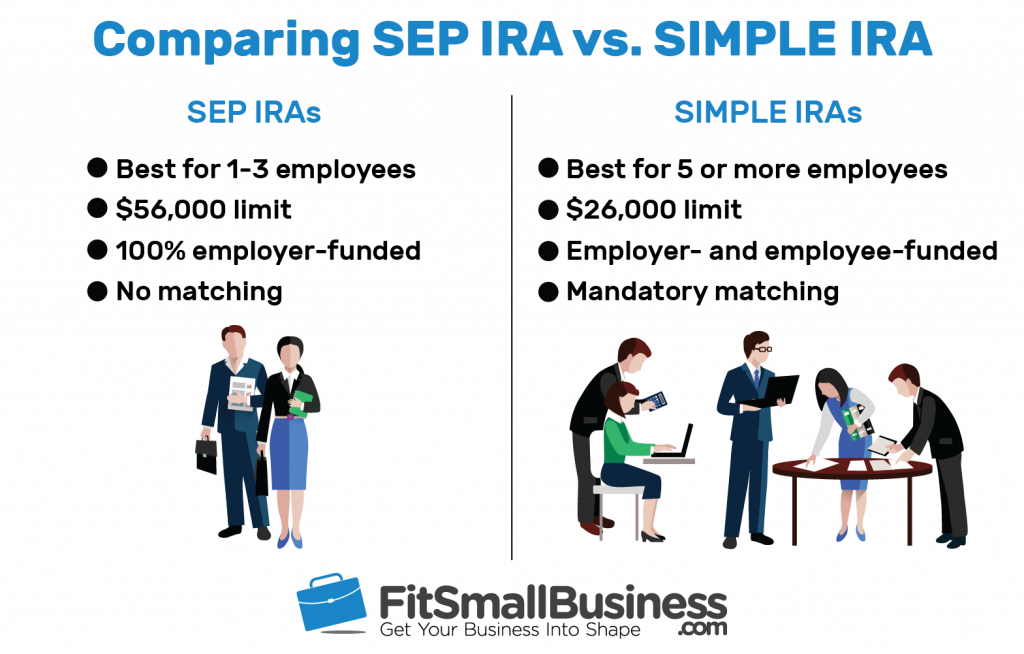

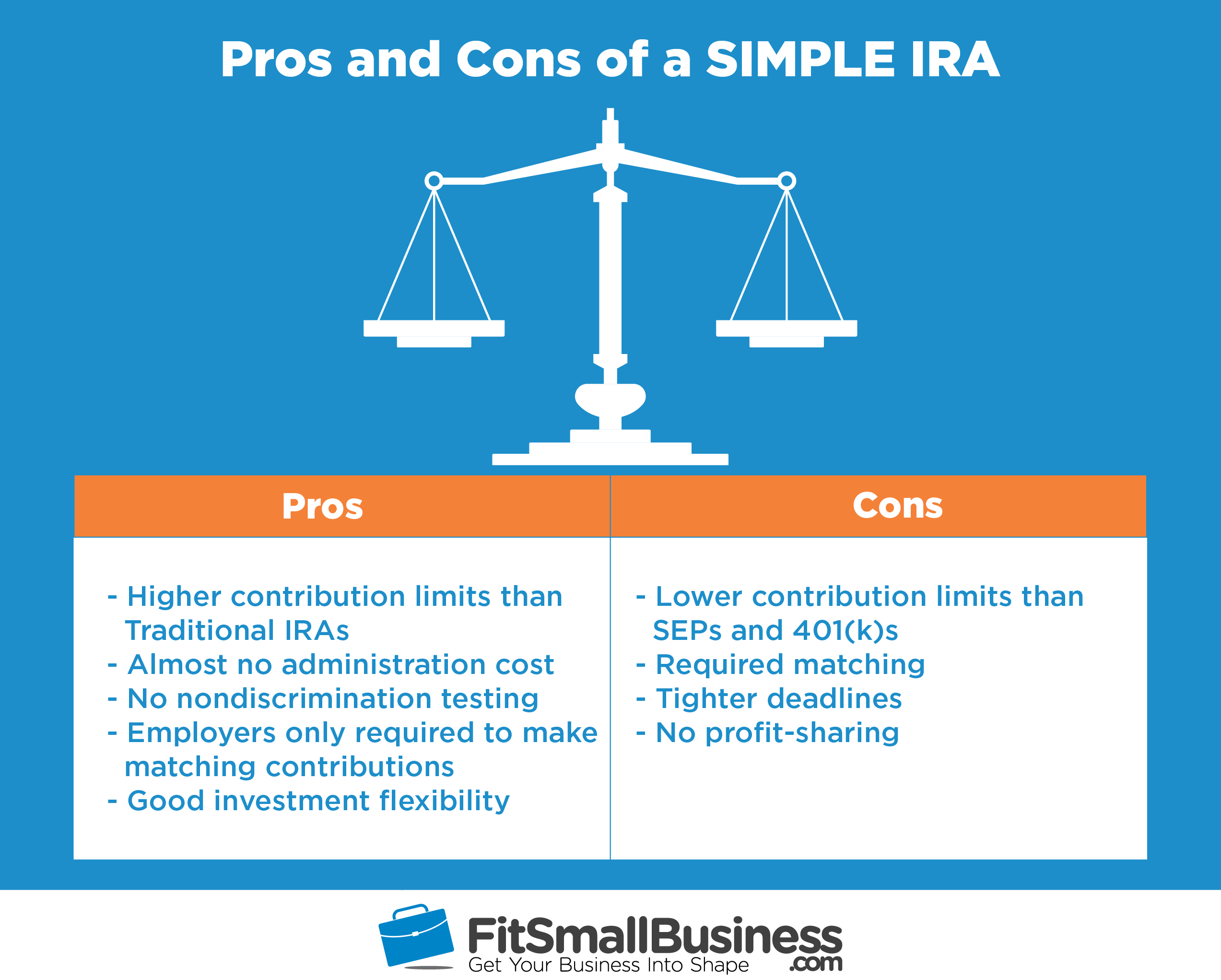

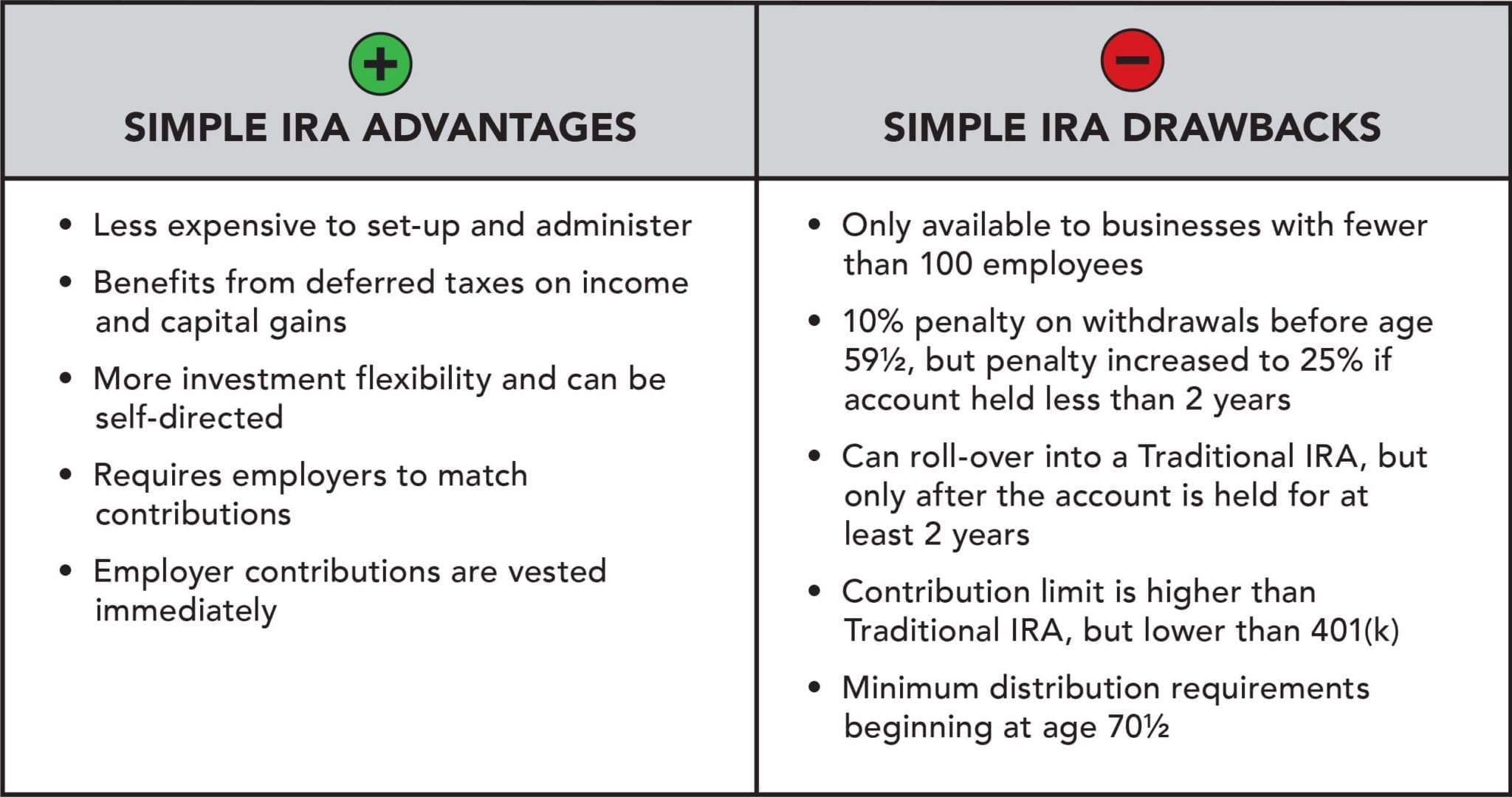

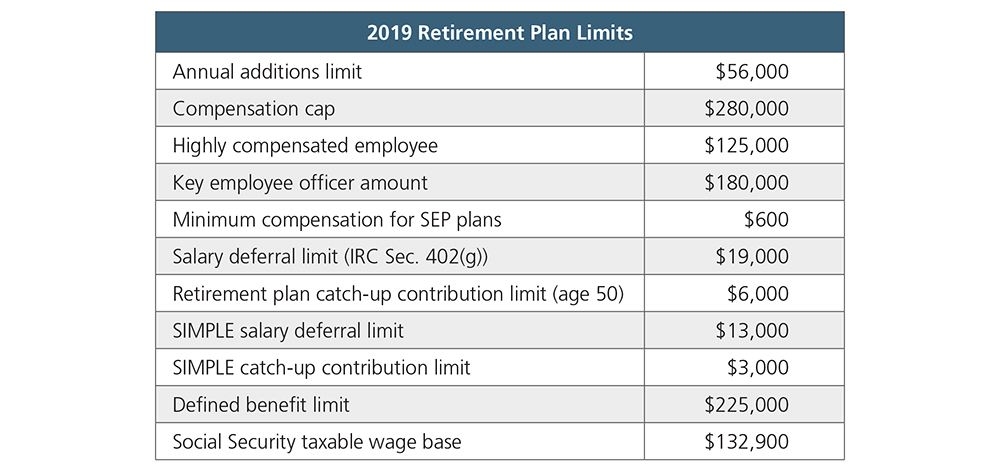

Simple ira employer match limits. Employer simple ira contribution limits for 2020. Deadlines for employer contributions. Among its benefits is a tax credit of up to 500 per year for the first three years and no annual government reporting requirements. Simple iras are employer sponsored retirement plans allowing participants to save up to 26 000 pre tax in deferrals and matching.

A savings incentive match plan for employees simple ira is one of the easiest and least expensive small business employee retirement plans to set up and run. However an employer cannot lower the threshold below 1 and she cannot keep the lowered limit in place for more. Matching contributions or b. An employee may defer up to 13 500 in 2020 13 000 in 2018.

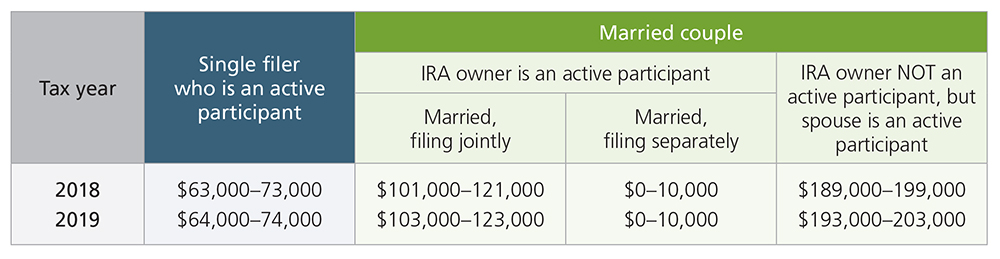

Salary reduction contributions the amount an employee contributes from their salary to a simple ira cannot exceed 13 500 in 2020 13 000 in 2019 and 12 500 in 2015. To use a simple ira employers must implement their plan before october 1 of the year it becomes effective. An employer may choose to make either matching contributions to an employee s simple ira from 1 to 3 of his or her salary or non elective contributions. Employees age 50 or over can make a catch up contribution of up to 3 000 in 2016 2020 subject to cost of living adjustments for later years.

Using a simple ira employers must match employee deferrals on a dollar for dollar basis between 1 3. An employer may choose to lower the matching limit to below 3. Salary reduction contributions and. 12 500 in 2016 2018 subject to cost of living adjustments for later years.

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)