Term Whole Life Insurance

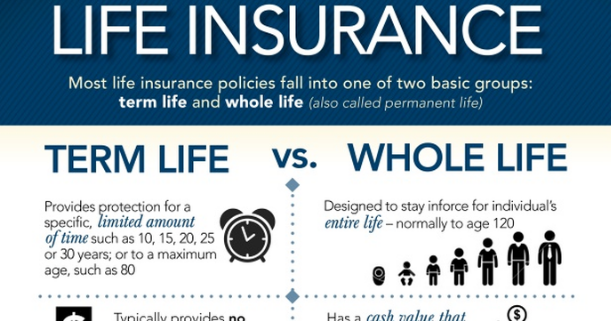

Whole life insurance or whole of life assurance in the commonwealth of nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insured s entire lifetime provided required premiums are paid or to the maturity date.

Term whole life insurance. What is whole life insurance. Many life insurance sales people focus on the investment portion of the whole life insurance policies. A type of life insurance with a limited coverage period. A whole life insurance is a term insurance policy that covers you for 99 years.

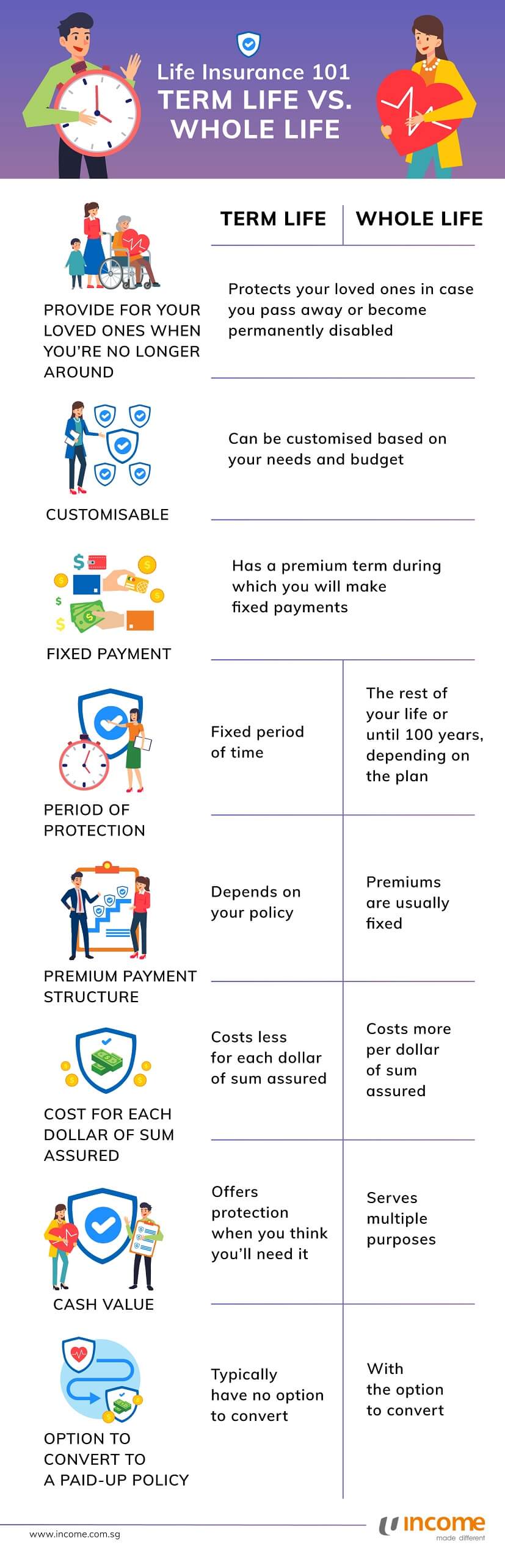

Whole life insurance pros and cons. As a life insurance policy it represents a contract between the insured and insurer that as long. Buy term life insurance whole life insurance plans from singapore s leading insurance provider to protect you your loved ones. As the name implies whole life insurance covers you for your whole life provided you continue to pay your premiums.

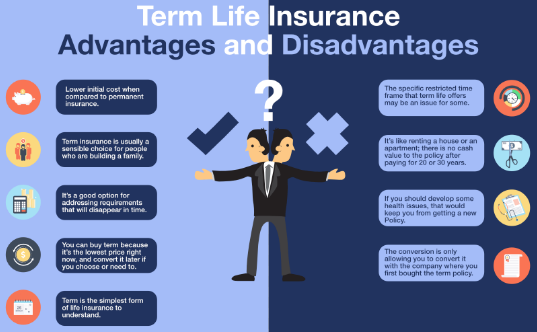

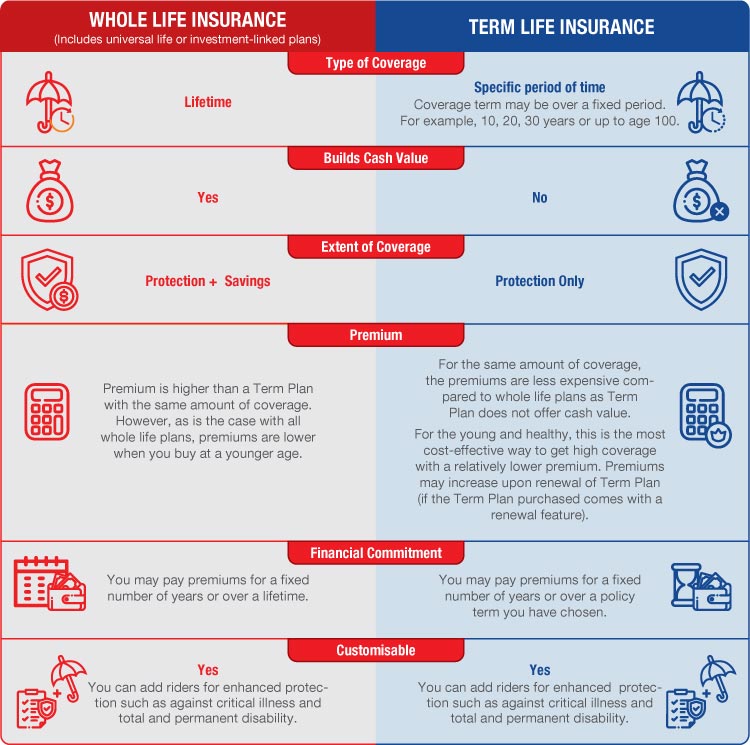

Term and whole life insurance policies both come with their own sets of positives and negatives. It covers you for a fixed period of time like 10 20 or 30 years. For most people the negatives of whole life insurance outweigh the negatives and term life insurance is the better option but there are some circumstances where a whole life policy is a better fit. They are different from ordinary insurance policies which have a defined term of say 10 20 or 30 years.

Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end. Term life insurance premiums will be lower than premiums for most whole life insurance policies which last a lifetime and build cash value. Term life insurance is the easiest to understand and has the lowest prices. However you can purchase term insurance to complement your whole life insurance.

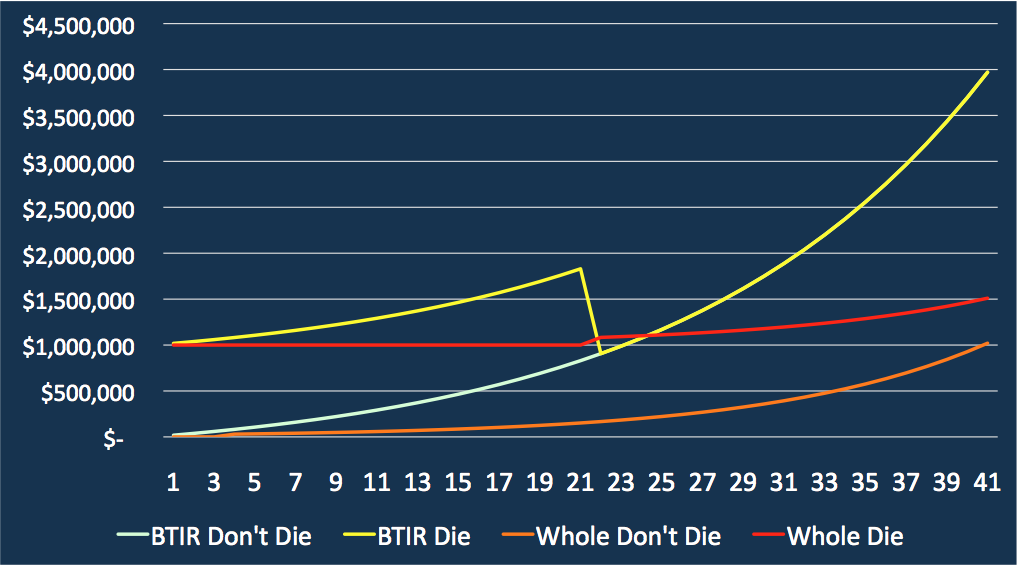

You can get life insurance quotes online. The cost of whole life insurance is much higher because of this and the rates of return on whole life insurance are usually much lower than normal investments.