Setting Up A Trust For A Minor Child

Assets of minor children should always be held in trust.

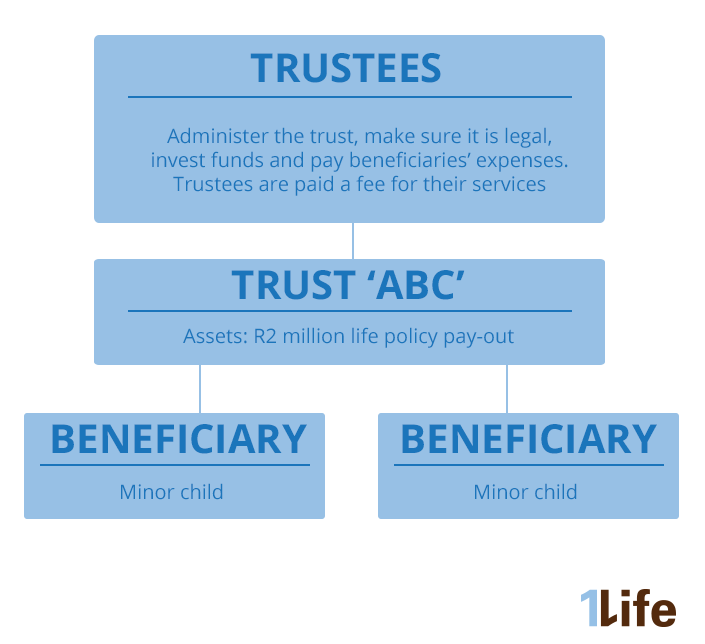

Setting up a trust for a minor child. Many people know just one key fact about trust funds. A trust account is a bank account that you open for your child. This kind of trust can be set up within a will or living trust. The trustee s powers are listed in your will and they give the trustee wide discretion to use trust assets for the basic educational.

You can set it up so the trustee makes payments for education and living expenses until your beneficiary has completed her degree or reaches a certain age. In it you can direct that property slated for a young beneficiary must be managed until he or she turns an age you choose through age 35. They re set up by the ultra. As stated above when a grantor creates a trust they must name a trustee.

You do not want children under 18 inheriting assets. If you ve heard of trust funds but don t know what they are or how they work you re not alone. Draft a trust document that specifically identifies the minor child the custodian you wish to appoint a backup custodian in the event that the first is unwilling or unable to perform her duties and the amount and location of the funds to be included in. While they are under 18 their guardian or conservator will control the money for them.

These are trusts set up by parents for children under 18 who have never been married or in a civil partnership. Decide whether or not the trust will eventually go to your child in total. Setting up a trust for minor children requires a handful of steps but is relatively straightforward. Trusts for minors are usually set up by parents or relatives who want to leave property to a young person but also want to name a trusted adult to care for the property until the child is old enough to be financially responsible.

How a minor s trust works. The downside to setting up a bare trust is that the beneficiary is entitled to take control of the trust assets at age 18. The account will be named in trust for name of minor child your financial institution will be able to take care of this step for you. Here are the steps to follow.

Trust funds 101. A child s trust is a legal structure you can set up in your will. At that time the trust expires and she receives all the assets. They re not a type of trust in their own right but will be either.

Despite this shift uk households are spending on average 31 per cent.

/money_with_ribbon-5bfc328f46e0fb0083c1bfee.jpg)