Sole Proprietor Llc Taxes

If you re a member of a multi member llc it can be difficult to estimate how much in taxes you ll have to pay on your share of the business although a tax professional will be able to help you.

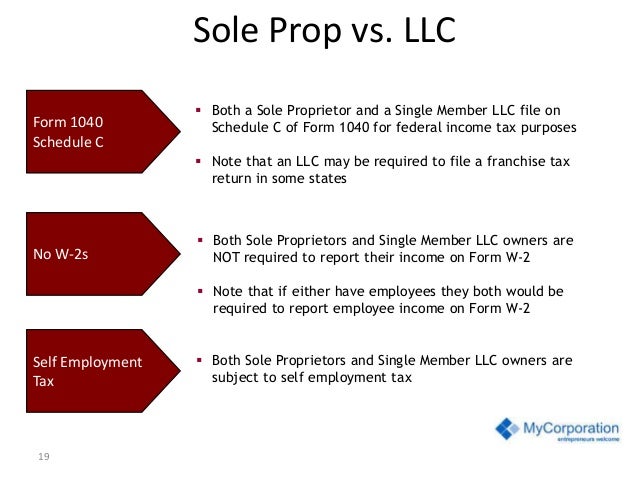

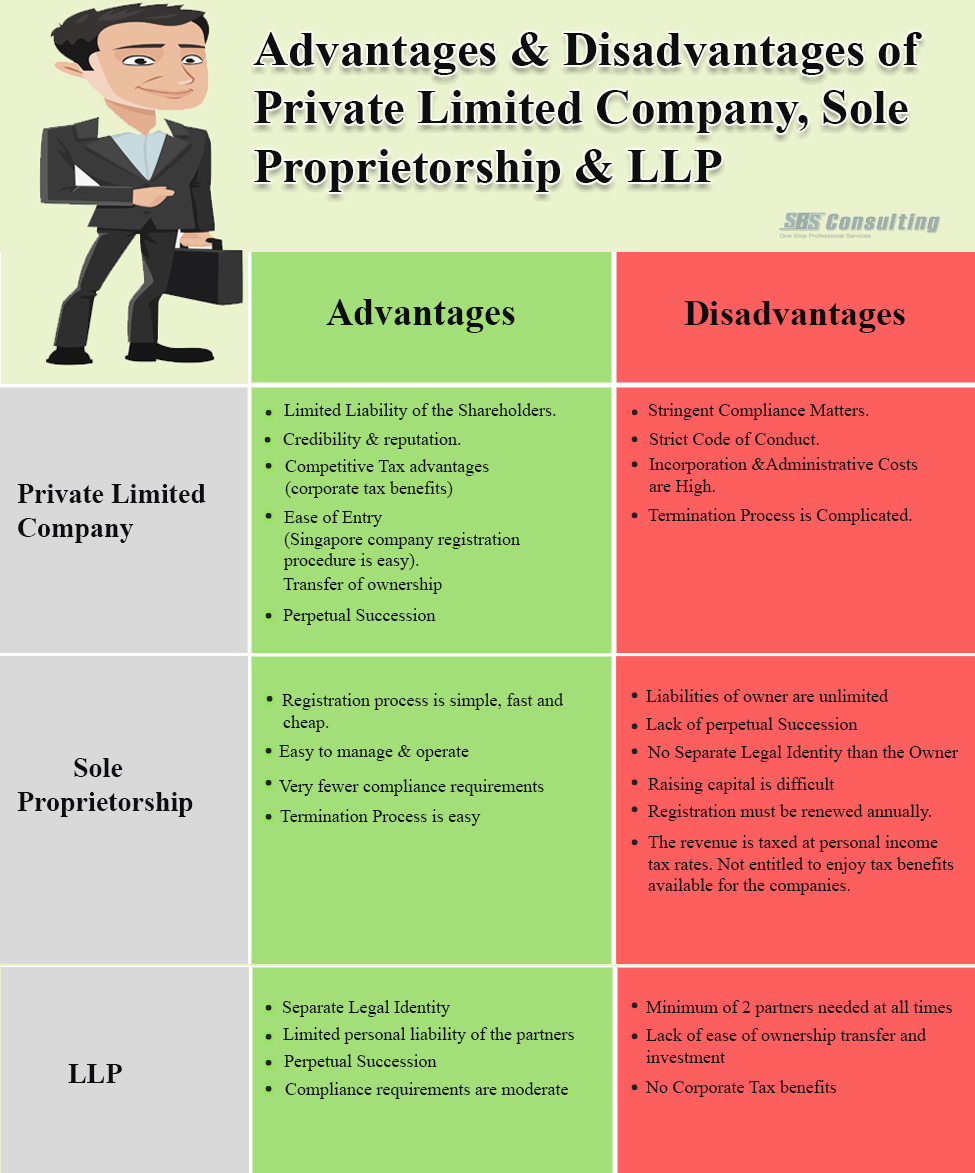

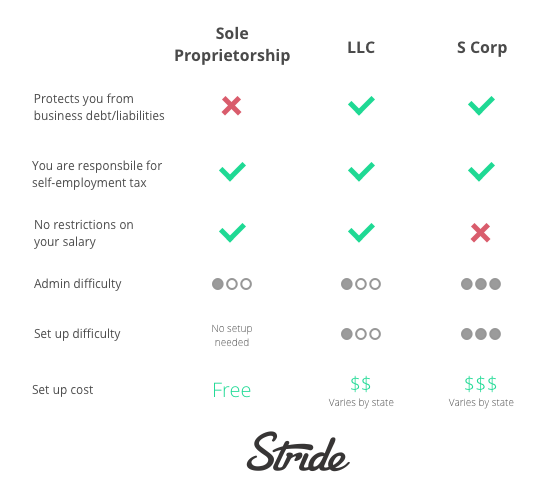

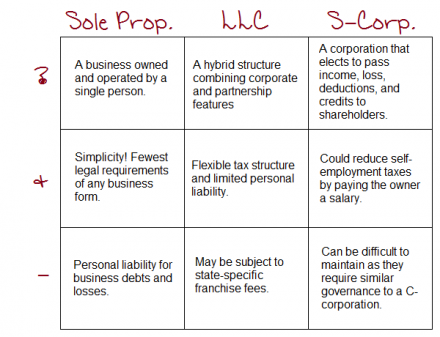

Sole proprietor llc taxes. A single member llc is considered a disregarded entity and is taxed as a sole proprietorship filing schedule c to for the individual s personal tax return. However if you are the sole member of a domestic limited liability company llc you are not a sole proprietor if you elect to treat the llc as a corporation. You likely cannot escape paying taxes on business profits or filing an annual tax return. A single member llc that is classified as a disregarded entity for income tax purposes is treated as a separate entity for purposes of employment tax and certain excise taxes.

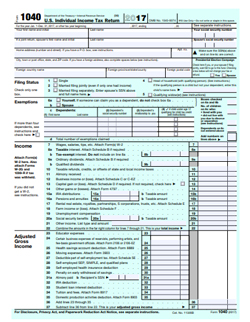

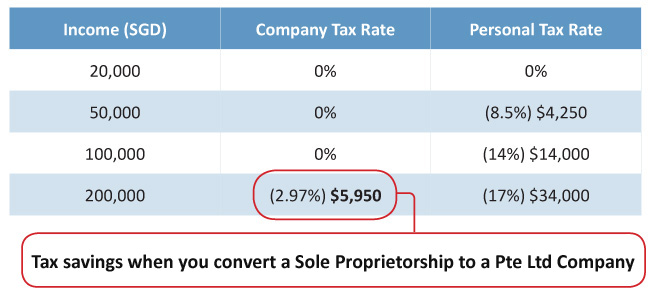

A sole proprietor vs llc for you small business faces different taxes. Self employed sole proprietors partners if you have received full time or part time income from trade business vocation or profession you are considered a self employed person. If you are an llc that elects to be treated as a sole proprietorship for tax. Self employment tax is included in form 1040 for federal taxes calculated using schedule se and the total self employment tax liability is included on line 57 of form 1040.

With a sole proprietorship federal taxes are based on the company owner s net business income yet the taxes must. Llc taxes may be more difficult to file than sole proprietorship taxes and they also tend to be a little more costly. Find the definition of a sole proprietorship and the required forms for tax filing. A sole proprietor is a self employed individual and must pay self employment taxes social security medicare tax based on the income of the business.

For wages paid after january 1 2009 the single member llc is required to use its name and employer identification number ein for reporting and payment of employment taxes. The quarterly tax requirements for your llc will depend on which business structure you elect to be taxed as. Sole proprietors must also pay the so called self employment tax which means paying both the employee and the employer sides of social security and medicare. You have to report this income in your tax return.

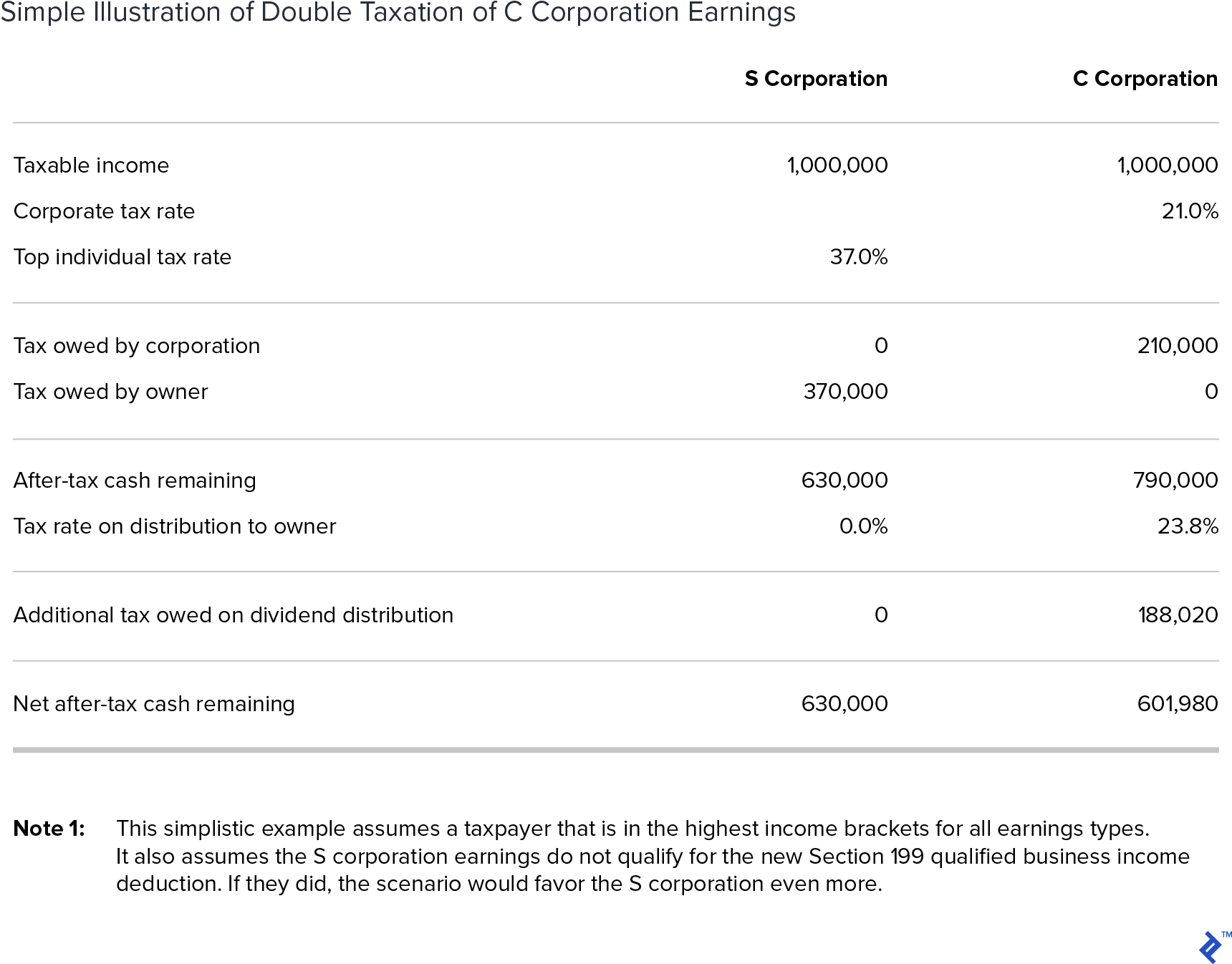

That s a total of 15 3 percent or double what an employee would normally pay and it s a bummer for sole proprietors. A multiple member llc is taxed as a partnership. Taxes also come into play when choosing between a sole proprietorship and an llc.

-(1).jpg?sfvrsn=0)

-(1).jpg?sfvrsn=0)