Starting A Roth Ira At 25

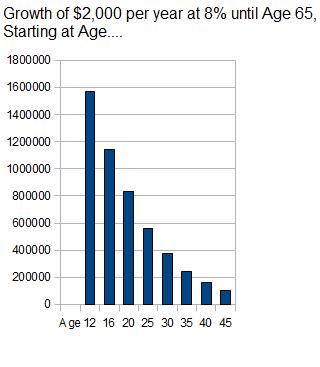

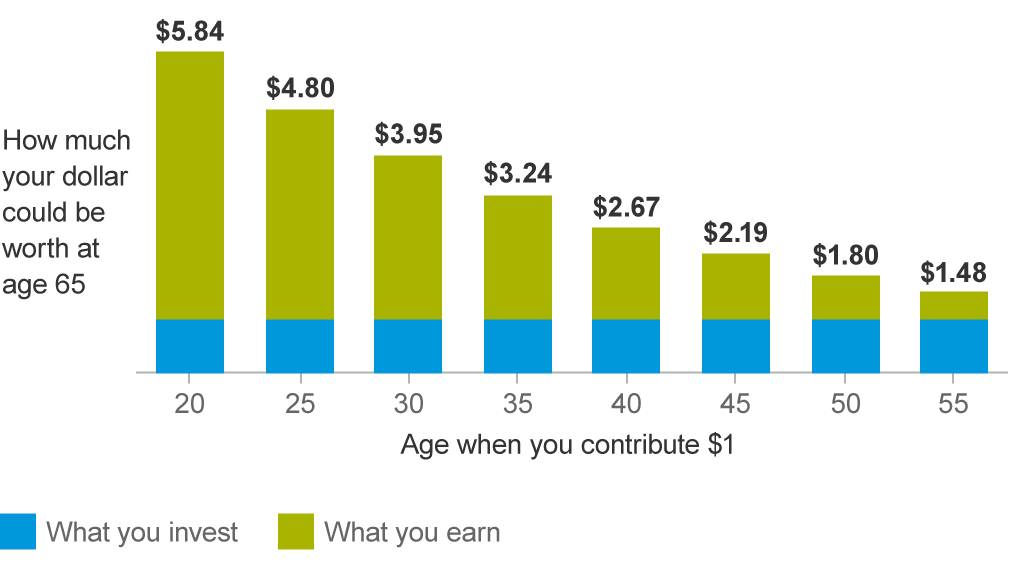

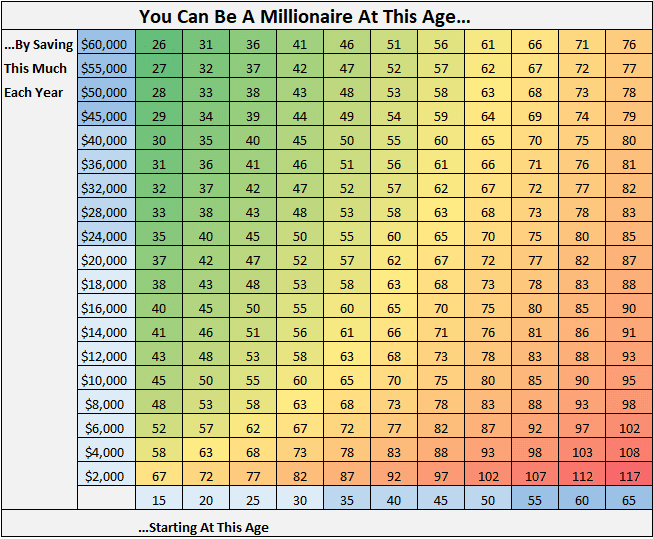

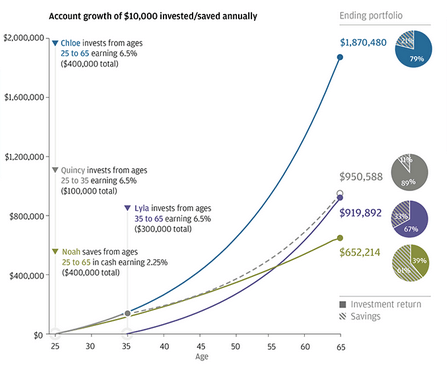

Retirement savings is never one size fits all bar the one constant which is start saving early especially if you want to retire by 55.

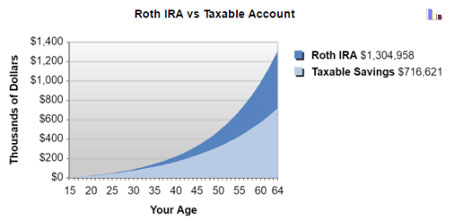

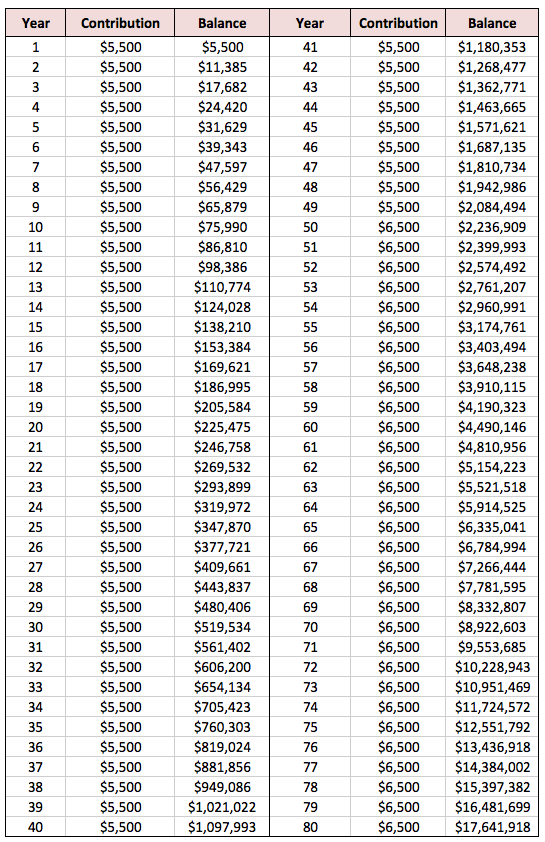

Starting a roth ira at 25. So if your 15 year old has earned 6 000 at a summer job you can gift them up to 6 000 the maximum annual contribution to invest in a roth ira. If you open an ira at 25 with 3 000 and max it out from age 26 to age 30 you ll have deposited 33 000. According to the 2018 tax rules you can invest up to 5 500 a year in a roth ira. The earlier you start a roth ira the better but opening a roth ira when you re close to retirement can still make sense under some circumstances.

I am 40 and have continued to contribute the max to my traditional ira since 1996. From there see if you can add in an additional 2 000 by the end of the year. Here is my question and help would be appreciated. 1 for example a 19 year old who contributes 5 000 a year to a roth ira which earns 8 for 40 years would be positioned to have about 1 4 million by age 59.

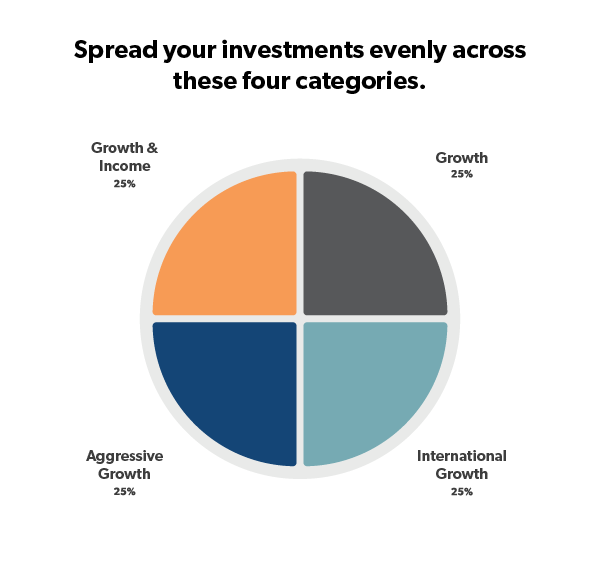

The center for retirement research in boston suggests to retire by 62 saving 22 percent of salary starting at age 25 for workers with average income of 43 000. Many are at their peak earning years late in. Start by opening an account with 1 000. Opening a roth ira can be as simple as visiting your bank s website and filling out an online application.

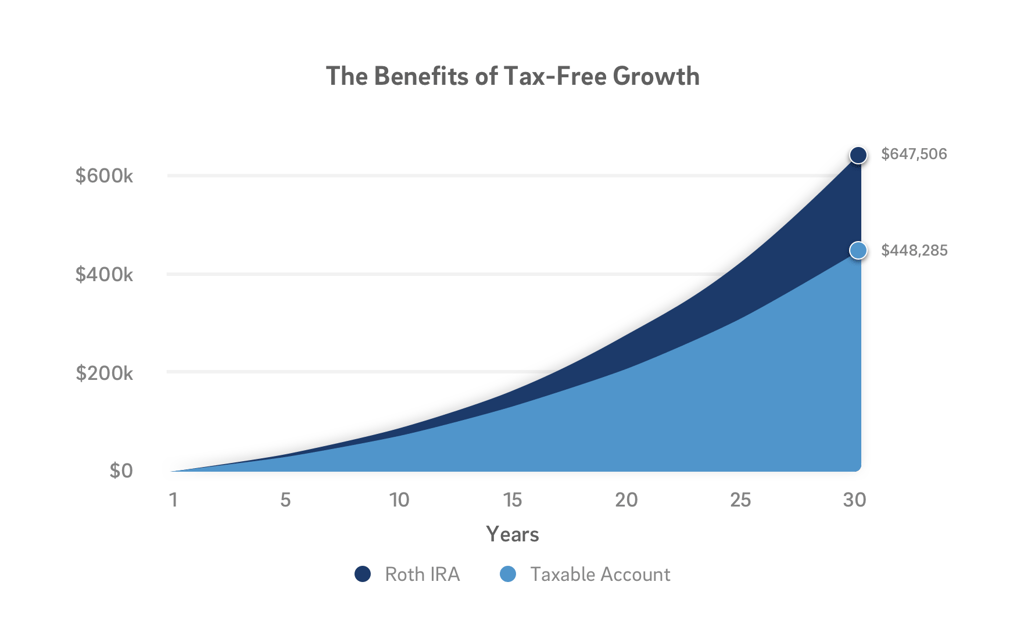

In 2020 as long as your gross income is less than 124 000 for single filers and 196 000 for married couples filing jointly you can contribute the maximum amount into a roth ira. Setting up a roth ira for a teen means that you can gift them some of the funds to get it started provided that your teen is earning income. How to start a roth ira. Plus a roth ira has the potential to accumulate over the years and the owner may be able to better manage their tax burden if they withdraw the money after age 59 1 2.

For example if she contributes the current ira maximum of 5 500 a year starting now and continues to sock away that amount annually she would end up with an income tax free roth ira balance of.