State Farm Homeowners Insurance Coverage Water Damage

Backup sewer and drain.

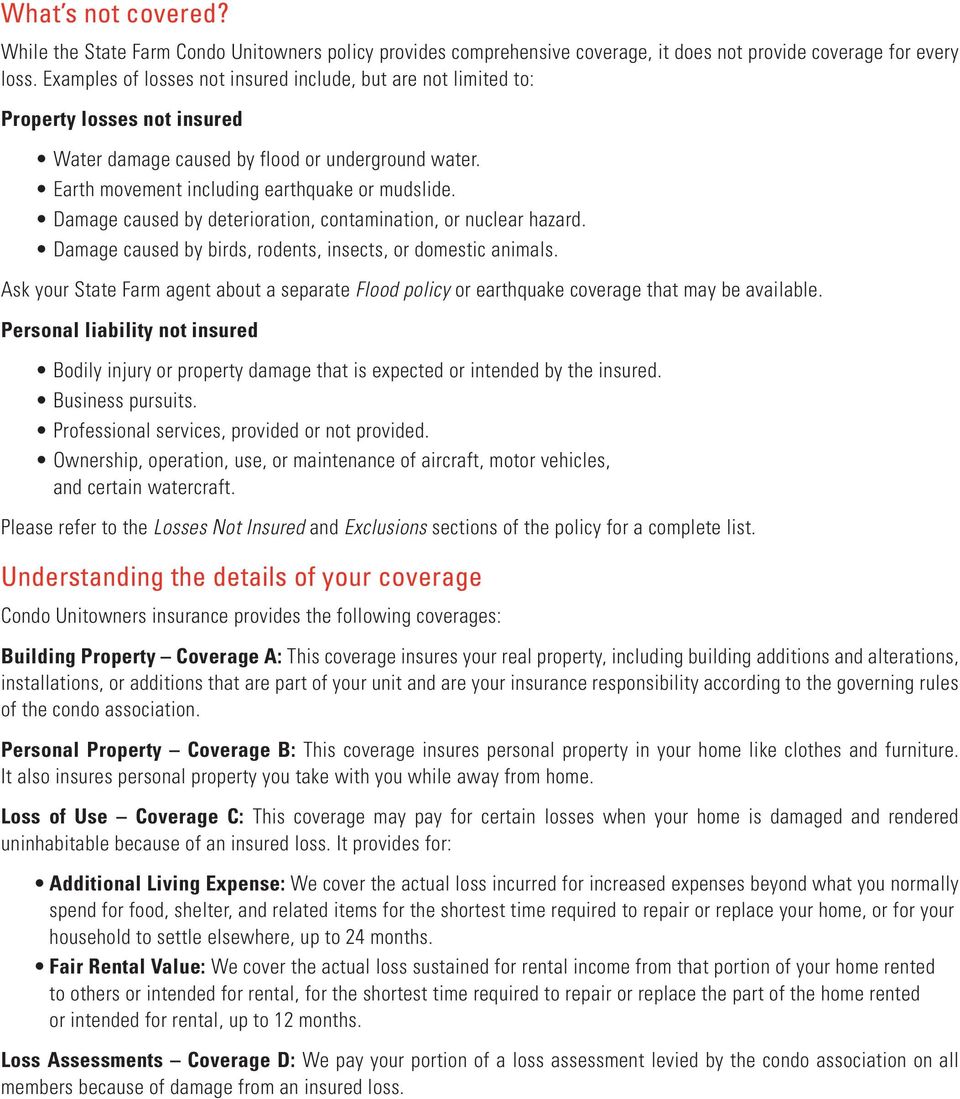

State farm homeowners insurance coverage water damage. For most perils your coverage is fairly easy to understand and doesn t require much reading in between the lines but water damage to your home is a different story. It is important to understand however that not every possible cause of damage is covered. Due to high claims activity for losses caused by mold many insurance companies are excluding coverage for mold damage. While this type of policy will not cover floods from the outside many other types of water damage would be covered.

2 please refer to your actual policy for a complete list of covered property and covered losses. What makes the state farm water damage coverage clause so unique. Homeowners insurance protects your home and personal property against destructive weather theft and elemental perils like fire or ice. If you have state farm homeowners insurance it will protect you from a number of different types of water damage.

Homeowners who have flood coverage and have experienced flood damage should report their claim to their flood insurance carrier so that damages can be assessed. According to the insurance information institute homeowners insurance may help pay for repairs if for instance your drywall is drenched after your water heater ruptures or an upstairs pipe bursts and water saturates the ceiling below. Homeowners insurance provides coverage for damage to your house and other structures on the property where your house is located. Minor water damage from something like a burst pipe is generally covered by a state farm homeowners insurance policy but a flood caused by an external source like an overflowing.

If you have water damage contact your agent for guidance. Many policies contain dollar limits for water damage due to such things as a broken pipe. That is unless your insurer is state farm. Most homeowners insurance policies help cover water damage if the cause is sudden and accidental.

If you are experiencing water damage in your home you may want to file a claim to get the problem taken care of. Water damage is one of the most common causes of home insurance claims according to the insurance services office iso water damage claims are the second largest frequent insurance claim following wind and hail damage. 1 data provided by s p global market intelligence and state farm archive. Some insurance policies may cover this but most homeowners insurance policies will not pay to repair or replace your water heater.

Refers to damage from rising water mudslide or wave action.