Stock Buying Limit

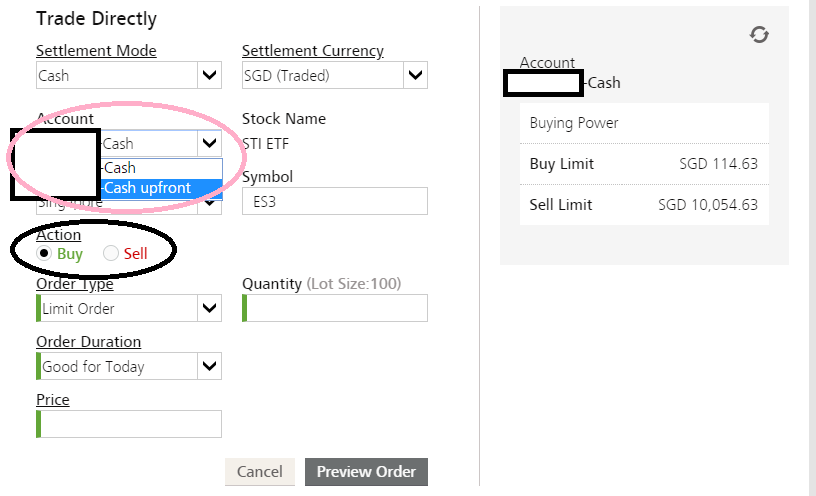

For example let s say you want to buy 100 shares of a stock with the ticker xyz and the maximum price you want to pay per share is 33 45.

Stock buying limit. If you want to buy an 80 stock at 79 per share then your limit order can be seen by the market and filled when. If that price is not met your order will not be executed. How limit and stop orders work. You wait for the right buying opportunity when the price drops at 90 or lower to buy.

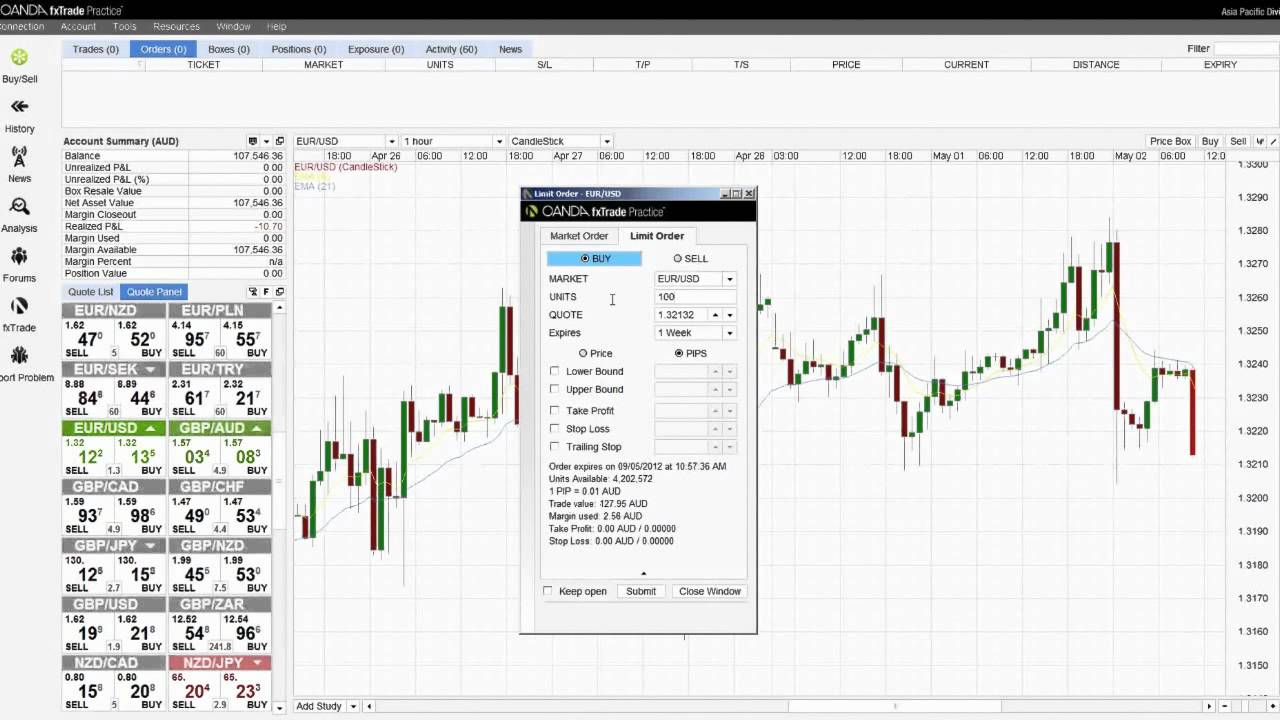

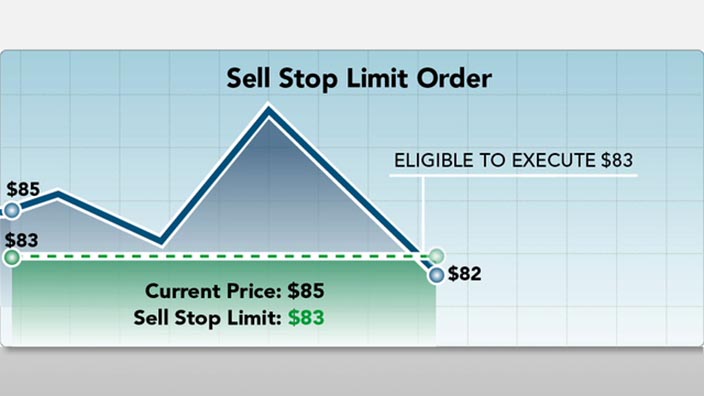

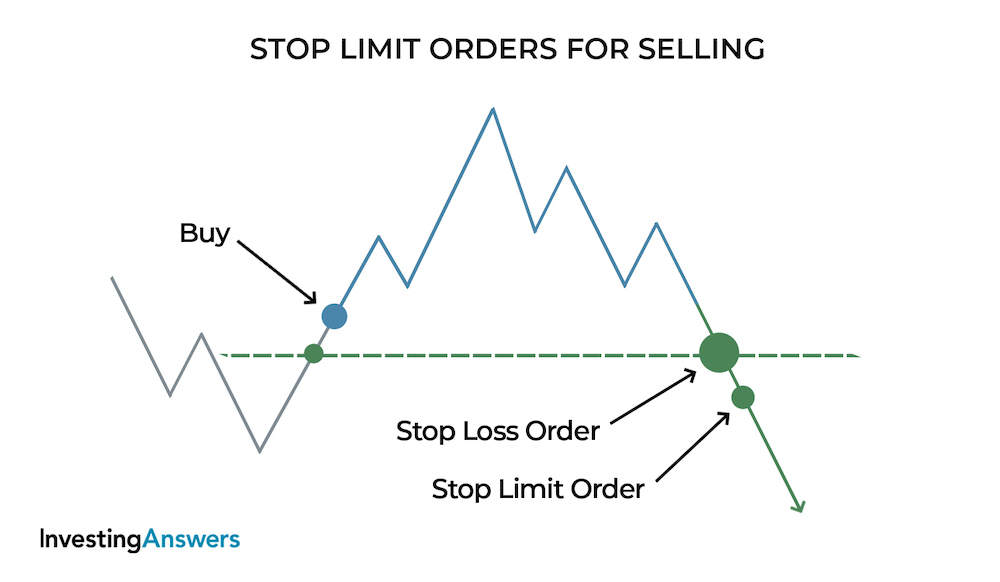

An investor wants to purchase shares of abc stock for no more than 10. In this scenario the stop limit sell order would automatically become a limit order once the stock dropped to 50 but the trader s shares won t be sold unless they can secure a price of 49 50 or better. A limit order is an order to buy or sell a security at a specific price or better. For example a buy limit order could be placed at 2 40 when a stock is trading at 2 45.

It is used to buy below the current price when the value is believed to increase after dropping at the limit price. It sets the maximum or minimum value you are willing to buy a certain stock. If the limit order is for a stock purchase the price can be lower than the specified price for the trade to occur. A stop order can t until it is triggered.

It will not be executed until the price. A limit order can be seen by the market. If the price dips to 2 40 the order is automatically executed. For example a trader placing a stop limit sell order can set the stop price at 50 and the limit price at 49 50.

When you place a limit order you are stating the price at which you wish to buy or sell a stock. Limit buy order. A limit order guarantees a price but does not guarantee an execution. A limit order can be executed at a better price than the limit price you set.

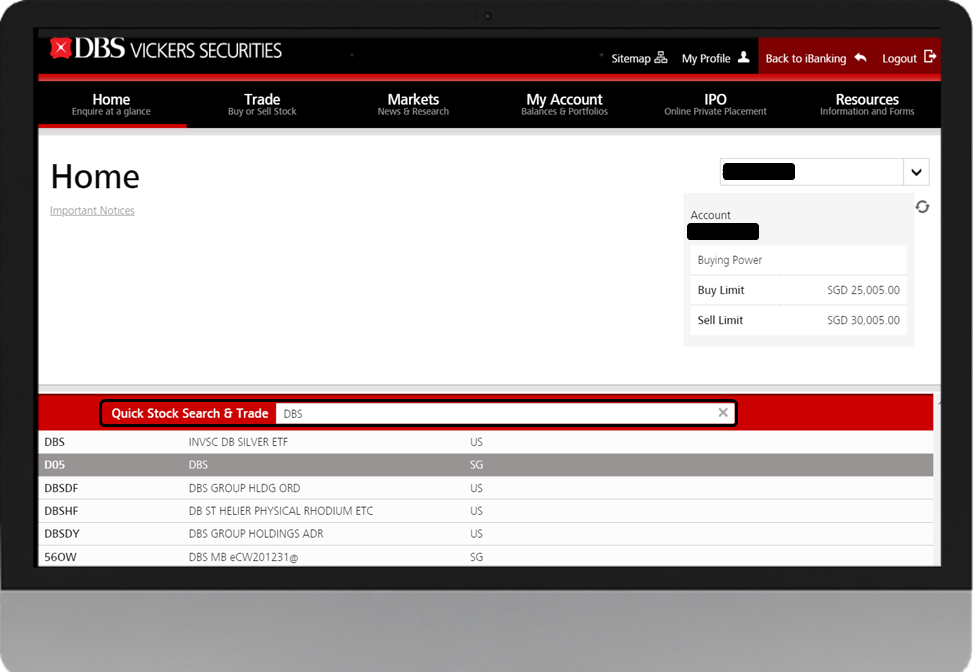

A limit order is an instruction to the broker to trade a certain number shares at a specific price or better. In that case you d use a limit buy order and you would express it like this. Orders on the hong kong market. A limit order is an instruction to a stock broker or brokerage service to either buy or sell a stock at a specified price.

The investor would place such a limit order at a time when the stock is trading above 50. Limit price at 90. For example for an investor looking to buy a stock a limit order at 50 means buy this stock as soon as the price reaches 50 or lower.

:max_bytes(150000):strip_icc()/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

/blur-1853262_19201-485cc15952974d8ab3af724fc5636238.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Margin-Debt-Stock-Broker-56a0928b5f9b58eba4b1aa30.jpg)

/GettyImages-956752490-f855ea697f214f07b13b777eb4787945.jpg)

/what-is-a-market-maker-and-how-do-they-make-money-ab0b42f23a1e43019113a34b52649c26.png)