Take Money Out Of Roth Ira

John is 58 and has had a roth ira more than 5 years with a balance of 20 000.

Take money out of roth ira. Roth ira withdrawal rules differ depending on whether you take out your contributions or your investment earnings. A friend of mine says that if you withdraw money from a roth ira within five years of putting it in you ll pay tax and a penalty. Taking money out of an ira is as easy as calling the financial institution where your ira account is held telling them you would like to take money out and signing the appropriate paperwork. Another 2 000 of his roth is from investment gains.

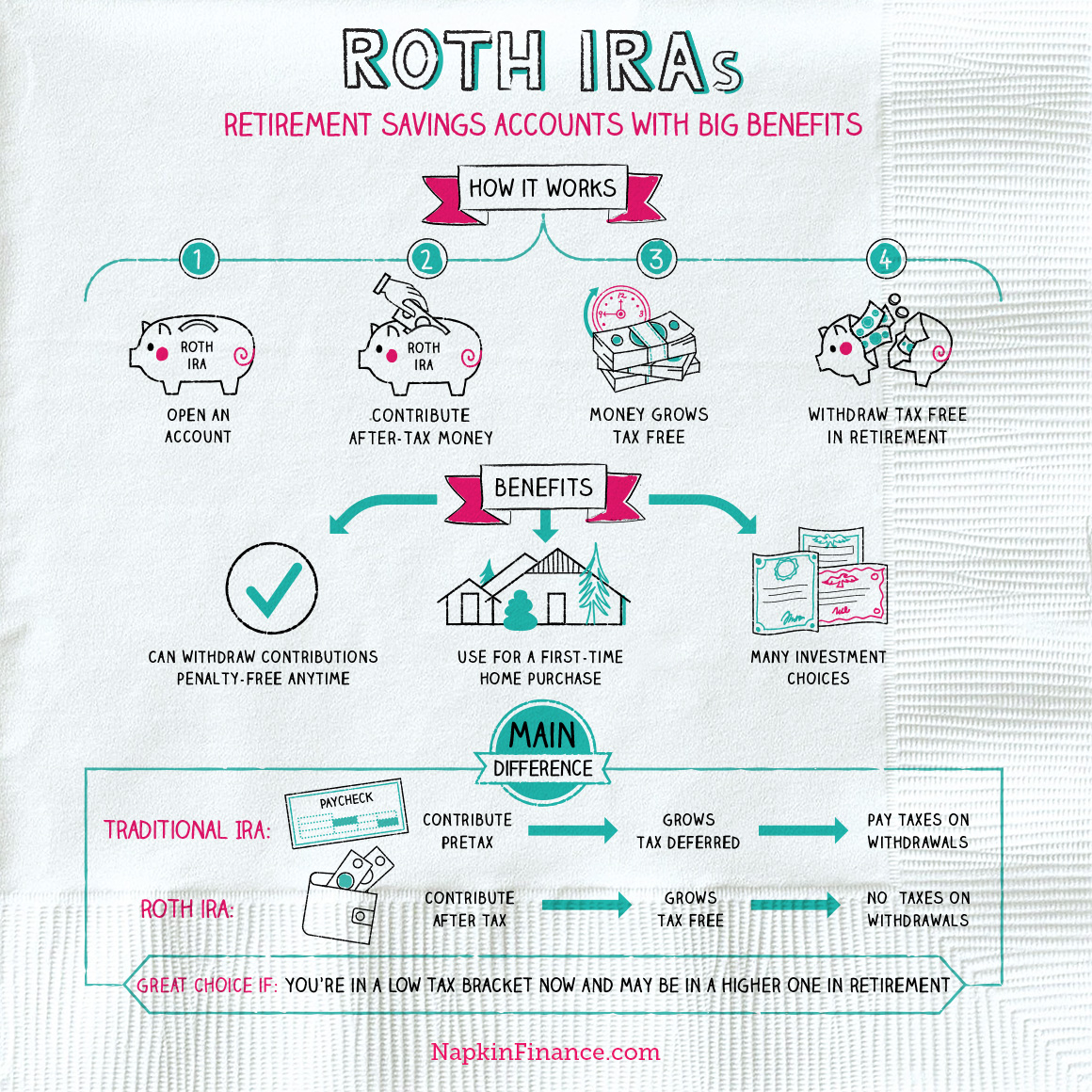

Roth accounts don t impose rmds. I started my roth in 2018 when i turned 30 and thought i. However you may have to pay taxes and penalties on earnings in your roth ira. If you re forced to take an rmd not only will you lose out on tax advantaged growth for the money you withdraw but you ll be subject to taxes on that sum as well.

7 ways you can take money from a roth ira before age 59 1 2 without paying a penalty if you need money in a pinch and meet these exemptions a roth ira can be an emergency source of cash. You can take money out of your roth ira anytime you want. Withdrawals from a roth ira you ve had less than five years. But the process as well as potential tax and penalty consequences require thoughtful consideration to make informed decisions on ira withdrawal.

If you take out more money from a roth ira than the combined total of all contributed and rollover funds the withdrawal counts as earnings for tax purposes. John cashes in his entire roth ira. His original contributions totaled 10 000 and last year he converted 8 000 from a traditional ira to his roth. In order to make qualified distributions in.

If the distribution is not qualified earnings removed from a roth are subject to income taxes. The irs does not make any exceptions to this rule. Technically you can t take a loan from a traditional or roth ira but you can access money for a 60 day period through what s called a tax free rollover as long as you put the money back into.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)