Tax Law Definition

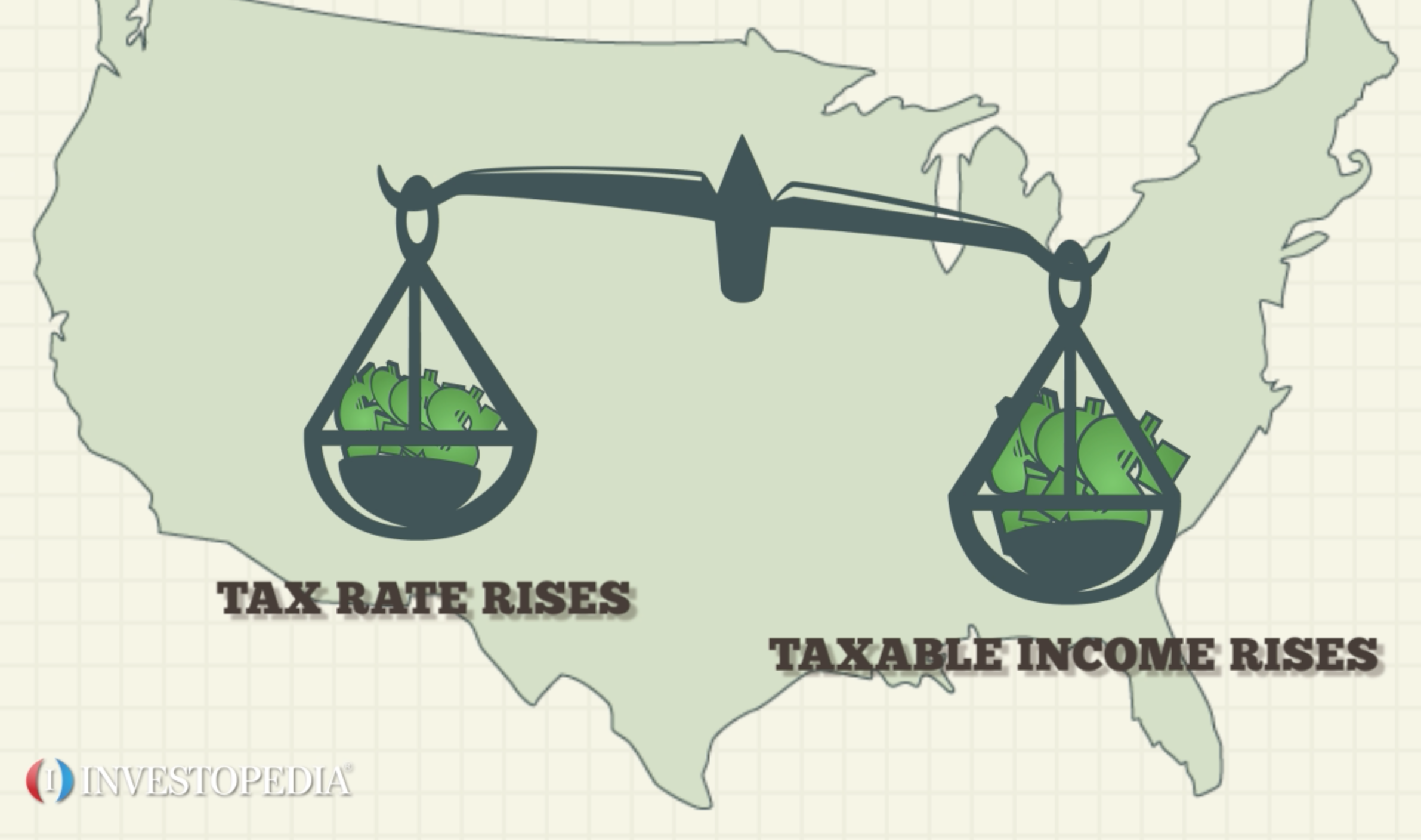

Primary taxation issues facing the governments world over.

Tax law definition. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Taxes in the u s. A governmental assessment charge upon property value transactions transfers and sales licenses granting a right and or income. These include federal and state income taxes county and city taxes on real property state and or local sales tax based on a percentage of each retail transaction duties on imports from foreign countries business licenses federal tax and some states.

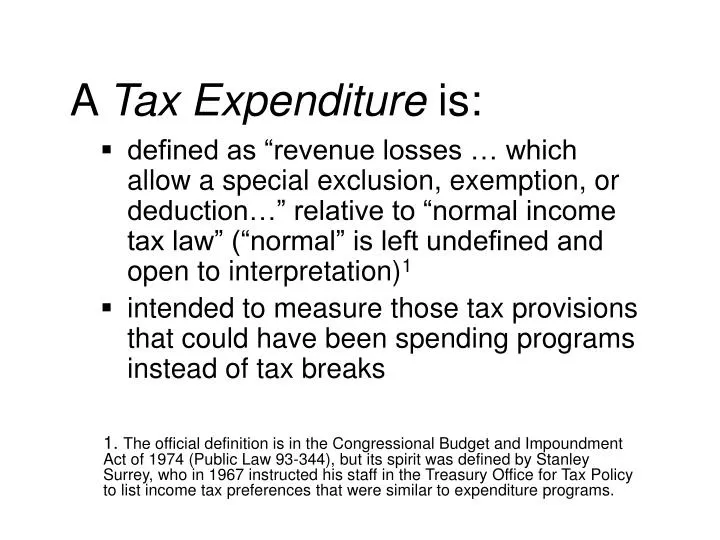

A tax lien is a legal claim against the assets of an individual or business who fails to pay taxes owed to the government. Definition of tax law. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the internal revenue code or state law. Tax law can also be divided into material tax law which is the analysis of the legal provisions giving rise to the charging of a tax.

Dictionary term of the day articles subjects businessdictionary. In general a lien serves to guarantee payment of a debt such as a loan. Tax law synonyms tax law pronunciation tax law translation english dictionary definition of tax law. Tax law the body of laws governing taxation law jurisprudence the collection of rules imposed by authority.

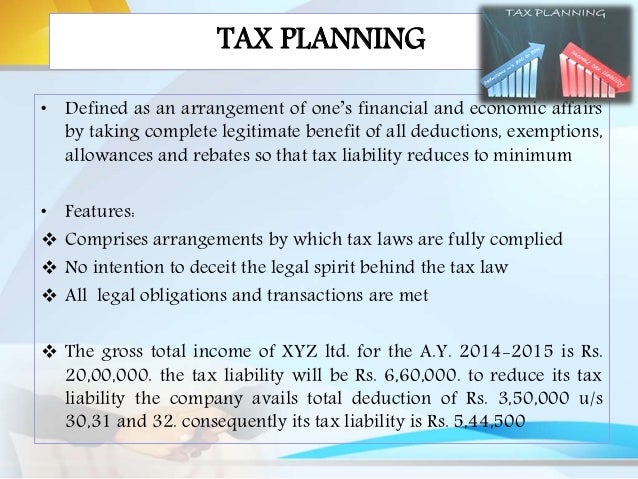

Taxes have been called the building block of civilization. This tax law glossary will help you understand the legal terms and phrases which are relevant to irs audits tax deductions and other areas of tax law. Body of law concerned with taxation. The tax law glossary gives you access to definitions for legal terminology commonly used in tax law related documents and court proceedings.

Tax law or revenue law is an area of legal study which deals with the constitutional common law statutory tax treaty and regulatory rules that constitute the law applicable to taxation.

:max_bytes(150000):strip_icc()/Netoftax-taxrates-464cac356d8c468c97eb98a8e92f4052.jpg)