Tax Lien Released Meaning

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

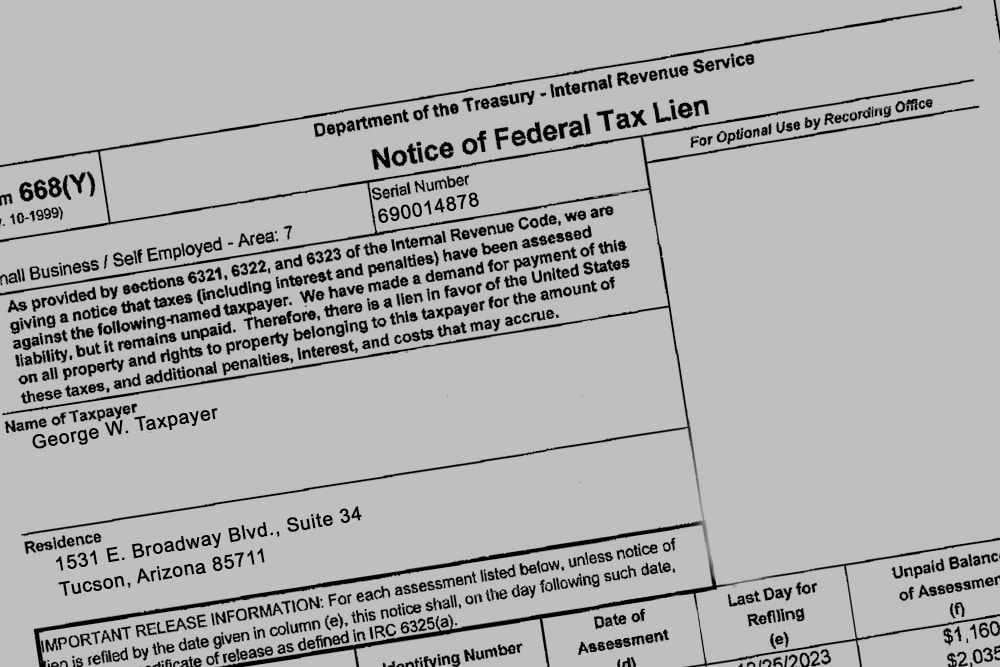

When all the liabilities shown on the notice of federal tax lien are satisfied the irs will issue a certificate of release of federal tax lien for filing in the same location where the notice of lien.

Tax lien released meaning. There s also the super lien which involves being behind on homeowner association fees. It means the lien been satisfied and it 39 s released. You would need to get it withdrawn typically it 39 s very difficult to do so for the state liens you would need to do reasrch on it in your state. Certificate of release of federal tax lien.

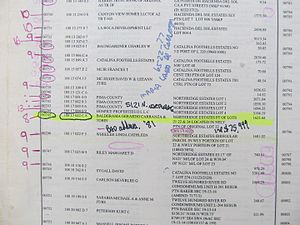

After a tax debtor pays off the debt the county records will be updated to reflect the fact that the lien has been released. In fiscal year 2012 the irs filed over 708 000. How to release or withdraw a federal tax lien. And you aren t alone if you have a tax lien.

Tax laws direct the irs to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable or the irs accepts a bond for payment of the liability. The lien will be released no later than 30 days after the debt was paid in full. Verify a lien request lien payoff amount or release a lien call 800 913 6050 or e fax 855 390 3530. The taxpayer will then be mailed a certificate of lien release to confirm that the lien has been removed.

If you have paid the irs in full but have not received a certificate of lien release call the irs at 800 913 6050. Generally the irs will not issue a certificate of release of lien until the tax has either been paid in full or the irs no longer has a legal interest in collecting the tax. Collection advisory group for all complex lien issues including discharge subordination subrogation or withdrawal. Just in case you are wondering no released dosent mean it will should be removed from your report.

Centralized lien operation to resolve basic and routine lien issues. A property will be released of federal tax lien after the lien has been cleared by the taxpayer. A federal tax lien is the irs s legal claim to your current and future assets if a company or an individual does not pay their first tax bill the irs may file a notice of federal tax lien ntfl which provides public notice to creditors. Release of a lien after the tax debt is cleared occurs within a few days.

You can go to irs website and search for form 12277. You could have a federal tax lien on your house but you could also have a state tax lien or a tax lien from your county or city. For federal tax liens. Although priority may be lost to competing liens both those in existence when the federal tax lien was erroneously released and those coming into existence between the erroneous release date and the revocation reinstatement date it is nevertheless important to use the revocation and reinstatement procedures in order to correct the presumptive conclusive extinction of the lien under irc.

Nevertheless the claim will remain on the person s credit report for. In order to have the record of a lien released a taxpayer must obtain a certificate of release of federal tax lien.

/tax-lien-497446038-c58c6c685be6482786f29fc2c9ade07b.jpg)

/how-to-invest-tax-lien-certificates-4156474_v4-07a1533f0d804376a110dad6664ed2df.png)

/how-to-invest-tax-lien-certificates-4156474_v4-07a1533f0d804376a110dad6664ed2df.png)