Tax Relief Program

Generally the price of tax resolution services varies.

Tax relief program. Latest updates on coronavirus tax relief irs mission critical functions continue. Tax relief costs range from 750 to 10 000 or more depending on your tax debt circumstances. This legislation is commonly called the taxpayer relief provisions. The program provides tax relief for eligible households where an occupant has lost their employment due to covid 19.

On average tax relief costs 2 000 7 000. Property tax relief budget information funding for the homestead benefit and or senior freeze program will be determined by the new budget proposed by the governor and agreed to by the legislature which is scheduled to go into effect october 1. Ic07 1r1 taxpayer relief provisions. Covid 19 federal stimulus payments to individuals are tax free individuals individual income tax deadline extended to july 15 extended payment faqs payment plan questions public targeted in covid 19 stimulus scam how to reschedule an individual income tax payment businesses paycheck protection program ppp tax and deduction clarifications.

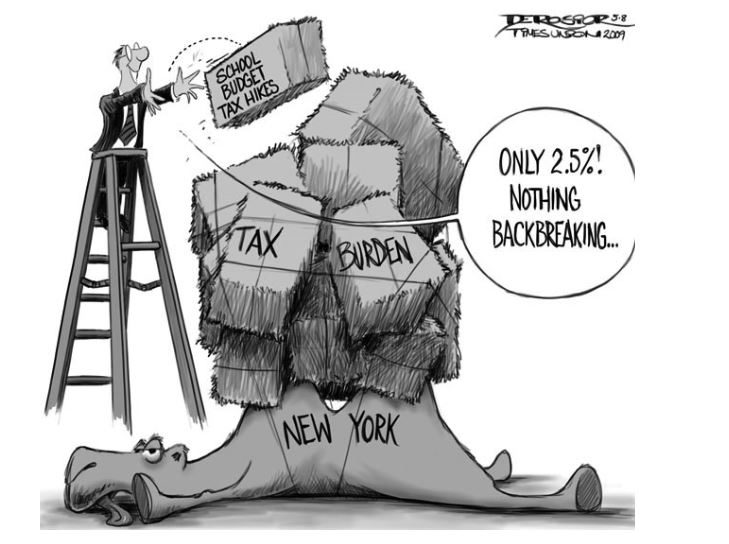

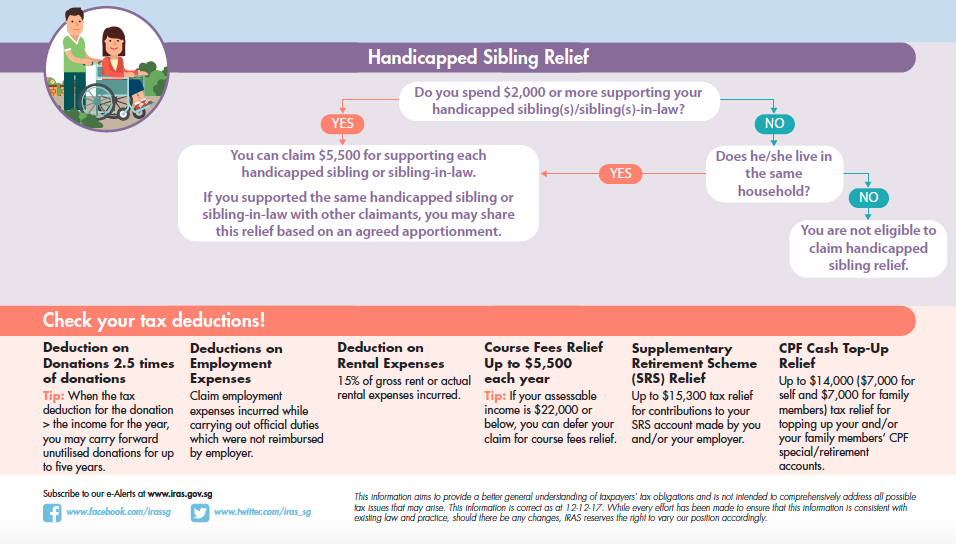

Whether deliberately cultivated or not the irs did little to dispel this perception. New york state school tax relief program star don t lose your basic star because of delinquent taxes a new york state law effective april 2020 prevents property owners who have been delinquent with their property taxes for more than one year from receiving the basic star benefit. Examples of tax relief include the allowable deduction for pension contributions. A maximum relief of 500 for real estate tax and 250 for personal property tax is available dependent upon application approval and individual circumstances.

Get up to date status on affected irs operations and services. Notification effective april 27 2020. The application fee for offer in compromise is 205 unless you qualify for the low income certification or submit a doubt as to liability offer. Back in the bad old days the image of the irs was one of intimidation.

We continue to process returns and issue refunds but we are experiencing delays due to limited staffing. Issue a refund or make an adjustment to refund or reduce tax payable beyond the normal three year period for an individual a graduated rate estate and for certain tax years a testamentary trust.

.jpeg?width=600&height=424)