Transfer Ira To 401k Rules

You are the beneficiary of a deceased simple ira owner.

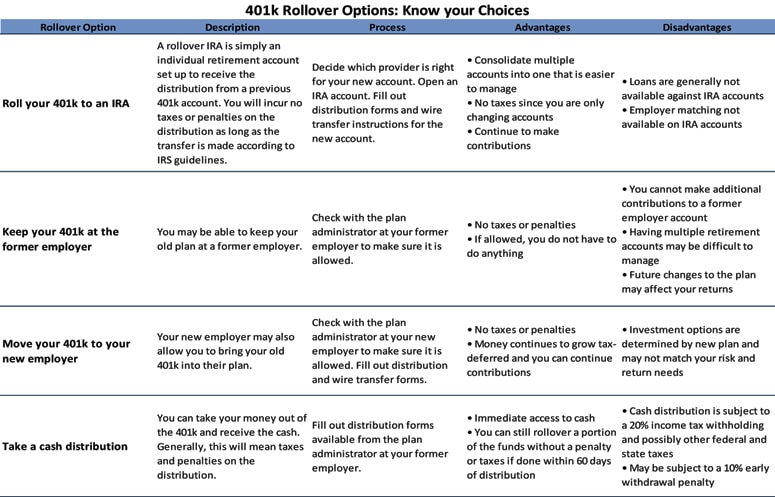

Transfer ira to 401k rules. This is what is known as a 401k trustee to trustee transfer. The withdrawal is the result of an irs levy. Although most people think of an ira rollover as moving funds from a 401 k to an ira there is also a reverse rollover where you move ira money back into a 401 k plan. According to reuters as of 2014 about 69 percent of 401 k plans accept ira rollovers.

As with a 401 k rollover the easiest way to roll a traditional ira into a 401 k is to request a direct transfer which moves the money from your ira into your 401 k without it ever touching. Transfers are generally free if made to similar type accounts. You can also have your financial institution or plan directly transfer the payment to another plan or ira. All retirement savings from the old ira account are withdrawn by the retiree and the ira custodian writes a check to the retiree.

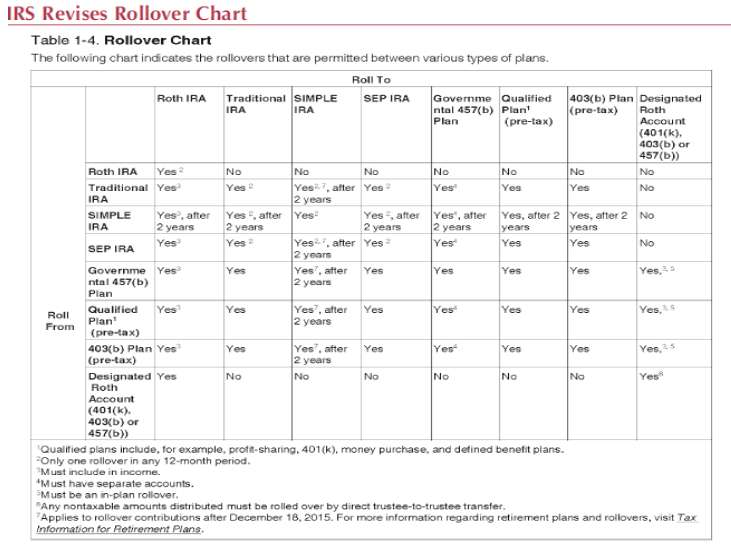

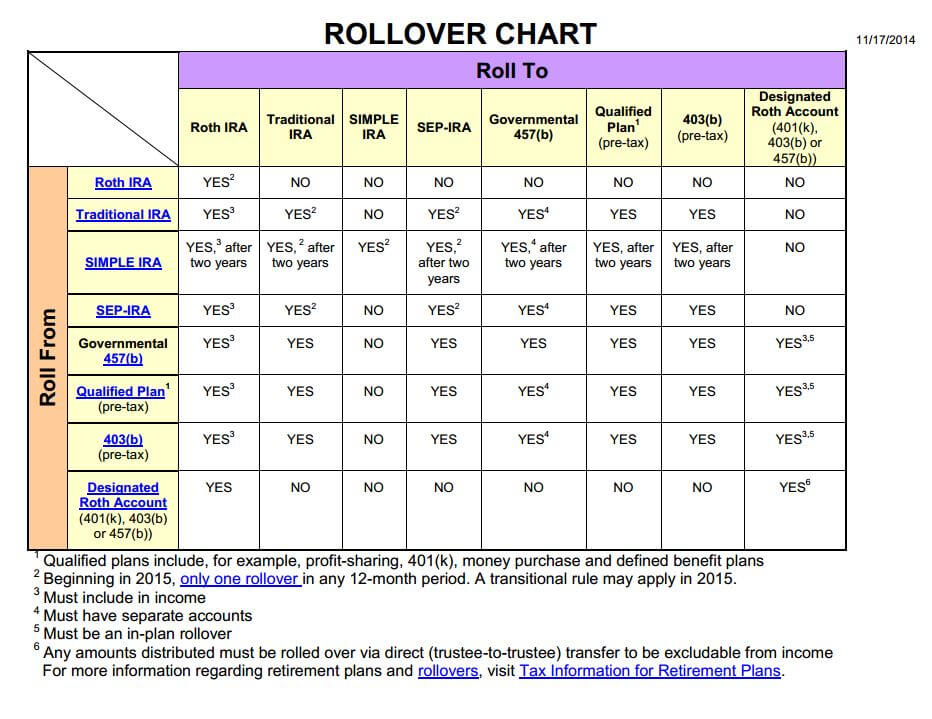

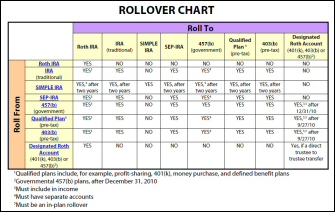

You may be able to transfer money in a tax free rollover from your simple ira to another ira except a roth ira or to an employer sponsored retirement plan such as a 401 k 403 b or governmental 457 b plan. The rollover chart pdf summarizes allowable rollover transactions. If you re 70 1 2 and have money in a traditional ira sep ira or simple ira you re required to take required minimum distributions from your account. Types of ira rollovers.

After 3 weeks the 25000 move from adam s traditional 401k plan into his new ira account. To that end it has authorized a number of tax advantaged plans to encourage workers to do so both via an employer and on their own. Understand the difference between a transfer and a rollover. 1 from one ira to another.

Congress also recognized that employees. Irs 401k ira transfer rules. If you re no longer working and have a 401k you re also required to start taking required minimum distributions by april 1 of the year after you turn 70 1 2. Congress recognizes the importance of saving money to provide for yourself and your spouse in retirement.

If you have small ira accounts in many places and your employer plan offers good fund choices with low fees using this reverse rollover option can be a way to consolidate everything in one place. Most pre retirement payments you receive from a retirement plan or ira can be rolled over by depositing the payment in another retirement plan or ira within 60 days. Confusing the two is the biggest mistake people make when moving ira accounts. In addition you re only permitted to make the transfer from your ira to your 401 k plan if your employer allows it.

Transfers from simple iras. You can t transfer from a roth ira or into a roth 401 k.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)