Transfer Mortgage To Family Member

The only way to know for sure is to ask your lender and review your agreement with a local attorney.

Transfer mortgage to family member. The mortgage still has to be assumable in the first place though. For example if you and your partner wanted to transfer your mortgage and house to your children while removing yourself from the mortgage this a separate process that would be completed with the support of your lender and solicitor. Certain life circumstances may require a homeowner to give his home to a family member. A transfer of equity can be with an existing mortgage where the new owners take on full responsibility and any old owners can be released from their debt and obligation or it can be done as a remortgage paying off the old mortgage and replacing it with a more appropriate arrangement.

Each process has different advantages with respect to title rights taxes and speed. Instead of moving the mortgage from yourself to a family member a portable mortgage transfers a single mortgage between two properties. Transfers between family members are often allowed and your lender can always choose to be more generous than what your loan agreement says. This also applies when transferring a joint mortgage to one person such as a couple who need only one name on the mortgage or a family mortgage transfer.

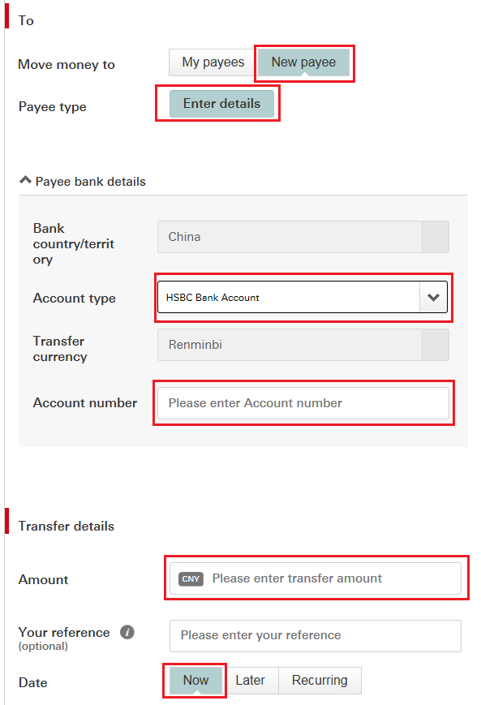

A transfer of equity can also be used by people who want to transfer a mortgage to a family member often where a parent chooses to add a child to the deeds of a property. However many of the costs of escrow and closing that are associated with the traditional mortgage are waived or bypassed. Loan transfer to a relative. If you want to take over a mortgage from a family member but would like to avoid the hassle of refinancing or starting the entire loan application process from square one there are certainly ways to do that.

Transfer a mortgage to a relative without making a profit. A portable mortgage is usually more expensive than a traditional loan. You may be able to transfer a mortgage to an immediate family member without activating the due on sale clause. Land transfer between family members can be easier if you do it the right way.

An aging or sick parent who moves out of his home. But as always when it comes to real estate matters there are rules and laws that govern this process and to successfully transfer the loan you ll have to understand what you can and. Transferring your mortgage and property to a family member or relative while removing yourself from the mortgage would typically take place as a sale or purchase. In some cases you can still transfer a loan even with a due on sale clause.

We will provide the four easiest ways to transfer property to family members so you can keep everyone happy.

/can-you-transfer-a-mortgage-315698-v2-0ab571d8ed8e4f3dad681629e9ef8aeb.png)

/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

:max_bytes(150000):strip_icc()/Remodel-Project-Financed-By-Home-Equity-1500-x-1000-56a49eb45f9b58b7d0d7df93.jpg)

/GettyImages-931812572-cd97d87b74a240e1b0060042dc219382.jpg)

/GettyImages-638918222-5a70dcc2eb97de00373ac83a.jpg)