Types Of Bankruptcies For Businesses

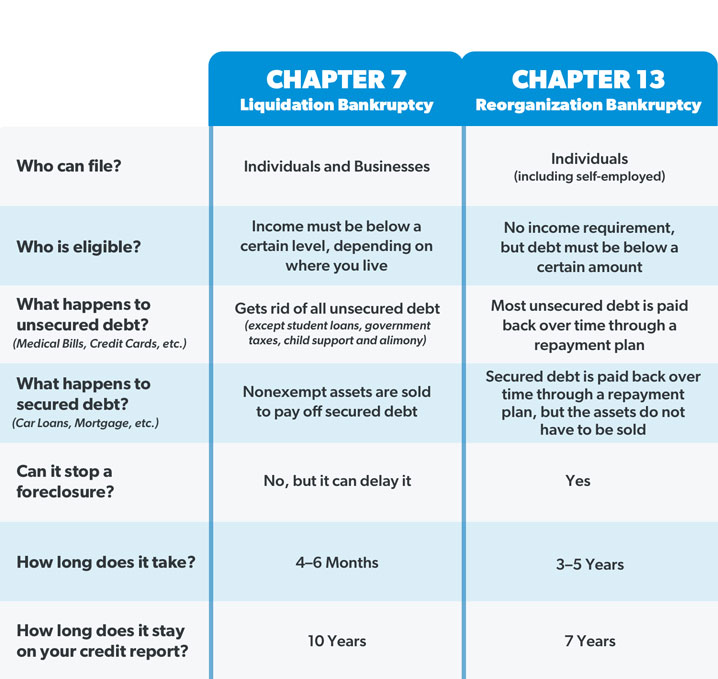

Chapter 13 bankruptcy addresses most secured and unsecured debts if you repay them partially or in full.

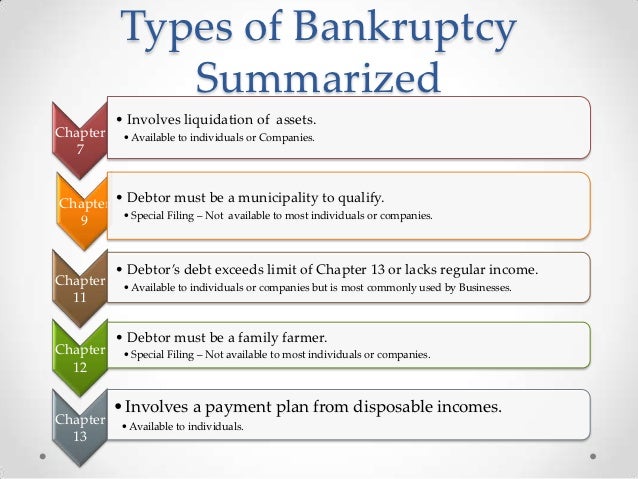

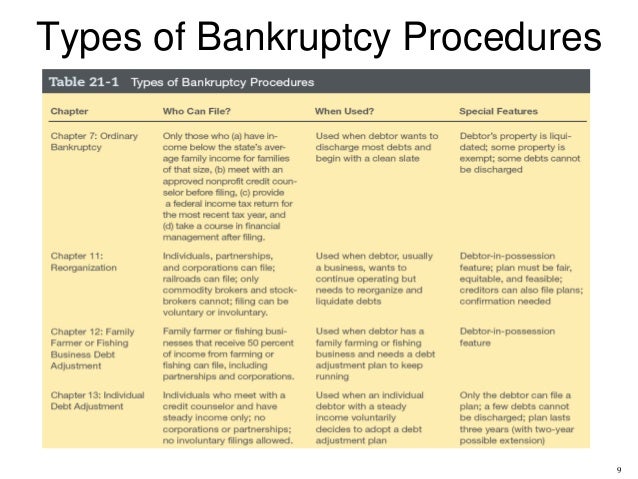

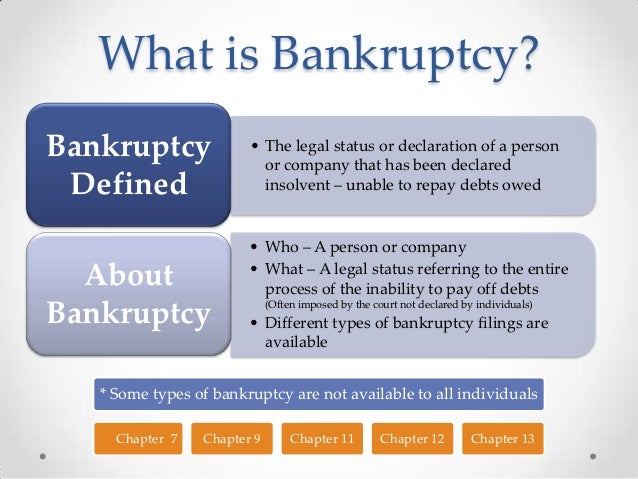

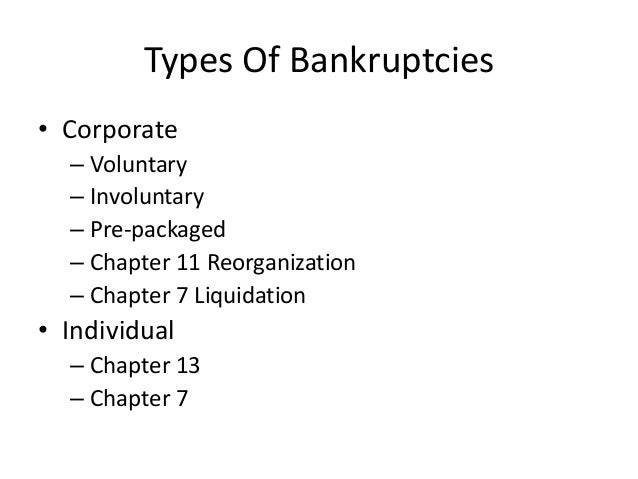

Types of bankruptcies for businesses. In the past a business had an. Here are the four types of bankruptcies available to a business in serious financial trouble. Two chapter 7 and chapter 13 are variations on the personal bankruptcy theme. Business bankruptcies typically fall into one of three categories.

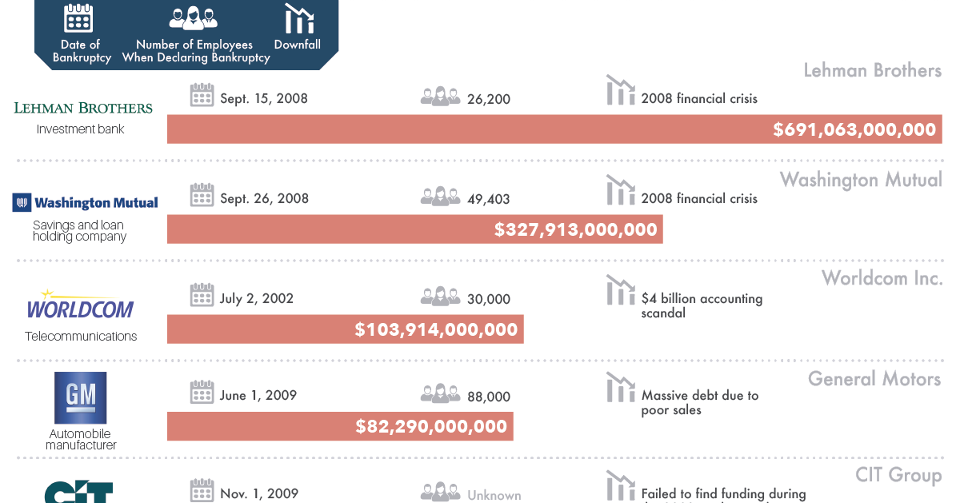

Types of business bankruptcies. In a chapter 11 bankruptcy filing the debtor continues to function maintains ownership of all assets and tries to work out a reorganization plan to pay off creditors. The purpose of chapter 7 bankruptcy is to immediately liquidate the business debtor s assets. Business bankruptcies are usually described as either liquidations or reorganizations depending on the type of bankruptcy you take.

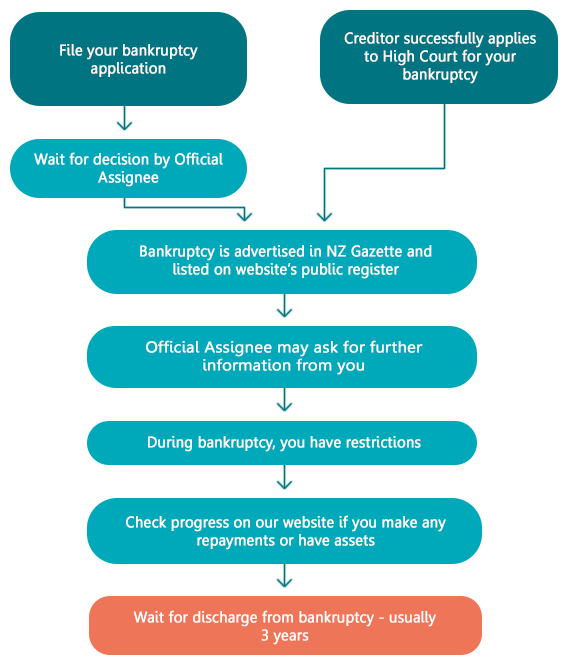

Chapter 11 bankruptcies temporarily protect businesses and high net worth individuals while they. Different types of bankruptcy. Bankruptcy is a process a business goes through in federal court. Businesses considering bankruptcy should carefully explore their options with the help of an experience bankruptcy lawyer.

Unless you have valuable assets repayment isn t required. It depends on the type of business you have but a business bankruptcy can stay on your personal credit report for seven to 10 years and on your business credit reports for up to 25 years. Chapter 11 bankruptcy is for businesses that have hit a bad patch and might be able to survive if their operations along with their debt can be reorganized.

:max_bytes(150000):strip_icc()/All-US-Retail-Chapter-11-Bankruptcies-and-Going-Out-of-Business-Sales-GettyImages-171268919-56a7f8d55f9b58b7d0efbf6c.jpg)

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)